June 2022 (SA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

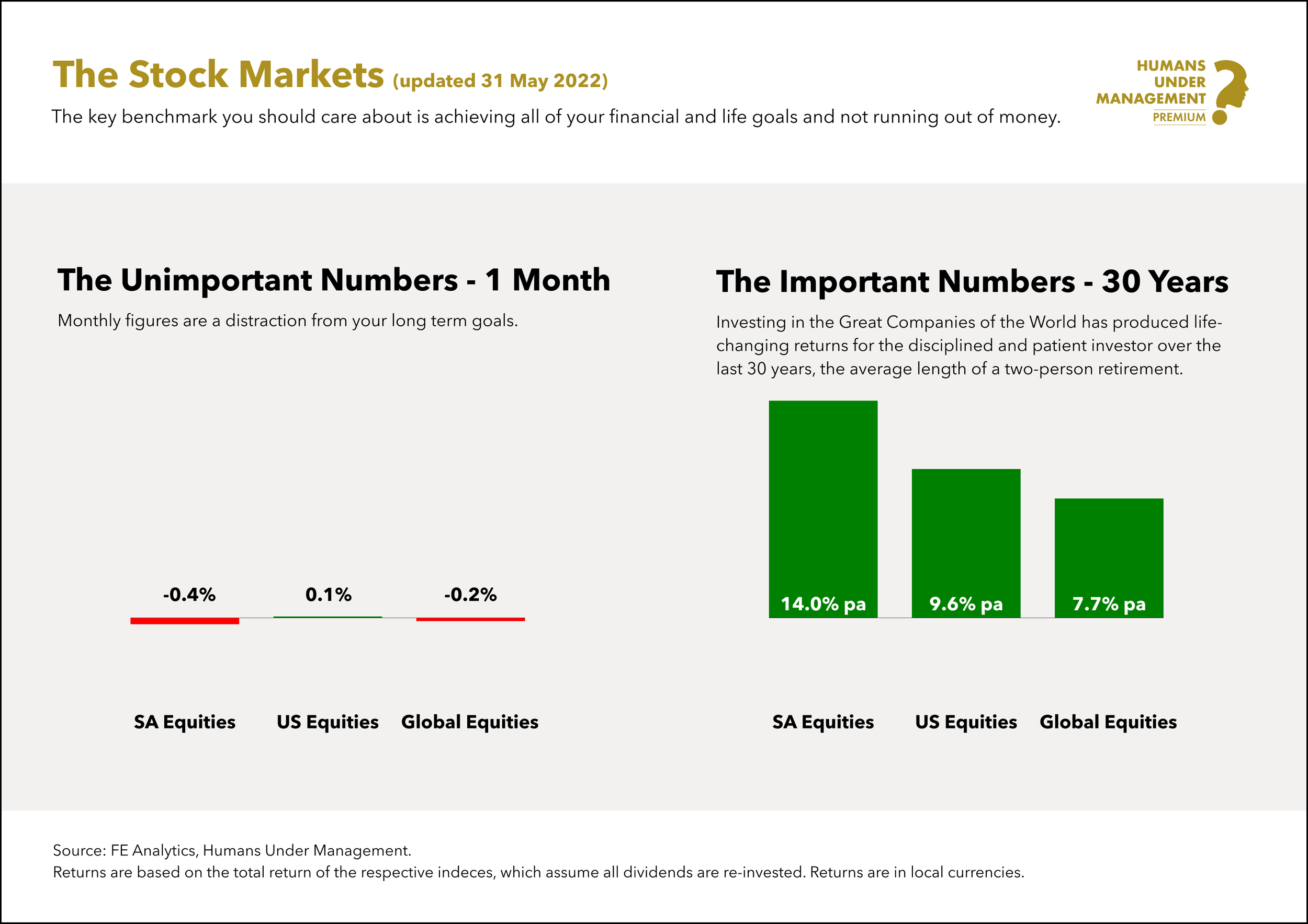

The Stock Markets

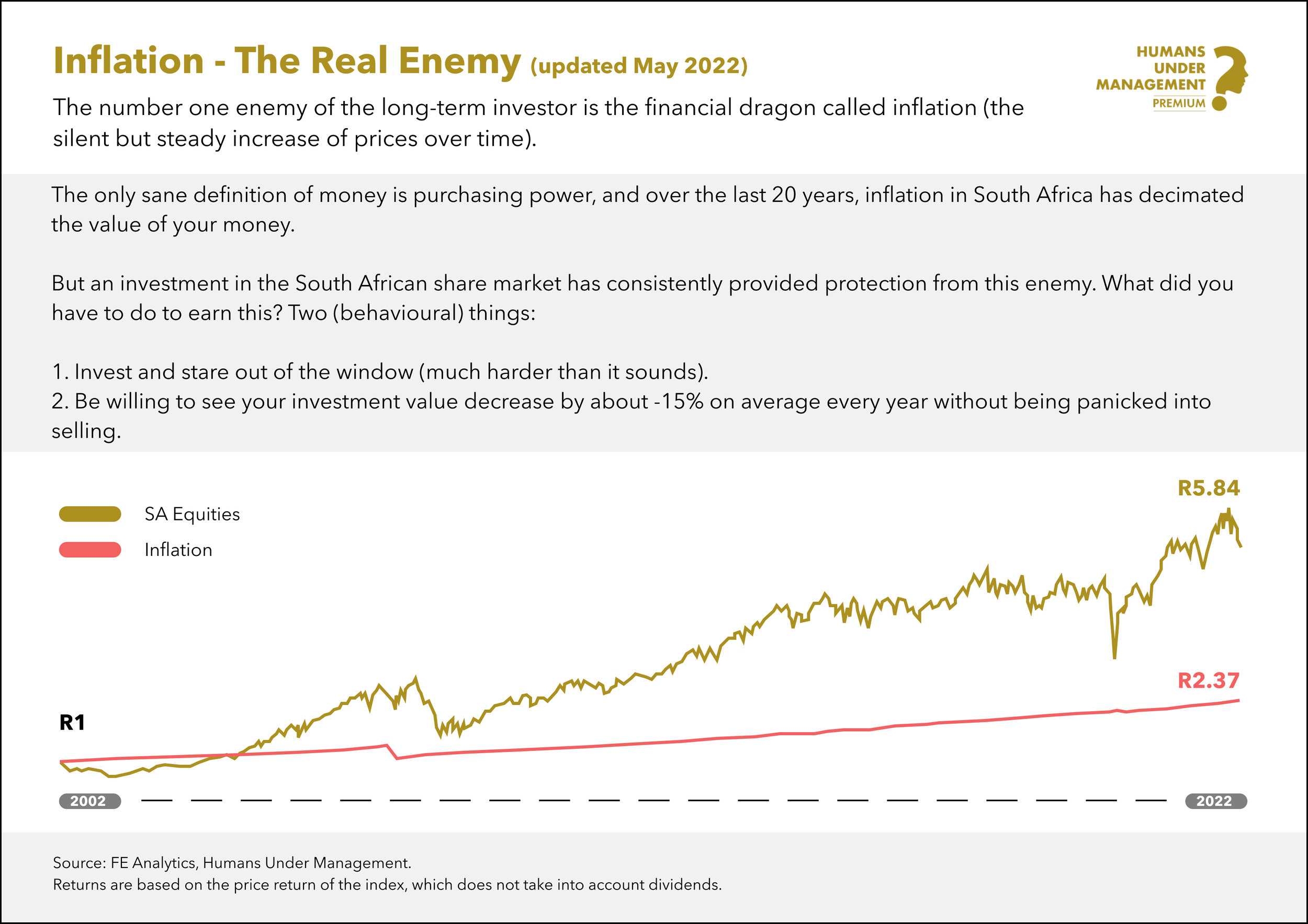

The Assault on Your Wallet

We all understand that the goods and services we buy increase in price over time. While it may not be noticeable from year to year, it’s impossible to ignore when we look back a few years.

