April 2021 (SA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

Your Most Important Investment Decision

If all you had to go by was the information presented in the financial media, you’d be forgiven for believing that to be a successful investor you needed to know which companies were best to own, and that you had to be able to forecast market cycles. Calling the tops and bottoms, which no one can.

Fortunately, neither of these are true. We believe that the most important financial decision you’ll make in your life is what portion of your assets you allocate to equities (the greatest wealth building asset).

Indeed, extensive research has shown that your asset allocation decision is responsible for the majority of your portfolio’s return. Asset allocation refers to your decision about how much you allocate to equities and fixed interest assets, respectively.

Before we proceed, let’s define these terms.

Equities (or stocks) is a part-ownership in a publicly listed business. Investors are rewarded if the company is successful in growing its revenues over time. This usually leads to an increase in share price. Investors are also rewarded in the form of dividends - company profits which management decide to payout to the owners.

Fixed income (or Bonds) are a form of lending to corporations/governments who need to raise capital for maintaining or expanding their operations. Usually, a fixed rate of return is agreed, hence the term “fixed income”. These investors do not own any share of the company (which costs them dearly over decades).

To the casual observer, both are forms of investments which provide returns over time. However, they are fundamentally different asset classes. The distinction is vitally important to understand.

Investing in equities makes you an owner of a business. Investing in a diversified portfolio of said equities makes you an owner of the great companies of the world, the companies we all use each and every day. What a thought!

Investing in bonds (or any fixed interest instrument) makes you a loaner to these same businesses. You have no claim to their future profits.

As an owner of a successful business, would you prefer to raise money by borrowing at a fixed cost, or would you give up a part of your business to access the cash? The answer may not be clear: if prospects were good you would borrow the money, all else being equal.

Similarly, as an investor, would you prefer to own a share of a successful business, or would you prefer to lend money to them? The answer may again be self-evident. You want to own small pieces of the great companies rather than just loan them money. Owners beat loaners.

Slaying The Dragon

As investors battling the silent dragon called inflation (the slow and steady increase in the price of goods), the only returns we are interested in are real returns - returns above inflation.

History has shown us that equities have provided investors with a significantly higher real return than fixed interest assets. The numbers differ between regions and time periods, as could be expected. This makes sense when you understand the distinction we explained above.

The best asset class to own in your fight against inflation is therefore shares in the great companies of the world.

No Free Lunch

Great news so far. Who wouldn’t want the returns of being an equity investor?

However, there’s a price of admission for earning higher returns. There’s no such thing as a free lunch, as they say.

The cost of owning stocks is the volatility in their price, the fluctuation (both up and down) over the short to medium term.

This will never change. If there was no risk, there would be no return

One Size Does Not Fit All

Your asset allocation needs to take into account your willingness, ability, and need to generate the returns provided by stocks. You also need to be able to endure the regular fluctuations in price, and your emotions, that come with being an equity investor.

Helping you to navigate this decision is our reason for being.

We’ll end with a Warren Buffett quote from the recently-published Berkshire Hathaway shareholder letter.

"Productive assets such as farms, real estate and, yes, business ownership produce wealth – lots of it. Most owners of such properties will be rewarded. All that’s required is the passage of time, an inner calm, ample diversification and a minimisation of transactions and fees."

