March 2022 (SA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

The Stock Markets

The only benchmark we focus on is our clients not running out of money and also achieving all of their financial and life goals.

The Unimportant Numbers - 1 Month ending 28 February 2022

UK - FTSE All Share Index: -0.5%

USA - S&P 500 Index: -3.0%

Global - MSCI World Index: -2.7%

South Africa - JSE All Share Index: +3.0%

Australia - MSCI Australia Index: +2.8%

The Important Numbers - 30 Years ending 28 February 2022

Investing in the Great Companies of the World have produced life-changing returns for the disciplined and patient investor over the last 30 years, the average length of a two-person retirement.

UK - FTSE All Share Index: +7.8% per annum

USA - S&P 500 Index: +9.9% per annum

Global - MSCI World Index: +7.8% per annum

South Africa - JSE All Share Index: +14.3% per annum

Australia - MSCI Australia Index: +8.3% per annum

Monthly figures are a distraction from your long term goals, we'll help you avoid the noise.

Your Financial Fortress

Empires fall for many reasons, but one of the surest ways to ruin is by letting the enemy inside the city walls. For this reason, fortresses are built to protect the people from unfriendly forces outside.

While it may not be visible, your family’s hard-earned wealth is under constant attack from forces wishing to reduce or destroy it. Your capital can take only two paths: (1) it can increase like a widening and deepening river (true wealth), or (2) it can run out, leaving you dependent on the help of others.

A plan and a guide (that’s us!) will provide most of the protection you need, but we want you to understand how to keep the enemy out. You’ve worked too hard for your money to have it needlessly destroyed.

Keeping The Enemy Out

Human nature means that anything new and exciting will bring about the fear of missing out (FOMO). It’s how we are wired. During your lifetime, you’ll see many of what appear to be attractive investment opportunities. However, within each one of these opportunities, danger may lie.

How can you spot the danger? If it’s exciting and seems too good to be true, it likely is. While some new shiny opportunities do turn out well, most don’t. Why risk it? Even if you do your homework, don’t rush into it and seek opinions from others. It frequently turns out disastrous. Nobody wakes up planning to make someone else rich today!

The biggest risk to your financial fortress is permanent loss of capital. It’s the one risk that is almost impossible to recover from. This is why it’s so important not to risk permanent loss without securing the family fortress first.

In the heat of the moment, the thought of significant gains may be exciting, but your priority at all times should be to protect the family financial fortress. Never let anything breach its walls.

Unfortunately, we’ve seen many clients succumb to a temptation that has harmed them financially. These show up as new fads, complicated investment structures, and sometimes outright scams. Sadly in many cases, the opportunity is presented to them by a well-meaning family member (usually a child) who knows just enough to be dangerous but not enough to be wise. The desire to attain quick wealth is universal, don’t think you’re immune to its temptations.

It may work out as hoped, but is it worth risking the family financial fortress? Think very carefully before you open the fortress doors to the Idea Peddlers.

Remember What Has Always Worked

Fads, scams, and opaque schemes should always be compared to the strategies which have always worked. Investing in the great companies of the world (the global stock market) has proven to work very successfully and delivered true wealth to those disciplined and patient enough to enjoy its compounding capabilities.

This strategy may seem boring to many in a world of instant gratification and new promises of easy wealth. Good, we say. Your family’s financial future is serious business and something that you consistently work on over many decades. If you’re after excitement, find a dangerous hobby.

If it’s wealth and security you’re after, make sure you’re benefiting from investing in human progress and innovation (the global stock market), which marches on slowly but steadily.

Life-changing returns are there to be had for the disciplined and patient investor. Why risk the fortress on an unproven long shot?

We’ll Stand Guard

Real wealth takes decades to build and only days to destroy if you’re not careful. Our advice is to only expose your family’s financial fortress to strategies that have always worked.

Our reason for being is to help you protect this fortress so that it can provide safety and security for your family for many generations to come.

As you navigate the financial world, we’ll stand guard at the fortress walls, helping you make informed decisions about who and what to let inside.

Please always contact us if you are considering a financial strategy that a friend or loved one has proposed to you. While they may be well-meaning, we’ve seen it all. We’re not letting anything into your family financial fortress that shouldn’t be there.

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 20 years, inflation in South Africa has resulted in an item costing R1 in 2002 now costing R2.38 in 2022. Your purchasing power has been decimated!

But R1 invested in the South African share market is worth R6.97 today, and that's ignoring 20 years of dividends! And this during a two-decade period that included the great financial crisis and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

99 Good News Stories You Probably Didn't Hear About in 2021

📰 Read

Now You Get It [4 minutes]. Some things must be experienced before they can be understood.

Do I Have Your Attention Now? [5 minutes]. How you invest your time is far more important than how you invest your portfolio.