A steady and stable increase in prices (what we call “inflation”) helps the economy function and encourages consumers to spend. As the owners of global companies in our investment portfolios, it also leads to the growth in personal wealth over time.

However, the compounding effect of multi-decade inflation is also the consumer's enemy. It effectively increases our cost of living, reducing the purchasing power of our cash.

A New Cycle

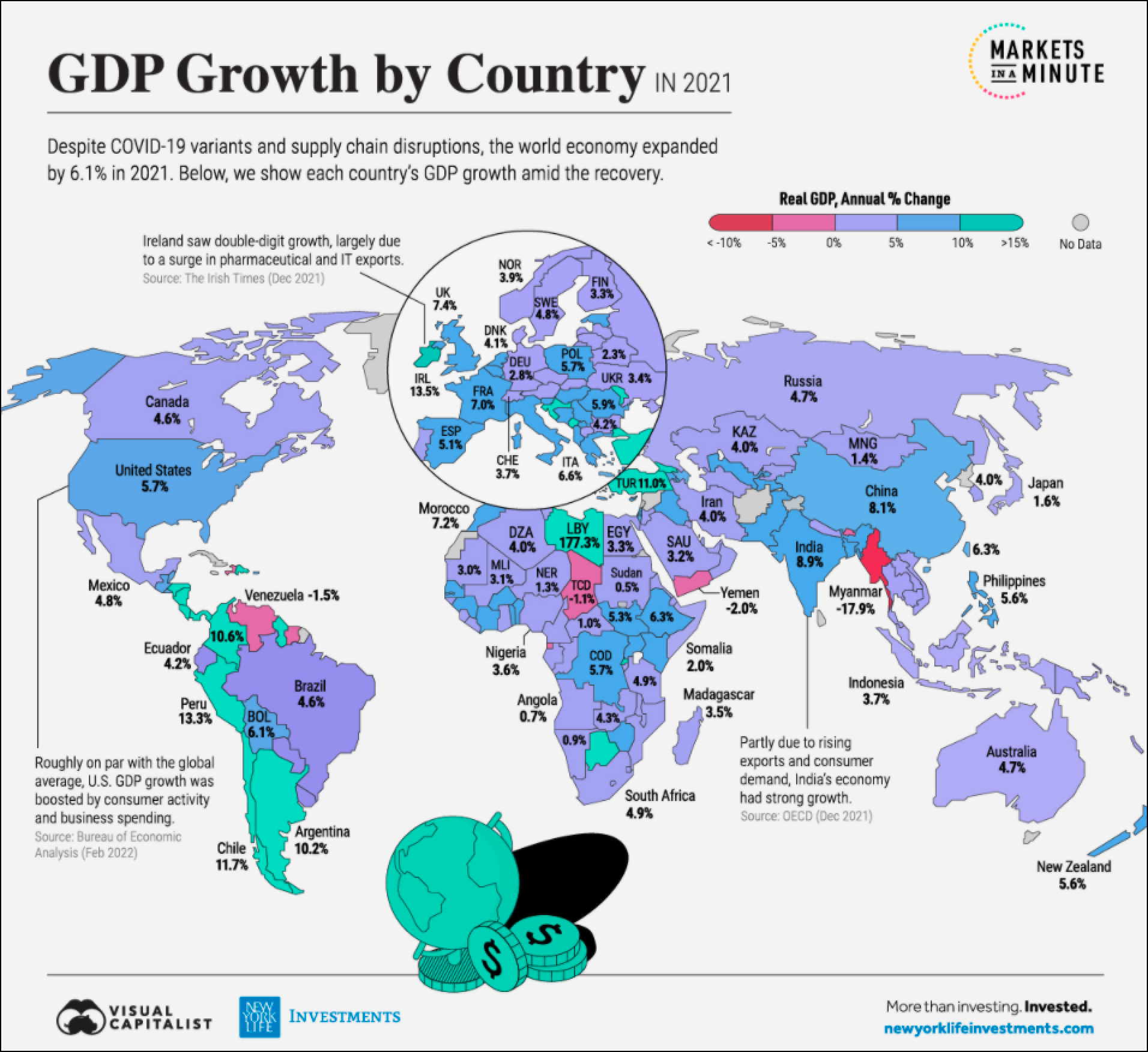

Globally, we find ourselves in a new economic cycle. After decades of decreasing interest rates and benign inflation, we have moved into a cycle of high inflation and increasing rates.

