June 2021 (SA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

The Mirage of Certainty

The world is collectively heaving a sigh of relief as larger numbers around the world are being vaccinated. Mask mandates are being lifted in many places, and we are even seeing a limited number of spectators at a few sporting events. With most of the developed world heading into summer, many are calling the coming months the Summer of Love (a throwback to the 1967 social phenomenon).

With the world coming out of a period of almost unprecedented uncertainty, one could be excused for expecting universal optimism and certainty about what the near future holds for both consumers and the stock market.

Instead, we somewhat annoyingly find ourselves facing a new round of events creating uncertainty and pessimism. Rising inflation, the possibility of interest rate increases, conflict in the Middle East, and cybercriminals hacking a US oil pipeline.

Like a parched desert-dweller stumbling towards water, only to realise that it is yet another mirage, so we stumble from crisis to crisis, hoping that things will soon become clear.

It Was Ever Thus

Unfortunately, certainty is not something we have ever had the luxury of knowing. However, because future problems are always just out of sight we somehow get tricked into thinking that there won't be any, until we are forced to stare them in the face.

Every decade is filled with a list of events that worried a large portion of the world population. Weirdly, these events quickly fade from memory which perhaps explain why we are so surprised when the next one arrives.

Take the 2010's as an example: The BP Oil Spill, US Debt Downgrade, Greek Debt Crisis, Boston Marathon Bombing, Ebola Outbreak, Chinese Stock Market Crash, Brexit Vote, Trump Inauguration, Global Trade Wars, Hong Kong Protest, and the start of the Covid Pandemic.

There is nothing wrong with being concerned about an event that is causing death, harm, or economic damage to people near or far.

The problem comes in when a false expectation for short and long-term certainty causes well-meaning people to delay making life and financial decisions that will be good for their future.

The Good News

While individually we do not enjoy facing an uncertain future, as a collective humanity has shown tremendous resilience. Our history is filled with examples of incredible progress, with each new generation arguably living in a better world than the one before.

The financial literate understands that certainty is not something to be waited for. They make the best decisions in the moment, knowing that course-corrections are inevitable, and not a sign of failure. History is the only guide we have, and it tells us that all global stock market declines have been temporary, with permanent gains the reward for those who have patience and discipline. Patience and discipline are the key attitudinal characteristics that Financial Advisers look to foster in their clients.

Control What You Can

The causes of future uncertainty is anyone's guess (Covid wasn't on many people's radar), and trying to guess them and plan your life and financial plan accordingly is a fool's errand.

The financial literate makes peace with the fact that there is no such thing as "certainty", factors that into their plan, and tries to focus on the things they have control over.

What do you have control over? Our lives are all different but most people have some measure of control over their spending, the amount they invest for their future self, the make-up of their portfolio, and the way they react (or more importantly don't react) to new events.

Do not fall for the lie that if we can just get through this one crisis there will finally be some certainty. Delaying a smart financial decision because there is an unresolved event taking place on the other side of the world is a tragedy that the media is largely responsible for. Don't wait for the media to declare that all is well in the world, there never will be any certainty. The financial winners dance with uncertainty.

