February 2022 (Aus version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

The Stock Markets

The only benchmark we focus on is our clients not running out of money and also achieving all of their financial and life goals.

The Unimportant Numbers - 1 Month ending 31 January 2022

UK - FTSE All Share Index: -0.3%

USA - S&P 500 Index: -5.2%

Global - MSCI World Index: -6.5%

South Africa - JSE All Share Index: -0.3%

Australia - MSCI Australia Index: -5.4%

The Important Numbers - 30 Years

Investing in the Great Companies of the World have produced life-changing returns for the disciplined and patient investor over the last 30 years, the average length of a two-person retirement.

UK - FTSE All Share Index: +7.9% per annum

USA - S&P 500 Index: +10.0% per annum

Global - MSCI World Index: +7.8% per annum

South Africa - JSE All Share Index: +14.2% per annum

Australia - MSCI Australia Index: +8.2% per annum

Monthly figures are a distraction from your long term goals, we'll help you avoid the noise.

The Permanent Challenge of Temporary Declines

Investment markets were kind to investors in the year 2021. Despite continued uncertainty around how the ongoing pandemic would impact society and the world’s economies, markets worldwide gave investors above-average returns.

More significantly, there were almost no periods of significant declines. To the dismay of the financial media, the world’s premier stock market index, the S&P 500, saw a maximum decline of only 5% throughout the whole year.

While this was a welcome respite from the normal market rhythm, there’s a danger that investors will forget the important lessons learnt from past declines.

With higher inflation now a reality in the developed world, fresh concerns about geopolitical conflict, and upcoming midterm elections in the US, the possible triggers for market volatility are many.

Now only a month old, 2022 has already set itself apart. The market has still not surpassed the mark it reached on 3 January, and at the time of writing is 6% below that point.

To prepare you for the probability of more and deeper declines during the coming year, we outline below a few points you should keep in mind when others are losing theirs.

What You Should Know

A market correction is defined as a 10% drawdown from a previous market high. While it may sound like a significant number, these events occur far more frequently than most investors believe. Indeed, they come around as often as your birthday, with years like 2021 being the exception. Over the last few decades, the average annual decline is -14%, with about three in four of these years still ending with a positive return.

Every five years (on average), we can expect a decline of about one-third, as we experienced in 2020. We know that the stock market does not move in a straight line, but rather fluctuates around a generally upward trend. We call this “volatility”.

Unfortunately, we cannot consistently predict ahead of time when these fluctuations will occur or when they will reverse. To be a successful long term investor is to accept the above with humility.

How You Should React

When a threat appears, it’s natural to want to run away. It’s how we’re wired. However, a market decline is not a lion. It’s a (mostly) harmless phenomenon that can only harm you if you react the wrong way.

Market declines will happen consistently over the course of your life, and your mindset when they occur is a choice that will determine your financial future. We recommend that you confront them with confidence rather than fear, mindful of the opportunities they provide.

Importantly, you have the luxury of being a long-term player in a system where everyone’s playing a different game. Contrary to the day-trader, what happens in the next 30 days is unimportant to your 30-year plans. If you’re in it for the long run, the odds are stacked in your favour. You’re guaranteed to win.

We know that stock markets provide positive returns about three in every four years. The negative year earns you the other three. It’s the price of admission for profiting from the collective ingenuity of the hundreds of companies working for you while you sleep. We encourage you to see the temporary declines are the reason for the stock market’s permanent returns. You can’t have one without the other.

Time Heals

The stock market is a device for transferring money from the impatient to the patient. As you exercise the patience you’ll need to repeat many times in the future, be encouraged that you are busy earning future returns. If you’re still saving, declines are your best friend, allowing you to buy more units of shares at knockdown prices.

Success in life requires the practice of rationality under uncertainty, and to be successful long term investors, we must decide to act on a plan rather than react to market movements. We are here for you as we continue to work on your plan together.

While we don’t know where the market will be in 6 months, we’re pretty confident where it will be in 10 years: much higher. Time is the enemy of market declines, and we’ve got plenty of it.