A few factors have led to the current environment:

Over a decade of very low interest rates,

Two years of global economic shutdowns,

Many governments handing out free money to their citizens, and

The knock-on effects of the Russian invasion of Ukraine.

In particular, increased energy prices have led to significant price increases in fuel, transport, housing costs, and consumer goods.

The mandate of most central banks around the world is to manage price increases (control inflation) in a way that leads to sustainable growth and promotes an environment in which people and governments can plan accordingly.

They do this by adjusting the money supply within an economy by changing interest rates. This affects the interest rate that consumers (you and me) pay on debt, and savers earn on cash savings.

Lower interest rates stimulate demand by making money cheaper to access. In comparison, higher interest rates suppress demand (and, in time, lead to lower inflation) by making access to money more expensive.

The recent sharp rise in inflation has forced central banks worldwide to increase interest rates, with further increases expected. While this may go some way towards reigning in the current price increases, it will also hamper growth and investment. While this will lead to short-term pain for consumers, business and economic cycles are a feature, and not a bug, of the global economy.

What You Can Do

We know that inflation is an enemy of those investors owning the wrong assets (cash) for the long term. This can be difficult to internalise during periods of low inflation, but it becomes abundantly clear during times like these.

Fortunately, this dangerous force can be countered by holding the right mix of financial assets. The portfolios we manage for our clients focus on combating inflation by aiming to achieve real returns (returns in excess of inflation) over an investor’s lifetime.

The wise investor can take comfort in the fact that, while your personal cash flow will be stretched during inflationary periods, the companies you own will adapt and continue to innovate. Long term, this will result in higher profits for them and an increase in wealth for you.

Consumers who have created a margin of safety in their monthly spending plans are likely to be able to absorb a temporary increase in their cost of living. Their ability to save may be hampered, but this period will pass. Rather than living in fear of global conditions, control your expenses as best you can. Excessive spending is dangerous to your long term financial plan, particularly during inflationary periods.

Now is the perfect opportunity to review your current spending patterns. Are you paying for subscriptions or services you don’t use anymore? Are there expenses that used to bring you joy but no longer do? Restructuring your spending habits during an inflationary time will set a foundation for future savings, or new expenses, which may increase the quality of your lifestyle.

We don’t wish the current environment on anyone but know that the ability to manage this transition will set you up for continued financial success. Faced with the harsh reality of the destructive power of inflation, we are all more easily able to appreciate the long term effect of its force and the tools available to us to fight it.