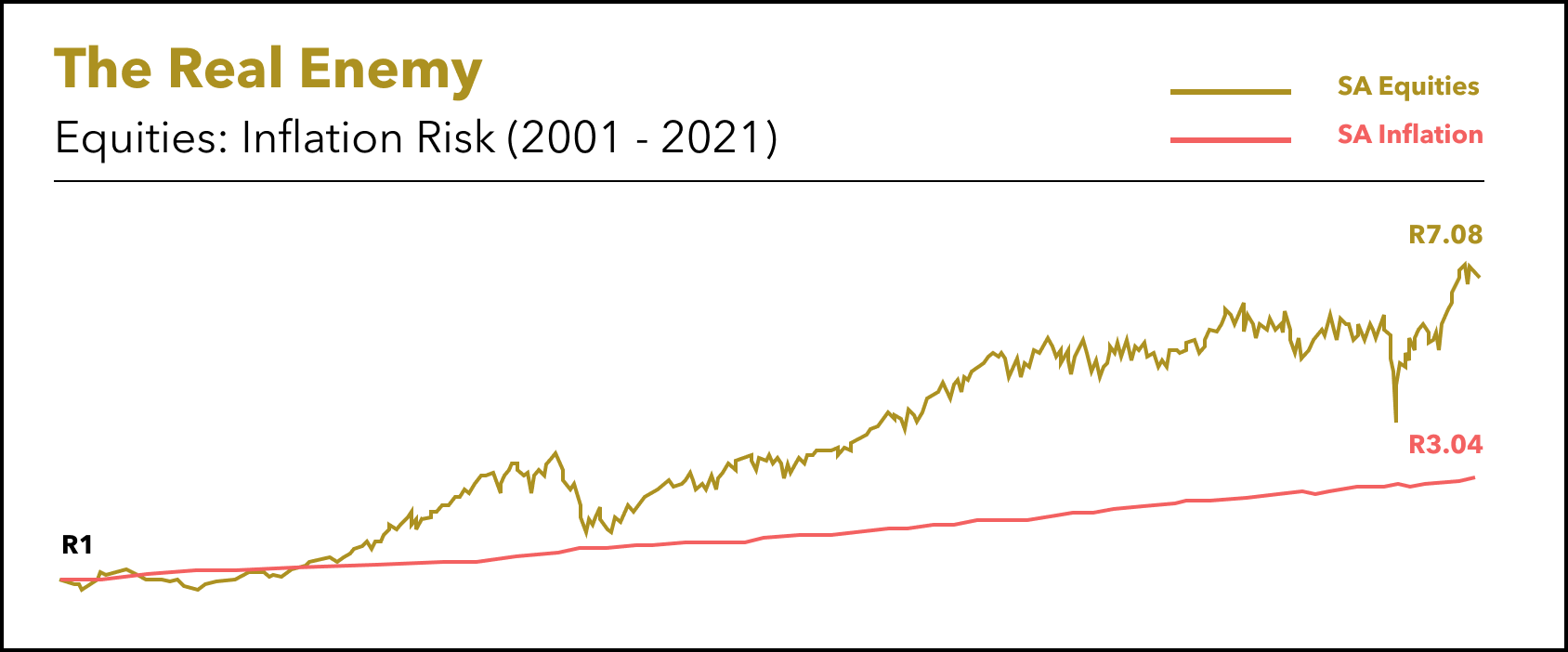

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 20 years, inflation in South Africa has resulted in an item costing R1 in 2001 now costing R3.04 in 2021. Your purchasing power has been decimated!

But R1 invested in the South African share market is worth R7.08 today, and that's ignoring 20 years of dividends! And this during a two-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