🐉 The Real Enemy

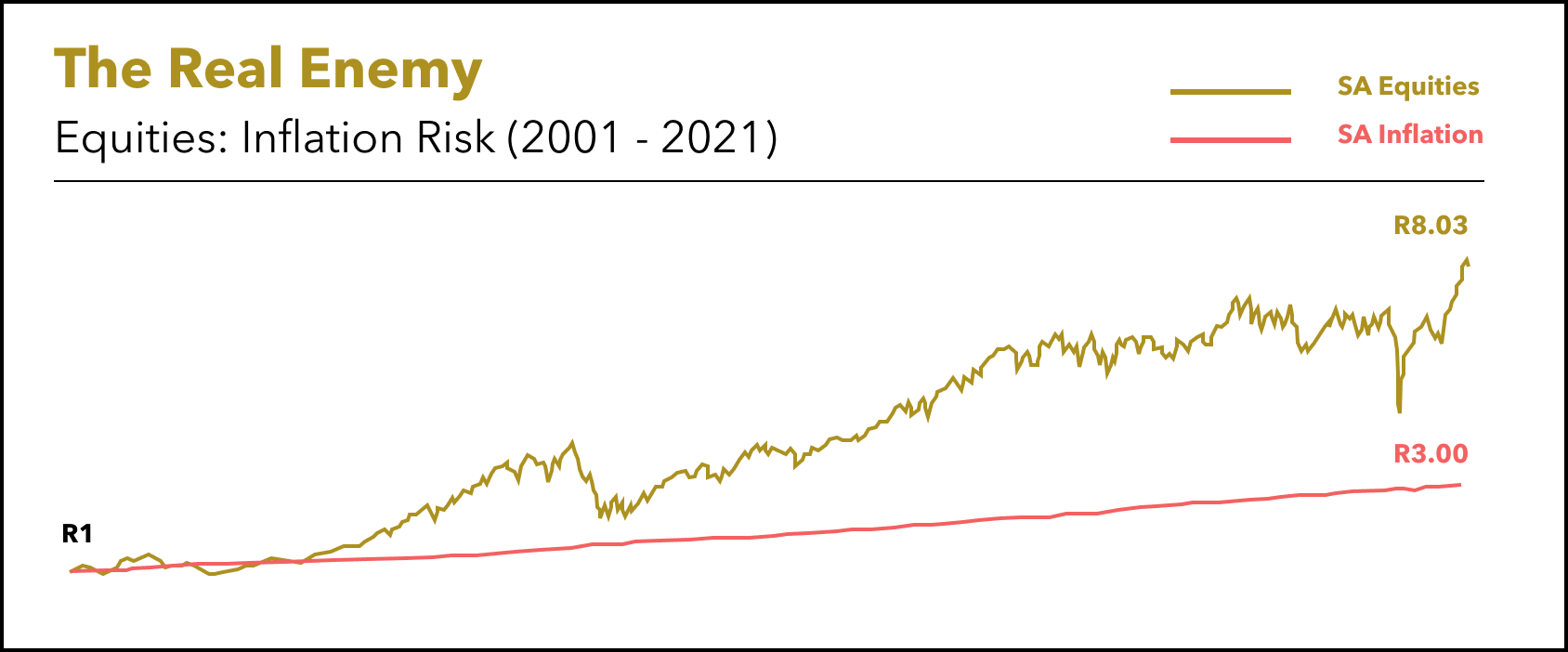

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 20 years, inflation in South Africa has resulted in an item costing R1 in 2001 now costing R3.00 in 2021. Your purchasing power has been decimated!

But R1 invested in the South African share market is worth R8.03 today, and that's ignoring 20 years of dividends! And this during a two-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

After Covid, get ready for the Great Acceleration

Natural Disasters Claim Fewer Lives Thanks to Human Progress

US Military Tests Satellite for Beaming Power Down to Earth

📰 Read

The Twelve Biggest Lessons I Learnt in my 30’s [5 minutes]. Great reflections on a decade full of change.

The Boy Who Cried Bubble [5 minutes]. Be very skeptical of grand predictions of market bubbles.

Investing: The Greatest Show On Earth [6 minutes]. Money is everywhere, it affects all of us, and confuses most of us.

Money is stored energy [5 minutes]. Energy storage, transmission, and shocks provide a great way to think about money.

A Generosity Philosophy [6 minutes]. A great way among others to fight off lifestyle creep – or at least keep it at bay – is being consistent in our generosity.

Four Things Everyone Needs to Know About the Markets [4 minutes]. Learnings from 120 years of market data.

Twelve Truths [4 minutes]. 12 Truisms of financial planning.

2020 Berkshire Shareholder Letter [20 minutes]. Another great letter with inspiring stories of human ingenuity leading to great companies.

🎧 Listen

The Shortness Of Life [11 minutes]. A good reminder that the time to live is now.

The Dangers of Financial Influencers [37 minutes]. A warning about the risk of taking financial advice from strangers on the internet.

🍿 Watch

🖼️ A Picture is Worth a 1000 Words

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,