March 2021 (USA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

What Game Are You Playing?

As January was drawing to an end the financial press was gripped by the story of a group of rebellious internet-based stock market traders taking on the giants of the hedge fund industry at their own game. A few hedge funds had taken significant bets on the demise (and share price decline) of a company called GameStop - an American video game retailer.

The hedge funds were planning to profit by borrowing the shares, selling them and then repurchasing at a later date for a profit. This practice is referred to as "short selling".

Members of the "Wallstreetbets" internet message board uncovered the fact that the hedge funds had taken this practice to the extreme (overconfidence?). They decided to orchestrate an increase in the company share price by buying up the stock and refusing to sell to the hedge funds. The hedge funds then became desperate to buy the stock back in order to limit their billion dollar losses that were brewing. A classic David vs Goliath battle, go on David!

While it made for interesting viewing, the game came to an inevitable conclusion: a sharp decline in the share price, accusations of regulatory interference and losses for many of the uninformed investors looking for a quick return.

Two lessons stand out for the mature, long term investor.

1. Understand The Game You Are Playing

While all investors are playing on the same "field", not all are playing the same game. Short term traders are concerned about what someone else will pay for an asset in a few hours or days, while long term buy-and-hold investors are more interested in a company’s profitability over a few decades.

Being influenced by someone playing a different game is a sure way to ruin. The financial literate is content to play their own game, maintaining the discipline required to be a successful long term investor.

Failed investors often innocently take queues from other investors who are playing a different game than they are.

One of the wonders of the GameStop saga is that most players knew how the game would end, but still chose to play. Like a game of musical chairs, the players were happy to chance their luck at grabbing a seat when the music stopped.

Now, as we write this, the GameStop share price has rallied again. You’re allowed to sit this one out! The beauty of the market is that many games can exist at one time - the challenge is to remember which one you’re playing.

2. Know When You Are Speculating

The second lesson is a reminder of how greed (or FOMO - fear of missing out) is an indelible feature of human nature. It can cause otherwise sensible people to abandon all rationality, lured by the promise of a quick return.

The great Warren Buffett, like his mentor Benjamin Graham before him, has made a point of distinguishing between investing and speculating. While the line separating the two is never bright and clear, he defines speculation as "the focus not on what an asset will produce but rather on what the next fellow will pay for it. It’s not a game which Charlie and I wish to play."

Speculation, while an exciting game, is not one in which you have a competitive advantage. On the other hand, patience and discipline is a game short of good players and one in which even the average investor (often referred to despisingly as "dumb money") can excel.

We are all tempted to speculate, but keep in mind your handicap.

Keep Your Eye on The Prize

GameStop is just one example of a scheme that was "working now". Similar opportunities will come and go until the end of time. As financial advisers, we’re more interested in "what’s always worked".

The best antidote to the temptations of speculation and being drawn into a foreign game is to remember your goals and your time frame.

You’re playing a different but wiser game. One that ends in an independent and dignified retirement and hopefully a meaningful legacy to those you love.

There will always be a GameStop saga brewing if you look hard enough for it. Our advice is avoid the unimportant and focus on the real prize.

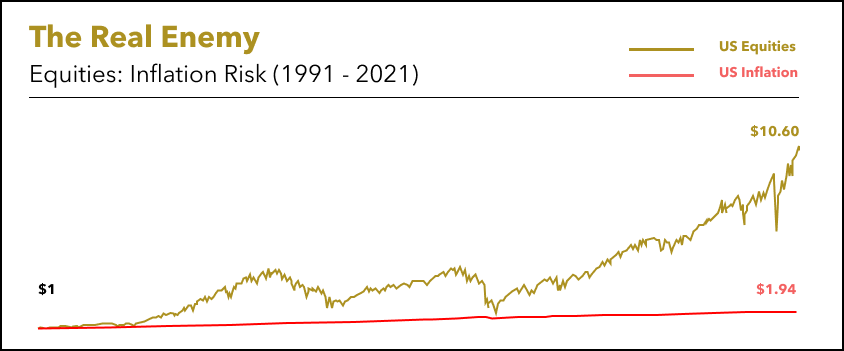

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in the USA has resulted in an item costing $1 in 1991 now costing $1.94 in 2021. Your purchasing power has almost halved!

But $1 invested in the US share market is worth $10.60 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Doctors Are Opening Digital Front Doors

Hills in the United Kingdom are being turned into batteries with new hydropower tech

📰 Read

The 10 Biggest Money Mistakes [5 minutes]. Mistakes are not only the foolish things that we do, but also the reasonable things that we don’t do.

What we get wrong about the Mexican Fisherman Parable [5 minutes]. Will you be a different person at the end of the story than you were when it started?

