April 2022 (USA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

As the conflict rolls on and the defiance and courage of the proud Ukrainian army is felt the world over, I felt it an opportune time to briefly share with you my thoughts on how this wasteful conflict is impacting your (and my) family’s life savings.

As a caring steward of your financial and investment plans, it’s important to appreciate that I have invested my family’s life savings in my most volatile, highest long-term returning investment portfolio. I have felt every drop of the recent declines and since I last wrote, have benefited from the market’s advance.

Successful investing is characterised by one’s ability to dance with uncertainty and act calmly when every cell in your body is telling you to react (flight). Reacting to world events and market gyrations will do great damage to your long-term returns - this is the investing mistake of market timing. It’s a feature and not a bug of investing. Doing the wrong thing at the wrong time for the wrong reasons dwarfs the impact of all the other investing mistakes combined.

In essence, investing is not an intellectual pursuit. It’s a temperamental pursuit, and success comes down to your behaviour during a few key market inflection points, primarily driven by cycles of fear and greed. Feeling fearful is absolutely normal; it’s human. Stopping you from acting on this fear is my reason for being, my life’s calling. You pay me to tell you that I don't know when these declines will turn, but I do know they will. Patience is a superpower, and discipline is required in order to be patient.

All investors know that markets move both up and down. However, when the declines arrive, many investors start to show the tendencies of speculators. Speculators hope to make ‘quick profits’ and usually fail miserably. Investors’ objectives are to create real long-term wealth that widens and deepens for the master it serves.

I’ll leave you with a quote from Nathan Meyer Rothschild, referring to the direction of the stock market during times of war:

“Buy when the cannons are firing, and sell when the trumpets are blowing.”