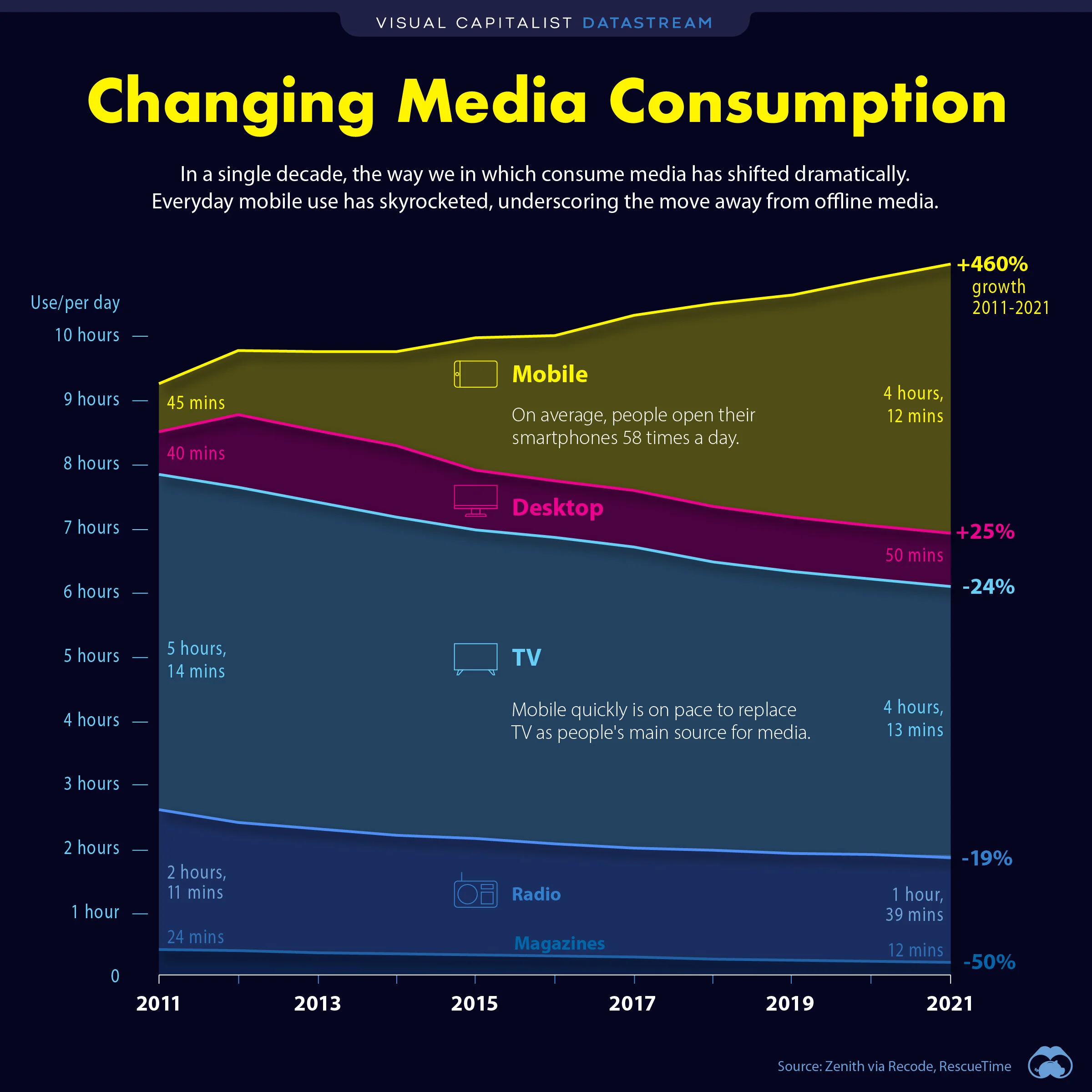

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Radioactive Rhino Horns Set to Add to Anti-Poaching Arsenal

📰 Read

Speculation: A Game You Can’t Win [6 minutes]. There’s a mental tax to be paid on top of any monetary result.

Why investing is more like golf than football [3 minutes]. It’s easy on the golf course to be influenced what other people are doing.

Discipline Equals Freedom [5 minutes]. Discipline may feel restricting in the moment, but it’s liberating in the long-term.

The 8 Essential Elements for a Complete Financial Plan [6 minutes]. The only path to true peace of mind and financial freedom.

4 Ways to Teach Kids About Money [3 minutes]. Lay the foundation for healthy money habits.

Be an Owner, Not a Loaner [2 minutes]. Never forget who gets to keep the profits.

Play Your Own Game [3 minutes]. People play wildly different games.

The Lessons of Time [3 minutes]. Investors who stay the course have historically been rewarded for their patience.

🎧 Listen

Investing in Happiness [61 minutes]. A deep dive into a host of theories and studies that have examined the connection between happiness and money.

10 things you shouldn't care about as an investor [6 minutes]. Fight the noise!

🍿 Watch

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,