August 2021 (Aus version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

A Life Lived On Purpose

It's easy to forget that money is a means to an end, not the end itself. Having a healthy interest in money is great, but overly focusing on it can distract you from its real purpose. One way to view money is as ‘fun vouchers’, if it can’t be enjoyed what’s the point. Money is also a tool to help others, whether they be dependent family or someone in need. Research conducted by Bronnie Ware, an Australian palliative care nurse, found that out of the top regrets of the dying, money did not feature in the top 5. She commented on the clarity of vision that people gain at the end of their lives, a clarity so often missing from those who are healthy.

The top 5 regrets she uncovered were:

I wish I’d had the courage to live a life true to myself, not the life others expected of me.

I wish I hadn’t worked so hard.

I wish I’d had the courage to express my feelings.

I wish I had stayed in touch with my friends.

I wish that I had let myself be happier.

Lifestyle, Not Numbers

The things we will most likely regret relate to the way we lived, not the money we didn't make or didn't spend. On our deathbeds we will lean heavier on our human connections than our financial connections.

While financial planning requires various numerical inputs, it's vital that those numbers are linked to a desired lifestyle and not a desire to reach an arbitrary level of wealth. You may not call yours a 'bucket list', but it's likely that there are things you would like to do that you haven't got around to yet. What are you waiting for? They may range from a simple thing like trying a new form of exercise, to larger dreams involving long-distance travel. The important thing is that they are being thought about and planned for. When was the last time you ticked something off your list?

You'll remember the things you did and the places you went, not the investment charts you gazed at.

The Great Tradeoff

Good financial planning is about balancing the competing forces of planning for tomorrow while still enjoying life today. The past 18 months have changed how many people view this tradeoff. While it was always true, it's now more apparent than ever that we don't know how many tomorrows we'll have.

Some financial professionals have convinced clients that tomorrow is always more important than today, leading to a prioritisation of the future at the expense of living a meaningful life in the present.

While in some cases the situation calls for this extreme position, it greatly oversimplifies the concept of "saving". Often reduced to only the money you have to invest, it neglects to take into account the other forms of capital we have at our disposal. These include our time, our energy, and our talent. A more comprehensive and balanced approach is what we need during this time of great upheaval. Does your plan include the ability to do the things that will bring meaning to your life now, or are you only focused on the future?

What Will You Change?

While the world is still not back to "normal”, and never again may be, we encourage you to reflect on the second chance that the pandemic has given us to calibrate what really matters to us. The restrictions placed on our freedom of movement highlighted the activities and people we most missed, as well as the things we had put off doing.

What did you take for granted? Who did you miss? What did you not get to do? Who did you not get to be? As the world opens up, we encourage you to take action on your plans. Life, as we all know, is certainly for living.

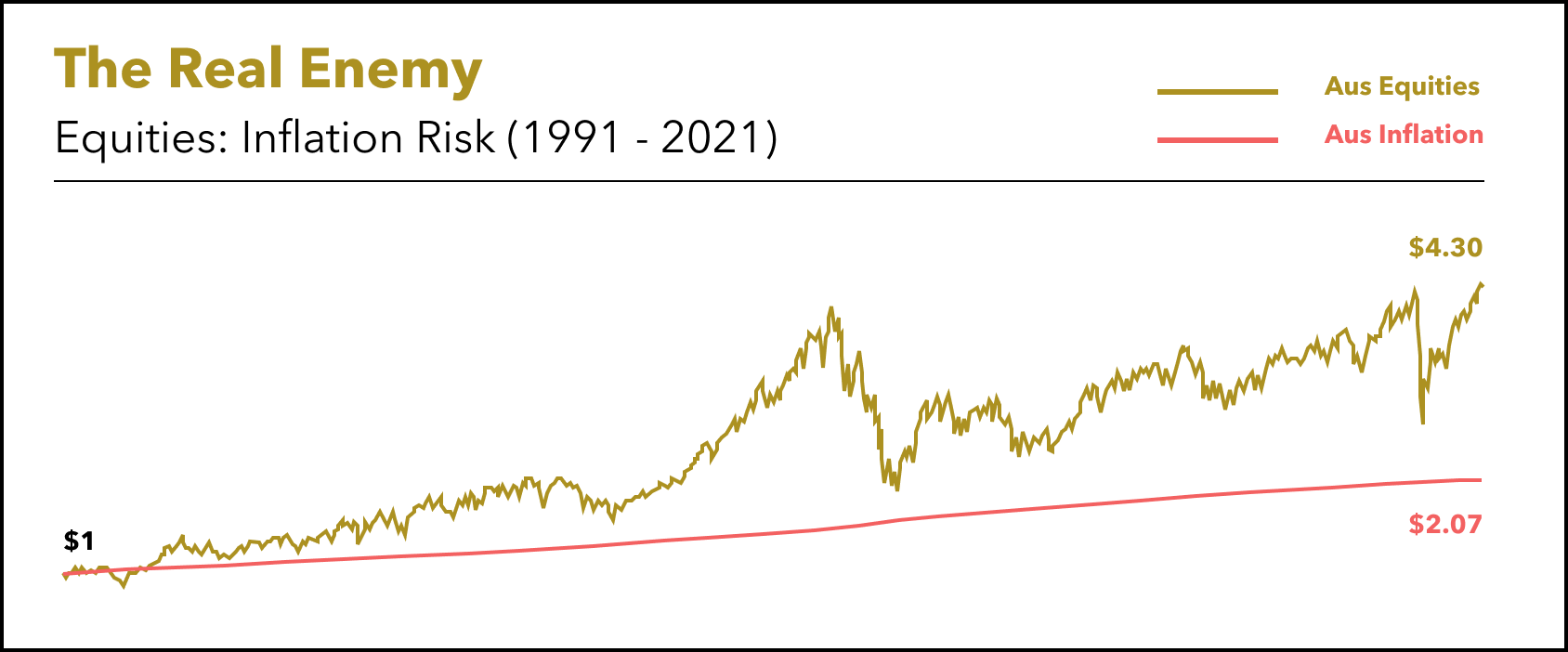

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in Australia has resulted in an item costing $1 in 1991 now costing $2.07 in 2021. Your purchasing power has more than halved!

