May 2021 (SA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

Love Your Stranger

One of the common human conditions that bind us together is a desire for a better future, one in which we are independent, able to provide for our family's needs, help others, and leave a financial legacy to the next generation.

The way to this life is fairly simple, and not a secret to most. By living within our means and investing the rest, the future described above is within reach of most people.

However, just like eating less and exercising more is a well-known recipe for better health, the trick to a secure financial future is more about the doing than the knowing.

The Affliction of Humans

Economic theory in the 20th century concerned itself with what a rational person unafflicted by the human condition would do. This person (or "econ" as behavioural economists now refer to them) understood the tradeoffs inherent in every decision and made a decision that both their current and future selves would be proud of.

If only "econs" existed. When real people make decisions under conditions of uncertainty, we take mental shortcuts to help us. In financial decisions, this often leads to sub-optimal decisions, often ending in regret.

These biases have been documented extensively, and we actively try to identify them in our own, and our clients', decision-making.

The loss-aversion and recency biases would have been difficult to resist by any investor during the height of the 2020 market correction precipitated by the Covid-19 lockdowns.

While these, and other, biases will continue to plague all investors on their journey towards financial independence, there is another challenge we face that needs to be addressed.

The Present Bias

The tendency to favour the present over the future is something everyone can relate to.

Prepare for next week's meeting? That can wait, TV sounds better now. Save for the future? No thanks, YOLO. In a world of shortening attention spans and more assaults on our senses than ever before, the allure of instant gratification is all around us.

While your future self does not exist yet, there will come a time when you will become responsible for the impact your current decisions will have on that person. For this reason, the ease of prioritising the present over the future is a significant challenge for anyone wanting to achieve the financial security we all crave.

There's a reason why this is difficult. Studies have shown that when you imagine your future self, your brain does something weird: It stops acting as if you’re thinking about yourself. Instead, it starts acting as if you’re thinking about a completely different person.

Your brain acts as if your future self is someone you don’t know very well and, frankly, someone you don’t care about.

The Solution

In a world where most of the financial decisions we make have multi-decade implications, the inability to relate to our future selves is a big problem.

Knowing this problem exists is half the battle. Research has also found that people who interacted with virtual future selves exhibited an increased tendency to accept later monetary rewards over immediate ones. As augmented and virtual-reality technology continues to develop, perhaps an elegant implementation of this will become available to us.

Until then, a two-step process of understanding what our future (based on our current trajectory) is likely to look like, and imagining how we will feel about this outcome, is a useful test of our actions. Any discomfort with this reality should provide the motivation needed to overcome the inertia to making better financial decisions.

Your future self is watching, there's no time like the present to make a change.

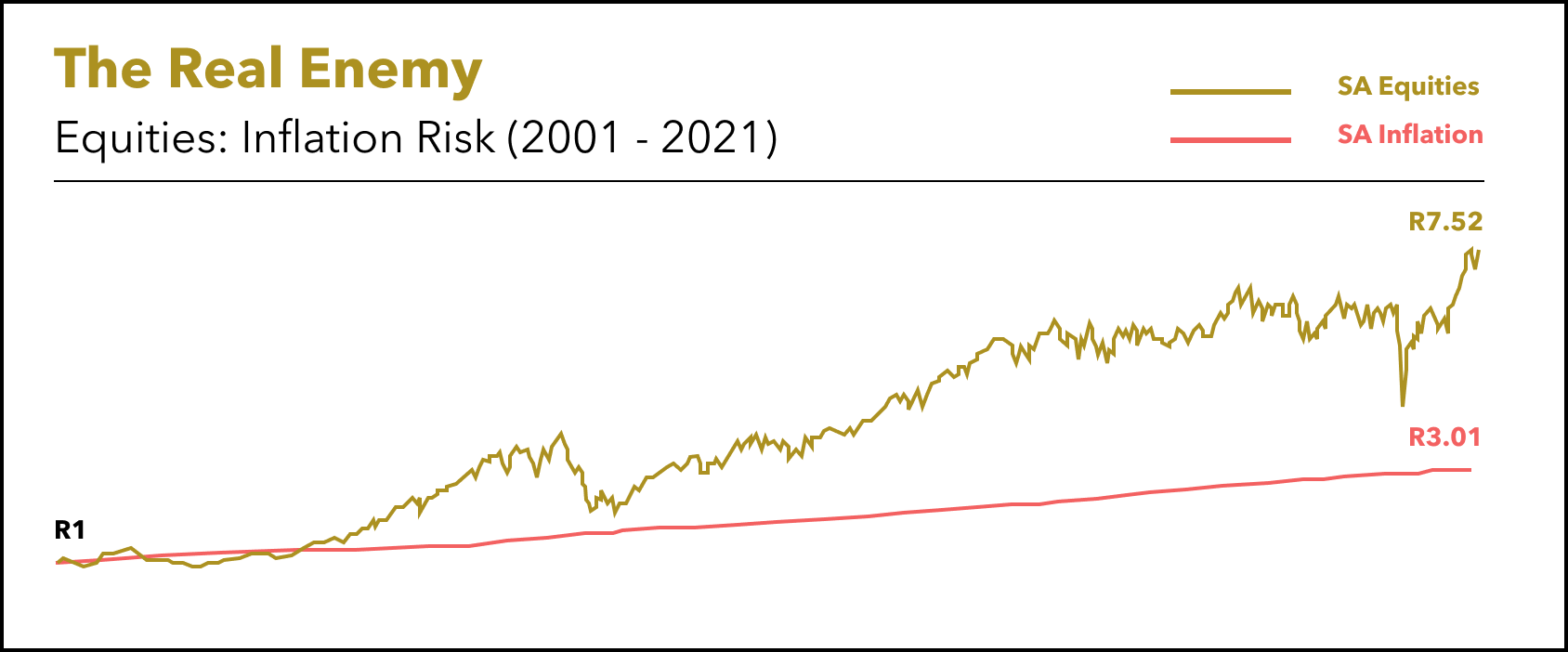

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 20 years, inflation in South Africa has resulted in an item costing R1 in 2001 now costing R3.01 in 2021. Your purchasing power has been decimated!

But R1 invested in the South African share market is worth R7.52 today, and that's ignoring 20 years of dividends! And this during a two-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Resources Are More Abundant Than Ever, and People Are the Reason

Aerion AS3 Airliner Will Fly From NYC to London in Less Than an Hour

📰 Read

When Wealth Isn't Real [6 minutes]. A few stories that illustrate how large sums of wealth are often illusionary.

David Booth: five timeless investment lessons I've learned [7 minutes]. Five lessons from forty years.

12 Personal Finance Numbers You Should Know [3 minutes]. How many do you know?

Five Investing Powers [3 minutes]. Stack the odds of lifetime success in your favour by learning these traits.

The Single Best Piece of Advice for Young Investors [2 minutes]. A great way to fight lifestyle creep.

Not Everything Gets Easier [5 minutes]. The challenge of raising children when money is no object.

Not wanting something is as good as having it [4 minutes]. Wanting less is a whole lot cheaper than getting more.

🎧 Listen

The Greatest Story Ever Told [5 minutes]. What is money?

The Portfolio Review Checklist [22 minutes]. What does an investment review really entail?

🍿 Watch

🖼️ A Picture is Worth a 1000 Words

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,