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

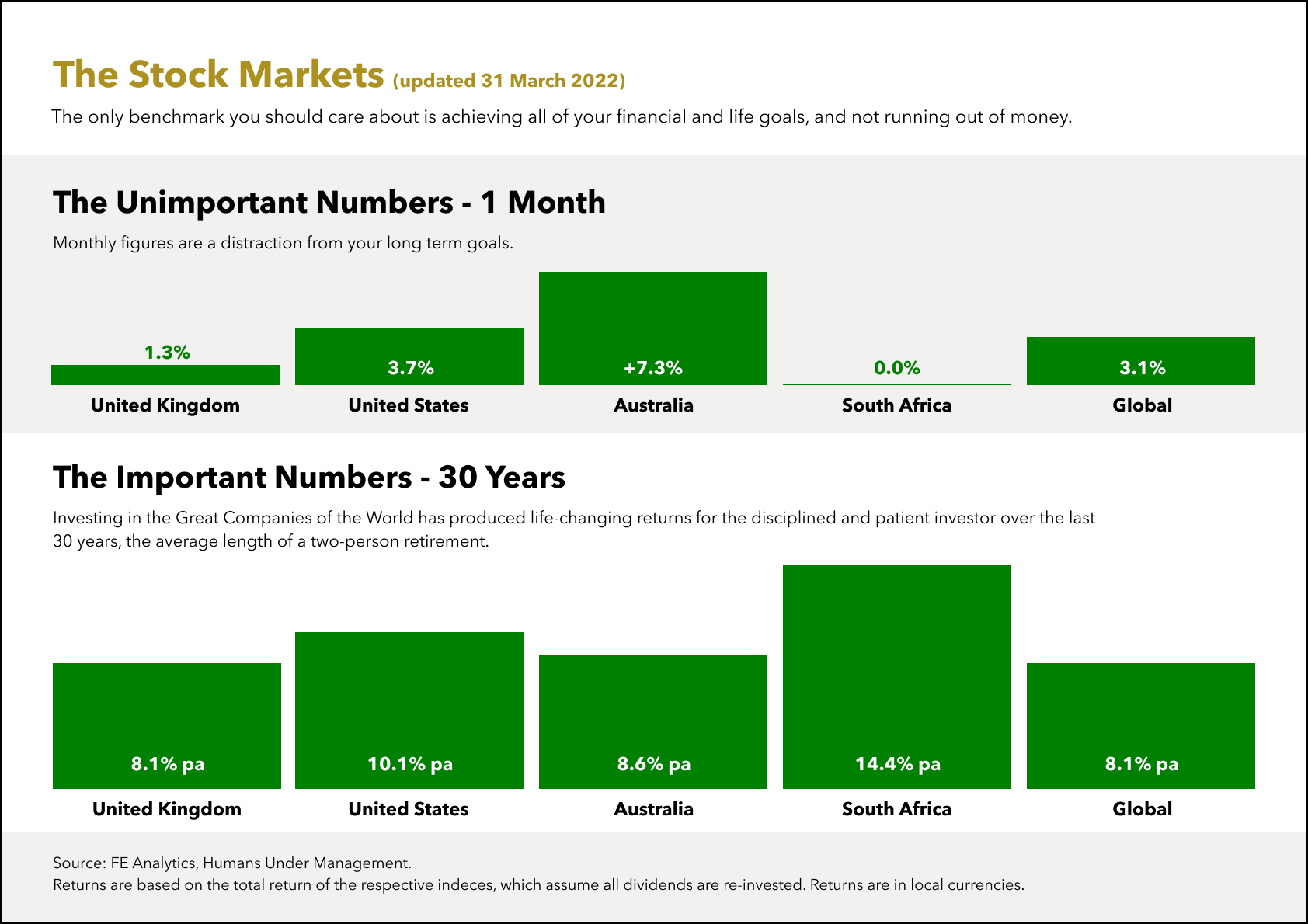

The Stock Markets

Your Most Important Transition

We face many important transitions during our lifetime. Arguably, the most important one of these is the transition from our working life into retirement.

We go from being busy, respected for being an expert in our chosen field, and waking up every day with a purpose to a blank page from which to craft our new life. We go from saving money and building wealth to needing to withdraw from our nest egg.

Sadly, many successful and respected people go on to have unhappy retirements. For those who saved diligently, this is a sad outcome. The key to making a successful transition is to be clear about what you are leaving behind and moving towards.

The Three Key Retirement Questions

In helping many people navigate this once-in-a-lifetime transition from work to retirement, we have identified three key questions to help you transition into a successful retirement. I’ve adapted these three questions from financial expert Mitch Anthony.

With increased longevity leading to longer retirements, this is not a transition you want to make without forethought. Deeply thinking about all three questions will prepare you for the successful and happy retirement you deserve.

Q1: Have you had enough of work?

While you may not have the same drive as before, many successful people have more that they want to contribute to their work environments. It may be possible that you can continue to enjoy the mental stimulation of being involved without working full time. The modern work environment has created flexible work options not open to those of past generations. Remote work, hybrid office structures, part-time consulting, or even mentoring could be a way to remain involved and give you a reason to get out of bed in the morning.

Regardless of this decision, it’s essential that you are emotionally ready to transition away from work as you knew it. Do not underestimate the magnitude of your work’s contribution to your well-being and identity.

In summary, question one is purpose-driven.

Q2: Do you have enough?

It is important to understand what lifestyle your savings are realistically able to sustain. Be mindful of day-to-day expenses, irregular expenses, and possible surprises.

Our process is designed to help you make sense of the complexities behind this simple question: Will I run out of money?

If an initial analysis gives an unexpected answer, consider that even an extra year or two of saving can make a significant difference in these projections. Ensure that you have received a detailed opinion from an expert before you make any irreversible decisions.

In summary, question two is money-driven.

Q3: Do you have enough to do?

This is often the most challenging question to answer for those happily busy for four decades. How will you fill your time?

When you are accustomed to working full days, an empty calendar can be difficult to navigate. Sadly, a two week holiday is not a reflection of what you may want to fill your days with. Those around you may still be in their everyday routines, leaving you with more time than you know what to do with. There are only so many rounds of golf you can play or TV series you can watch before you get bored. We suggest that you think carefully about what your ideal week will look like. Be sure to build in time for family, hobbies, and travel. If there’s too much time unaccounted for, it’s worth reflecting on whether you are ready for this big decision.

Lastly, if you and your partner are not used to being around each other all day, it’s important that you agree on what you will be spending your time on and how you will each retain some independence. As the joke goes, retirement is twice the spouse and half the income.

In summary, question three is lifestyle-driven.

A Happy Retirement Is Hard Work

Rather than being about leaving an old life behind, a successful retirement transition is more about moving intentionally towards a new life.

Carefully considering your, and maybe your spouse’s, answers to the above questions will ensure that you set off on this new journey with enough money, enough to do, and fewer regrets.

While our key focus is to ensure that you have enough money to sustain an independent life, we are committed to assisting you in making a happy and successful transition.

