July 2021 (UK version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

The Importance of a Margin of Safety

The human brain is powerful but subject to limitations. For this reason we have evolved to have a collection of cognitive biases. These are systematic errors in thinking that occur when we process and interpret information around us, and it affects the decisions and judgments that we make.

One of these biases is overconfidence. This is the tendency we have to be more confident in our own abilities than is objectively reasonable.

The well-known example of this are the multiple studies which have been done in which a majority of respondents believe themselves to be above-average drivers.

Financial planning requires a number of assumptions to be made before any useful projections and analysis can be done, and these inform the decisions that will impact the investor for decades to come.

It is therefore very important that we do not allow our own overconfidence, or those of the professionals we engage in the process, to jeopardise our family's future.

Room For Error

In the financial world, the term "margin of safety" is often associated with Warren Buffett, who tries to purchase stocks well below his estimate of the true value. This allows him to be wrong without incurring major losses. It's a sign of humility, acknowledging that there is so much we do not know.

It would benefit all investors to build in a similar "room for error" in their own financial projections. All of the following variables could take on a number of values: inflation, investments returns, tax rates, retirement expenses, life expectancy, health costs, and many more.

Investors, acting alone or with the help of a financial planner, can be tempted to make optimistic assumptions for each of these variables, knowing that it will make their current position look better. This saves them from the need to confront any financial weaknesses which they deep down know exist.

While assuming that recent inflation rates and investments returns will continue forever will make you feel better about your future prospects, it may also lead to you making decisions in the present that your future self will regret.

Practical Examples

Making better, or more realistic, expectations will give you the opportunity to make the required changes to your situation before it's too late. Investors who are still in the savings stage will be able to make full use of their savings window rather than leaving it too late. Investors in the spending stage will have time to make adjustments to their withdrawals and spending before they risk outliving their money.

Investment return assumptions can be based on long-term historical returns of different investment cycles, rather than the latest decade of great returns. They could even reduce this slightly to allow for any extended periods of lower returns, compensating by saving more or spending less.

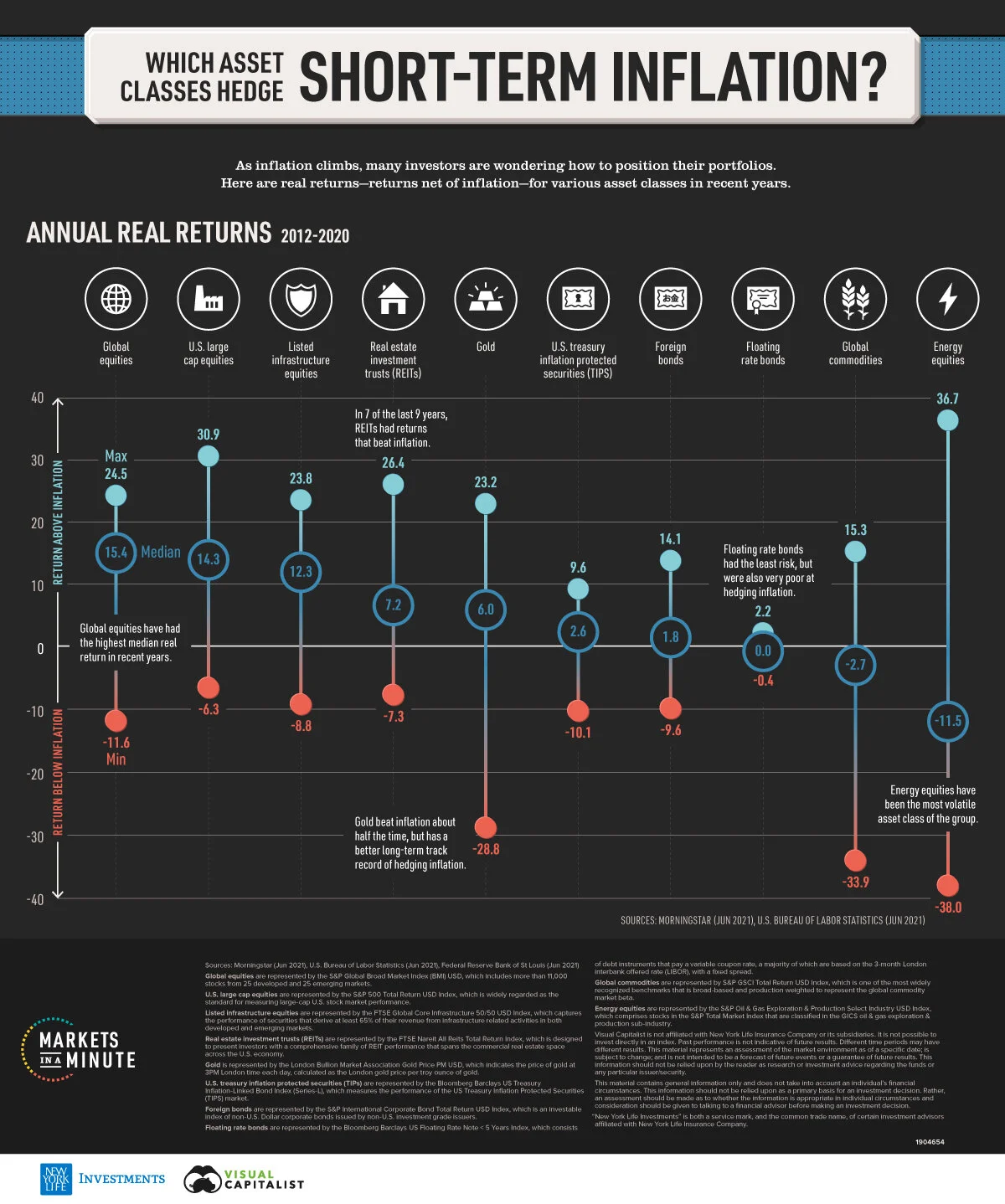

Inflation rate assumptions can be based on long-term averages, which will immediately highlight that recent years of low inflation is not the norm in most countries. This will show the need to allocate investments to assets which have the potential to grow in excess of this number.