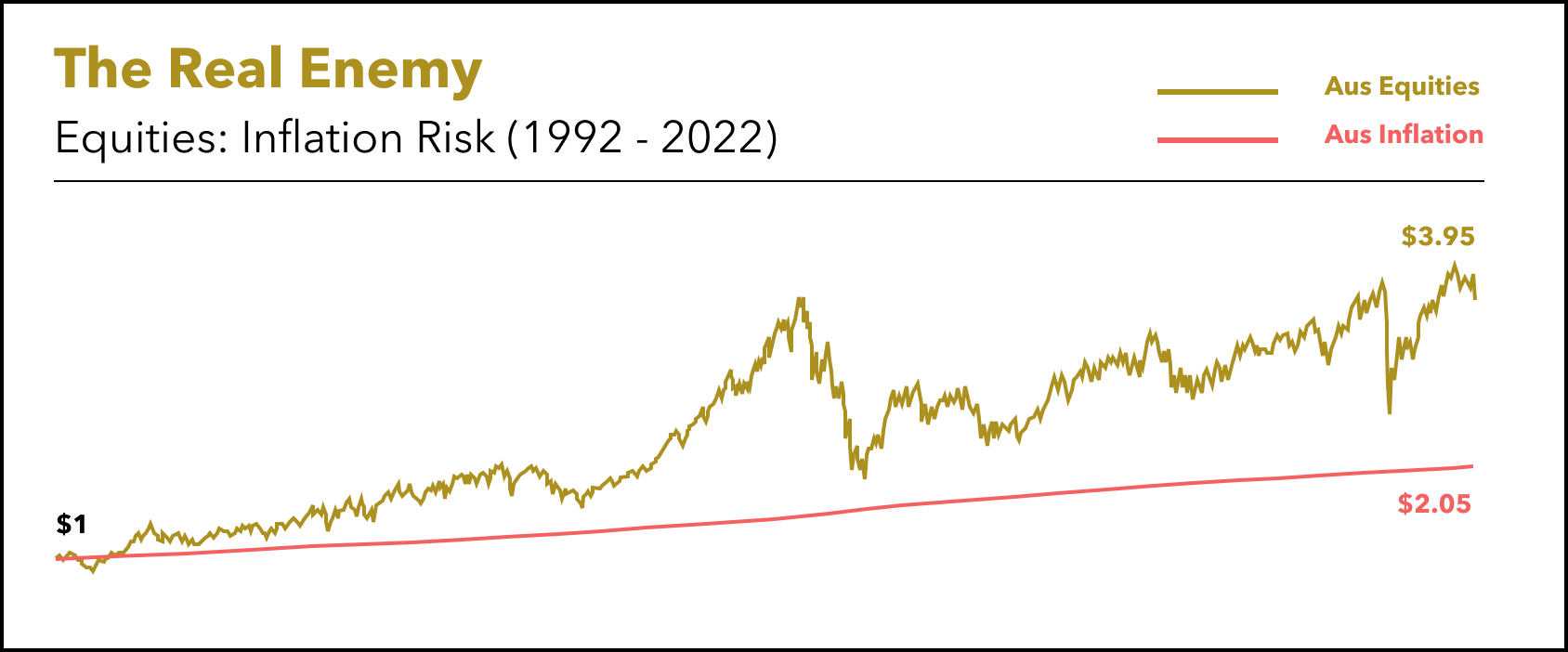

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in Australia has resulted in an item costing $1 in 1992 now costing $2.05 in 2022. Your purchasing power has more than halved!

But $1 invested in the Australian share market is worth $3.95 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Ninety-Nine Fascinating Finds Revealed in 2021

Silicon quantum computing surpasses 99% accuracy in three studies

It Took 66 Hours of Work to Buy a Bicycle in 1910. Today, It Takes Three

📰 Read

The Most Important Question [3 minutes]. We all have different answers.

Create Memories, Not Regrets [3 minutes]. People remember memories, not things.

Everything Must Be Paid for Twice [4 minutes]. Don't forget the second price.

Big Skills [2 minutes]. The power of compounding ordinary skills.

Hugging the X-Axis [13 minutes]. Commitment is undervalued.

The Time Trap of Productivity [3 minutes]. Presence of mind is very difficult to cultivate within the bounds of man-made inventions.