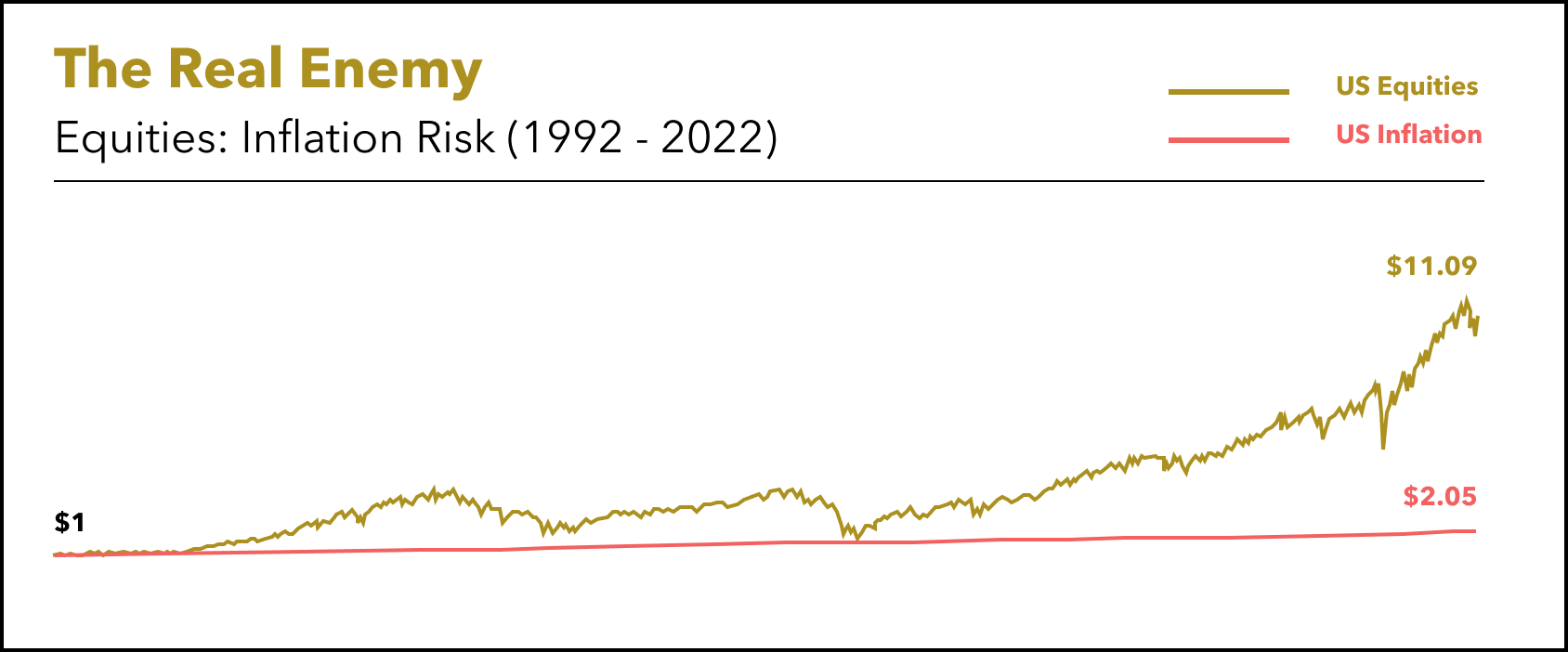

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in the USA has resulted in an item costing $1 in 1992 now costing $2.05 in 2022. Your purchasing power has halved!

But $1 invested in the US share market is worth $11.09 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Endurance: Shackleton's lost ship is found in Antarctic

DeepMind’s new AI model helps decipher, date, and locate ancient inscriptions

Endangered green turtles are bouncing back in the Aldabras, Seychelles

📰 Read

The Paradox of Happiness: Why Desiring More Makes Us Miserable [7 minutes]. When you always strive for more, you live a restless life.

How People Think [31 minutes]. 17 Insights into human behaviour.

Nine Infinite Games to Play with Your Career [7 minutes]. Examples of infinite games that can guide your career choices.

A Too Familiar Tale of Investing in Bull Markets [4 minutes]. He made every mistake in the book.

Why Market Corrections Shouldn’t Faze Long-Term Investors [5 minutes]. Key lessons from market history.

Thankfully, Life Is Full of Problems [8 minutes]. The key is to upgrade your problems.

🎧 Listen

Morgan Housel — The Psychology of Money, Picking the Right Game, and the $6 Million Janitor [187 minutes]. A fascinating insight into one of the finance world's clearest thinkers.

🖼️ A Picture is Worth a 1000 Words

How Many Humans Have Ever Lived?

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,