But $1 invested in the Australian share market is worth $4.30 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

We’ll soon know more about our bodies than ever before

📰 Read

Past, Present, and Future: Use Time Perspectives to Live Better [5 minutes]. What does time mean to you?

An ode to slowness: the benefits of slowing down [4 minutes]. Why the rush?

The Highest Forms of Wealth [4 minutes]. Wealth is easy to measure but hard to value.

Attention Is The Cash Value Of Time [3 minutes]. What’s worth paying attention to?

The Best Investments I Ever Made [4 minutes]. The real money is made by putting your savings into the market when stocks are in a free fall.

The real use of money is to buy freedom [6 minutes]. The freedom to do what you want, when you want.

Professional success and personal success: two independent dimensions [2 minutes]. Which do you value more?

🎧 Listen

Temperament Is Everything for Most Investors [55 minutes]. Your behaviour is more important than choosing the right investment.

Top 10 Rules for Money [8 minutes]. Wisdom only gained from experience.

🍿 Watch

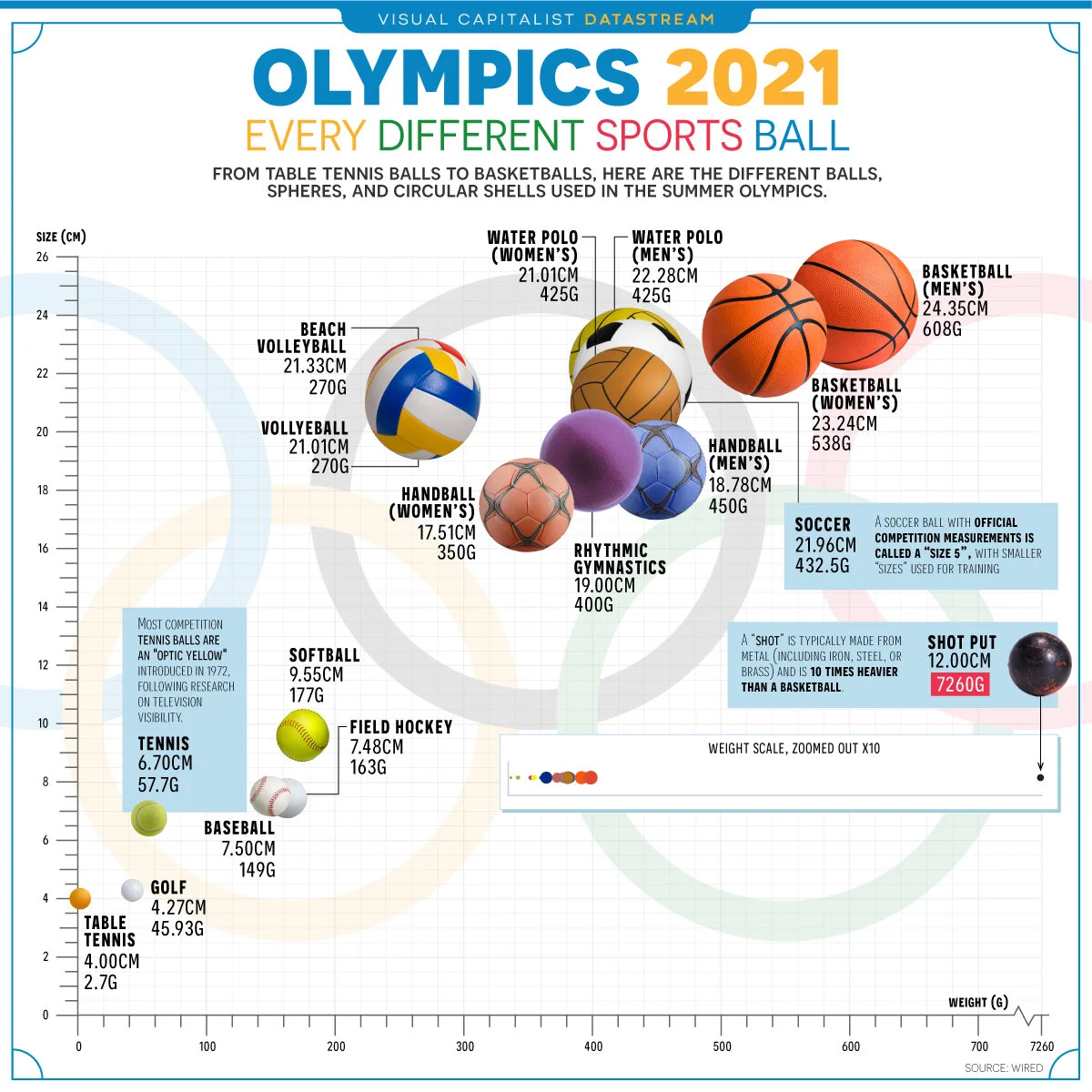

🖼️ A Picture is Worth a 1000 Words

The Biggest Ponzi Schemes in Modern History

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,