100 Tips for a Better Life [12 minutes]. There's something for everyone in here.

Is Delayed Gratification The Most Important Trait You Should Develop? [6 minutes]. The work you put in now will pay dividends in the future.

Once you’ve done one “impossible” thing, you start to wonder what else might be possible [4 minutes]. Once you have climbed over one unscalable wall, you start to re-assess your entire world view.

There Has Never Been a Better or Worse Time to Be an Investor [4 minutes]. Many of the benefits that investors now enjoy come with significant behavioural costs.

Should you die with zero? [7 minutes]. Be intentional about what you want from your money.

🎧 Listen

Brainfluence: Dan Pink on The Power of Regret [26 minutes]. We all have regrets, and usually we think of regret as something to avoid. Dan Pink explains how regret can be a positive force.

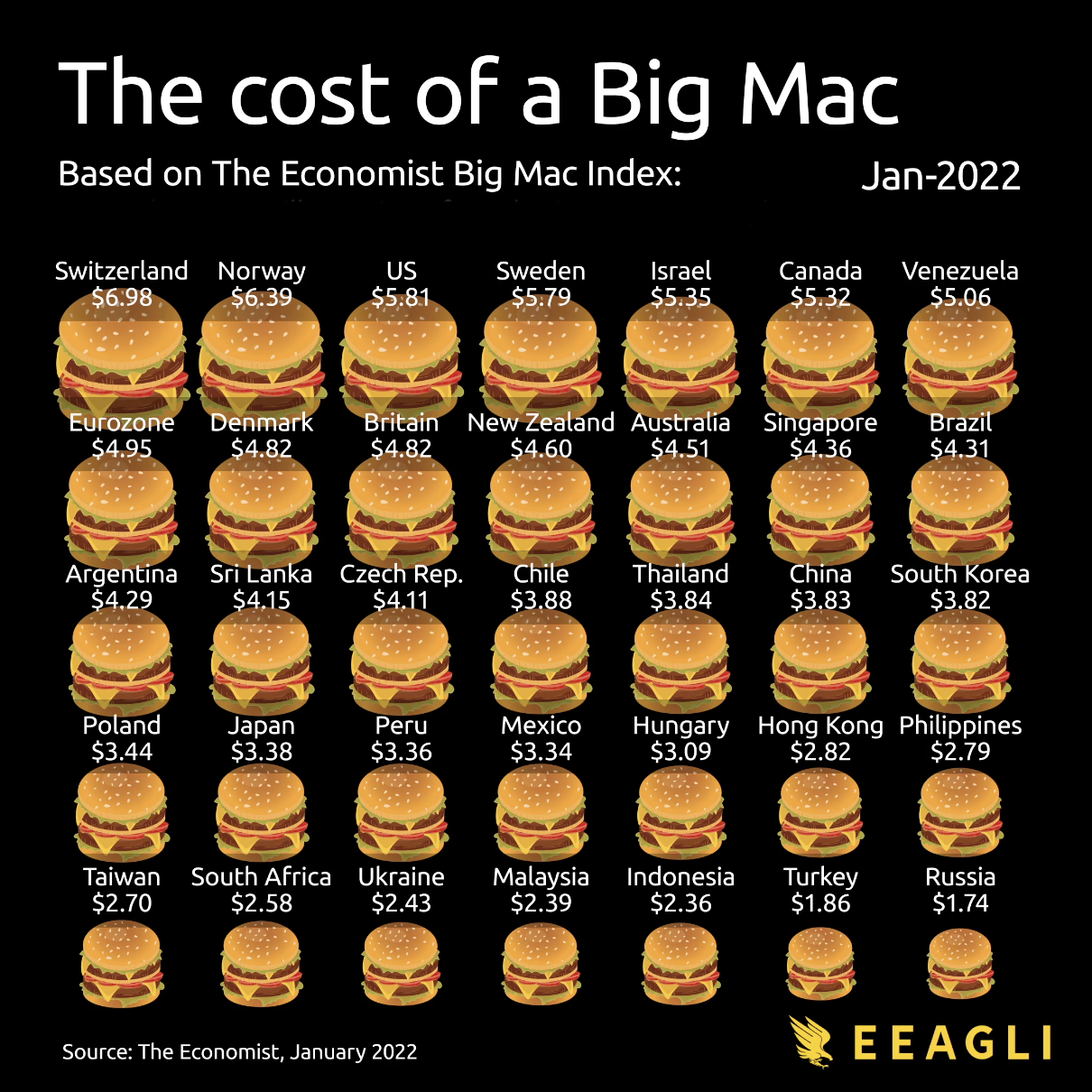

🖼️ A Picture is Worth a 1000 Words

Map Explainer: Key Facts About Ukraine

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,