Real Return Is All That Matters [3 minutes]. Real return is what buys the groceries.

When Everyone’s a Genius (A Few Thoughts on Speculation) [4 minutes]. Investing is not the study of finance. It’s the study of how people behave with money.

100 (Short) Rules for a Better Life [4 minutes]. Which of these are you not doing?

Overcoming Regret [3 minutes]. How can you avoid similar mistakes in the future?

Retirement Preview [4 minutes]. 8 Lessons from the pandemic.

🎧 Listen

How The Stock Market Works [7 minutes]. Your opportunity to benefit from ingenuity.

Hindsight Bias [6 minutes]. Our memories are clouded by the outcomes.

🖼️ A Picture is Worth a 1000 Words

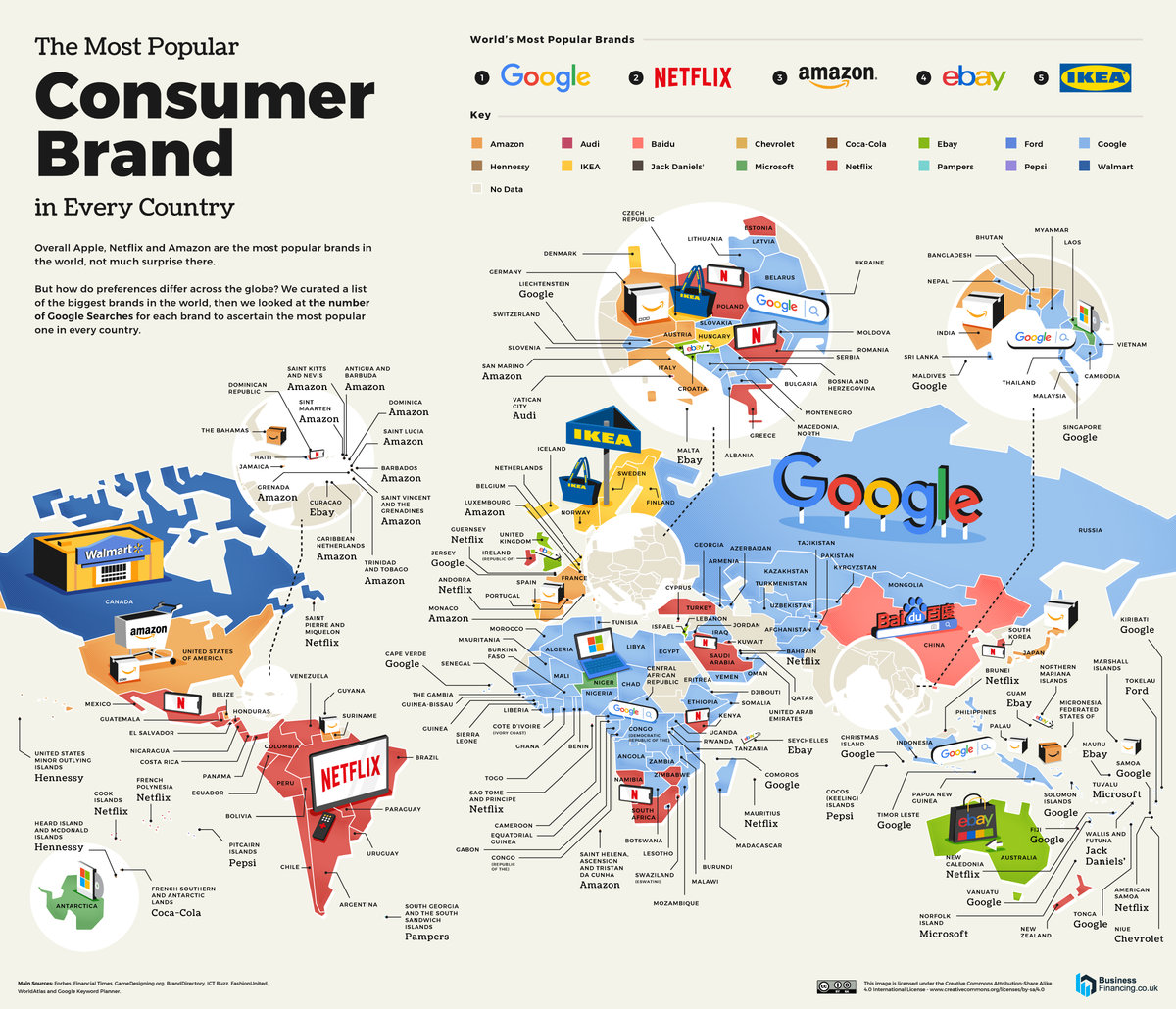

The Crazy World of Stonks Explained

World Beer Index 2021: What’s the Price of a Beer in Your Country?

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,