February 2021 (UK version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

The Price of Admission

For long-term investors, the ability to earn returns in excess of inflation is the bedrock of any investment strategy. History being our guide, we know that the decision about what percentage of your investment assets to allocate to different asset classes has the biggest impact on future portfolio returns. Equities, or shares in the great businesses of the world, have over the long term provided the best after-inflation returns to investors, making it the best investment vehicle for attaining and maintaining financial independence.

Owning a small share in the best and most innovative businesses across the globe is a thing of wonder. No longer are you spending money to buy the products of the best-known brands from around the world, but you are now also a shareholder and stand to benefit from their innovation and ingenuity. Over the last decade, innovation in the capital markets has made it easier and cheaper than ever to own a diversified portfolio of the best businesses across the globe.

However, there is one cost that will never be reduced: the volatility of the stock market. One could say that enduring the regular volatility of the stock market is the price of admission for anyone wanting to build long-term, multi-generational wealth. This fee is not disclosed on fact sheets, and it is not actively brought up by those who sell financial products. But, it's a cornerstone of the financial literate's understanding of the financial markets.

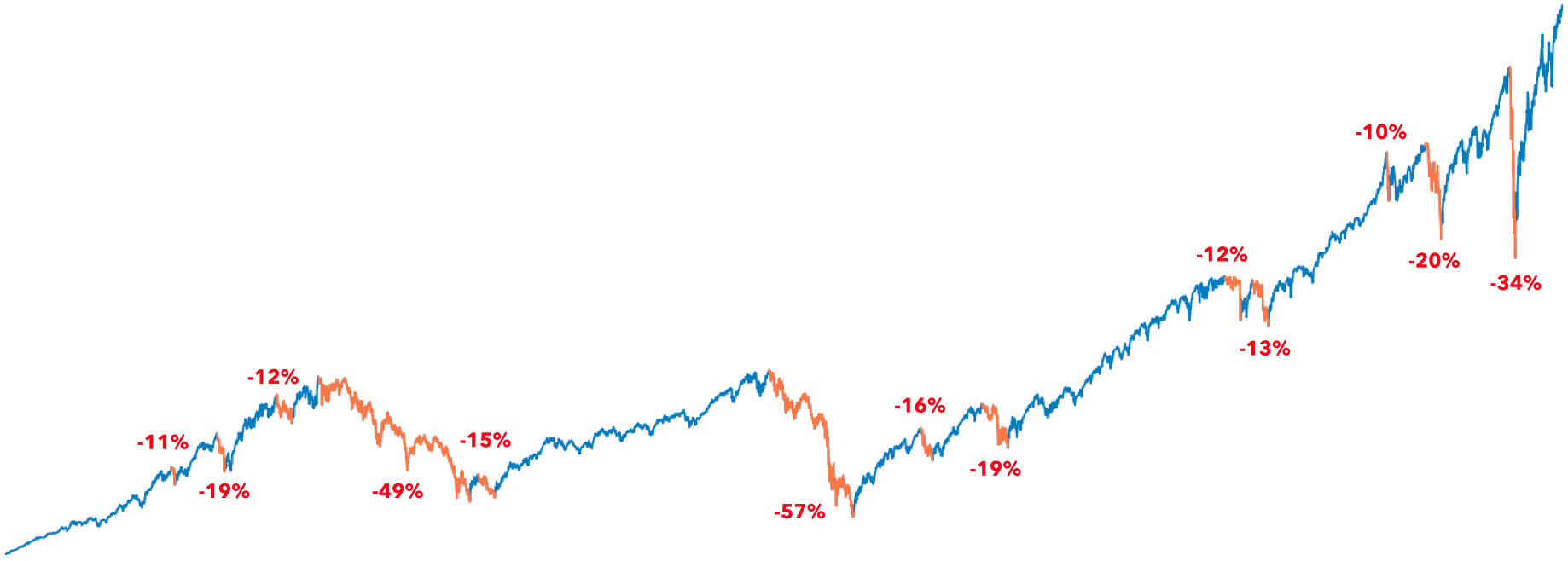

The good news is that a diversified portfolio experiences temporary volatility while providing permanent gains. It's a trade-off that any mature investor should be willing to make. The foundation of good investor behaviour is realistic expectations, and the best way to understand market volatility is to see how often the market experiences corrections. The chart below shows all the occasions the US market has dropped by more than 10% over the last 25 years.

The chart above shows us that these occasions are remarkably normal. What does this mean for us as investors? First, it's a challenge to make sure we have realistic expectations. Second, we need to be honest about our ability to pay the price that is required. While a portfolio made up of different asset classes is likely to experience lower drawdowns than that of the stock market, this will come at the expense of long-term returns.

Helping you to invest in an appropriate portfolio is one of the reasons we exist, and helping you to behave appropriately when the inevitable market declines arrives is the reason we are passionate about what we do. Don't let temporary market declines dictate any changes in your long-term financial plans. As Warren Buffett says, 'The stock market is there to serve you and not to instruct you.'

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in the UK has resulted in an item costing £1 in 1991 now costing £1.90 in 2021. Your purchasing power has almost halved!

But £1 invested in the UK share market is worth £3.73 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

This Artificial Heart Will Soon Be on the Market in Europe

New electric car battery can charge in five minutes

New water divining technique could alleviate drought all over the world

📰 Read

Personal Finance Philosophies [3 minutes]. A few eternal truths.

How Hindsight Bias Can Impact Your Investment Decisions [7 minutes]. Your brain loves tricking you.

The 2020 Lessons of "Let's Wait and See" [2 minutes]. The only certainty is uncertainty.

Those Messy Humans [5 minutes]. People + Money = Emotions.

How to avoid bear markets [8 minutes] [audio version]. Do you want risk in the short term or the long term?

It’s OK To Build Wealth Slowly [4 minutes]. Follow your own path.

The Surprising Power of The Long Game [4 minutes]. People who play the short game don’t realise the costs until they become too large to ignore.

🎧 Listen

Afraid of the Wrong Things [50 minutes]. Our minds struggle with the mathematics of risk - listen to why this is the case.

How to Make the Most Important Decisions of Your Life [68 minutes]. Making good decisions is a teachable skill that anyone can sharpen.

🖼️ A Picture is Worth a 1000 Words

10 Insights From 10 Financial Charts

The 50 Most Visited Websites in the World

5 Lessons About Volatility to Learn From the History of Markets

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,