🛑 Ignore the media

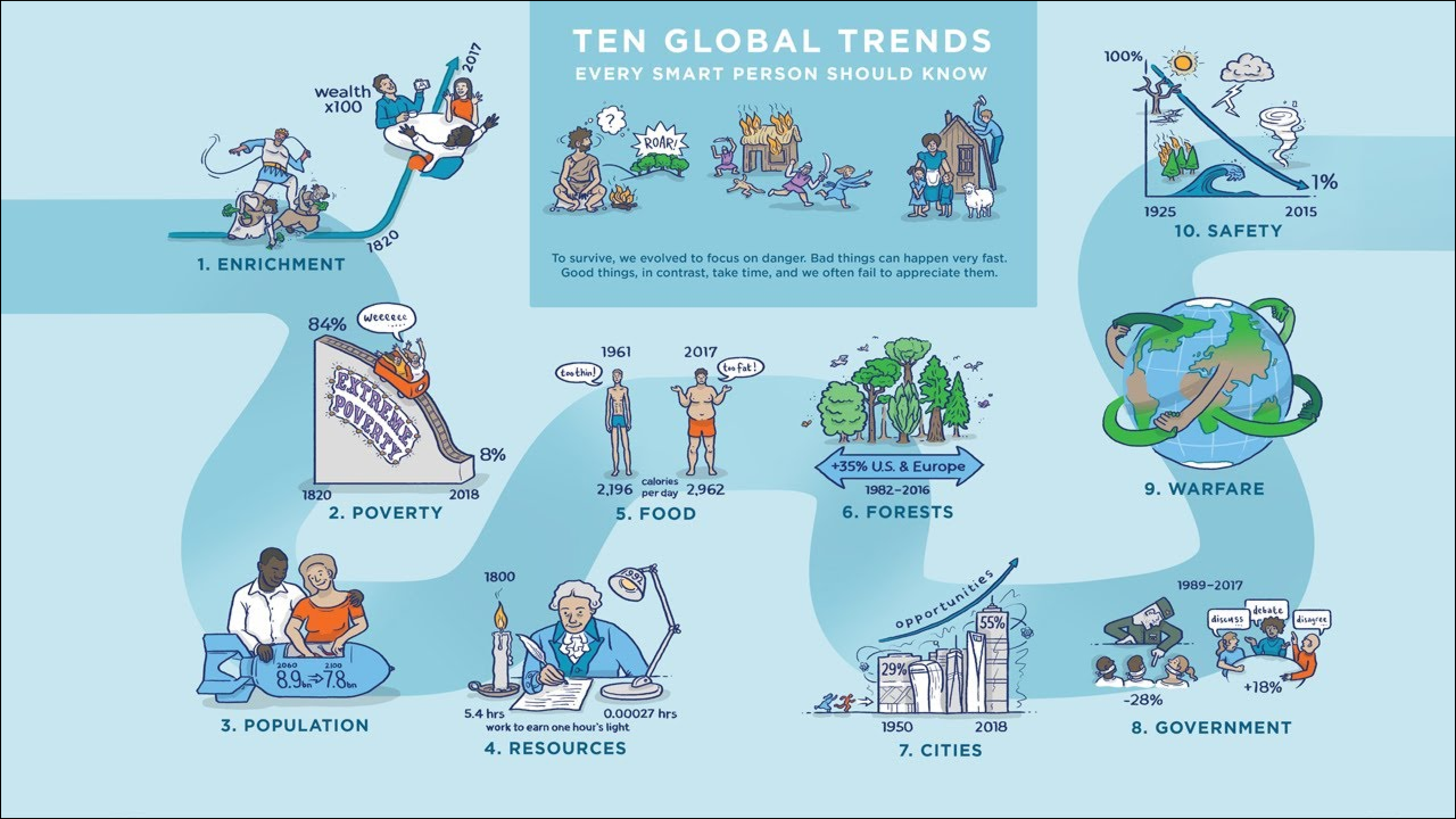

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Medic in jet suit reaches mountain top in 3.5 minutes

Urban forests create birdlife boom in New Zealand’s cities

📰 Read

Some Things I’m Not Going to Regret in 20 Years [4 minutes]. Life is a series of trade-offs.

Revenge is Easy, Kindness is Hard [6 minutes]. Behind every financial loss is a real person.

Addicted to Speed [8 minutes]. You don't want a house out in the country. You want to slow down.

Nostalgia and the Cessation of Time [4 minutes]. The subtle reminder that you were once capable of being free of time.

It’s less complicated than you think [3 minutes]. Who wins? The person who does the least.

18 Little Stories That Will Have Massive Impact On Your Life [8 minutes]. The quick and effective way is to learn by example.

🎧 Listen

What Most People Misunderstand About Investing [34 minutes]. And how to get them right.

🖼️ A Picture is Worth a 1000 Words

How Do Big Tech Giants Make Their Billions?

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,