Future spending needs should be based on a realistic picture of what daily life might look like, and take into account additional expenses we all hope won't be payable. Similarly, we need to take into account the increasing life expectancy for people who are well-educated and have access to quality medical care. Your memory of your grandparents may not be helpful when guessing how long you could live.

Balancing Act

It's advisable to be realistic, but caution must be made against being overly pessimistic. This will only serve to make most investors feel that it's not worth doing much, because no action will make your future look exciting.

Our job is to help you to make informed decisions based on realistic expectations. Through working with other families just like you we know what is realistic and reasonable.

Our recommendation is to build in breathing room so that you do not need the perfect combination of factors to get you to a dignified and independent future. We do not know what the future holds, but with a margin of safety we don't need to.

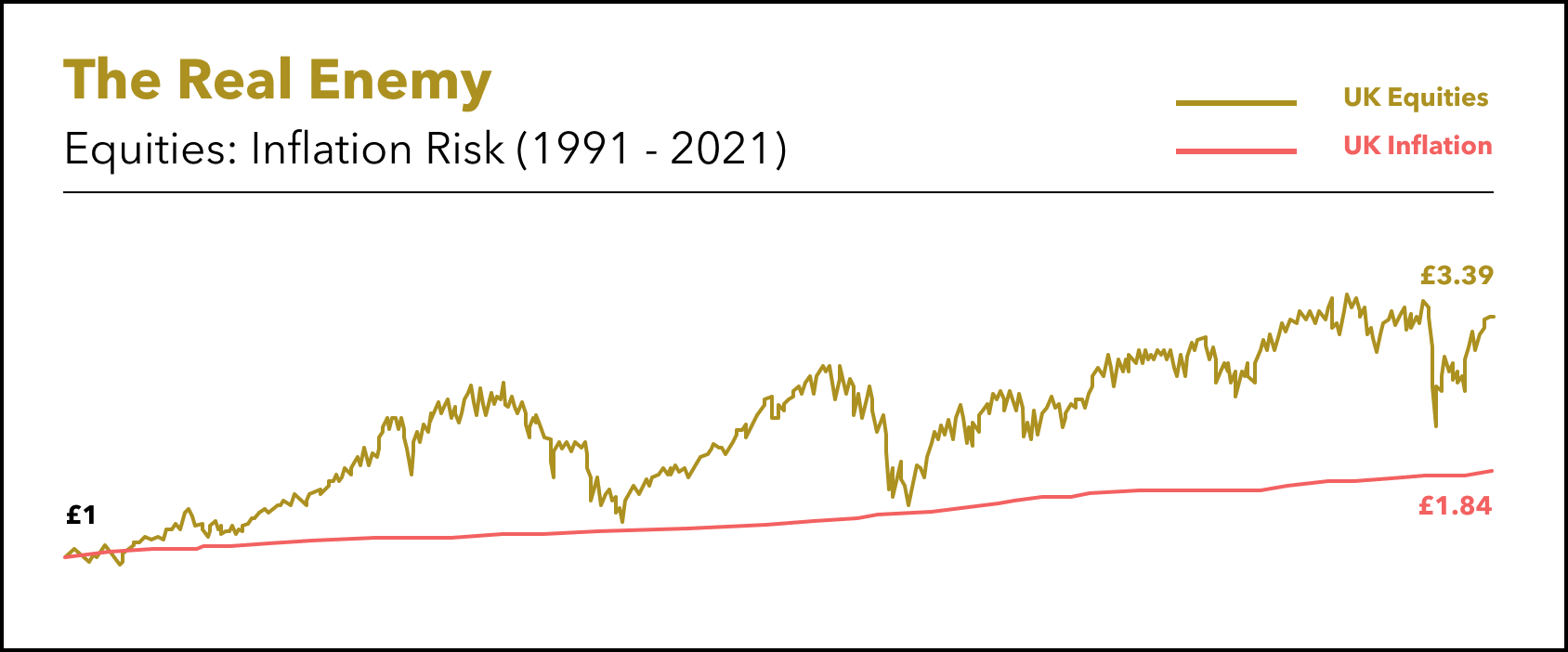

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in the UK has resulted in an item costing £1 in 1991 now costing £1.84 in 2021. Your purchasing power has almost halved!

But £1 invested in the UK share market is worth £3.39 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Amsterdam tests out electric autonomous boats on its canals

Arabian oryx population surges at Abu Dhabi nature reserve as conservation efforts pay off

📰 Read

Let’s Think of Future Us [2 minutes]. One question to help you make better decisions.

9 Money Principles I’d Tell My 17-Year-Old Self [3 minutes]. Simple, but not easy, principles.

Invest in the People You Love [6 minutes]. If you have come through the pandemic better than others, how will you spend the money?

The sushi wealth test [4 minutes]. What does wealth mean to you?

In Defense of Lifestyle Creep [3 minutes]. All spending is not equal.

How to Do Long Term [5 minutes]. The real price of long term is easy to minimise.

Faith In The Future [3 minutes]. Human nature, being what it is, is built to withstand incredible things.

🎧 Listen

Three Steps to Mastering Personal Finance [46 minutes]. A review of an upcoming personal finance book to get your house in order.

Do Something Great For Your Family, with Once I've Gone [25 minutes]. The importance of thinking about what you leave behind to those you love.

🍿 Watch

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,