The High Cost of an Easy Job [5 minutes]. The easy way out always has hidden costs.

🎧 Listen

Quick Wins with Financial Behaviour [49 minutes]. A few quick wins to help you make good decisions with your money.

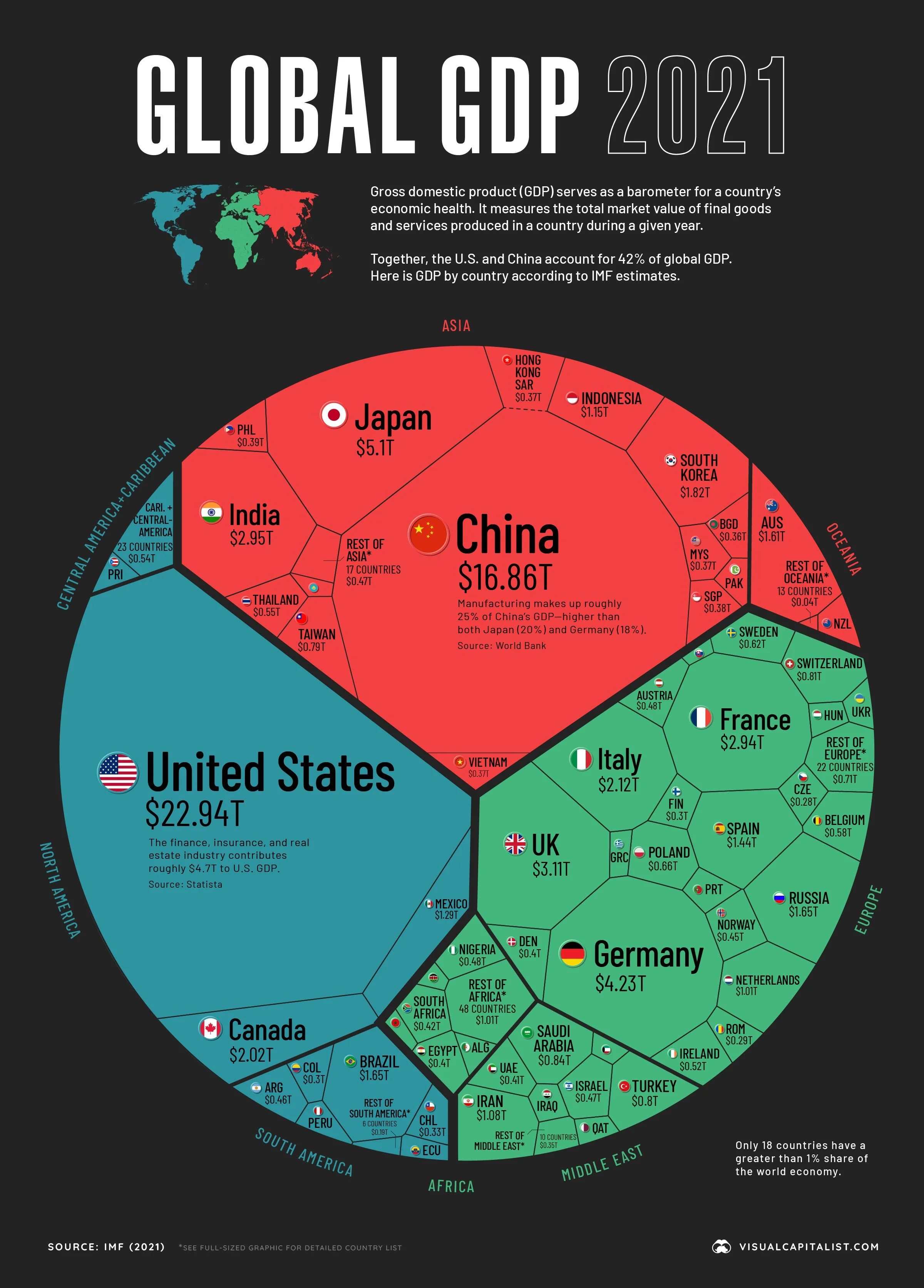

🖼️ A Picture is Worth a 1000 Words

Companies Gone Public in 2021: Visualizing IPO Valuations

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,