May 2022 (SA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

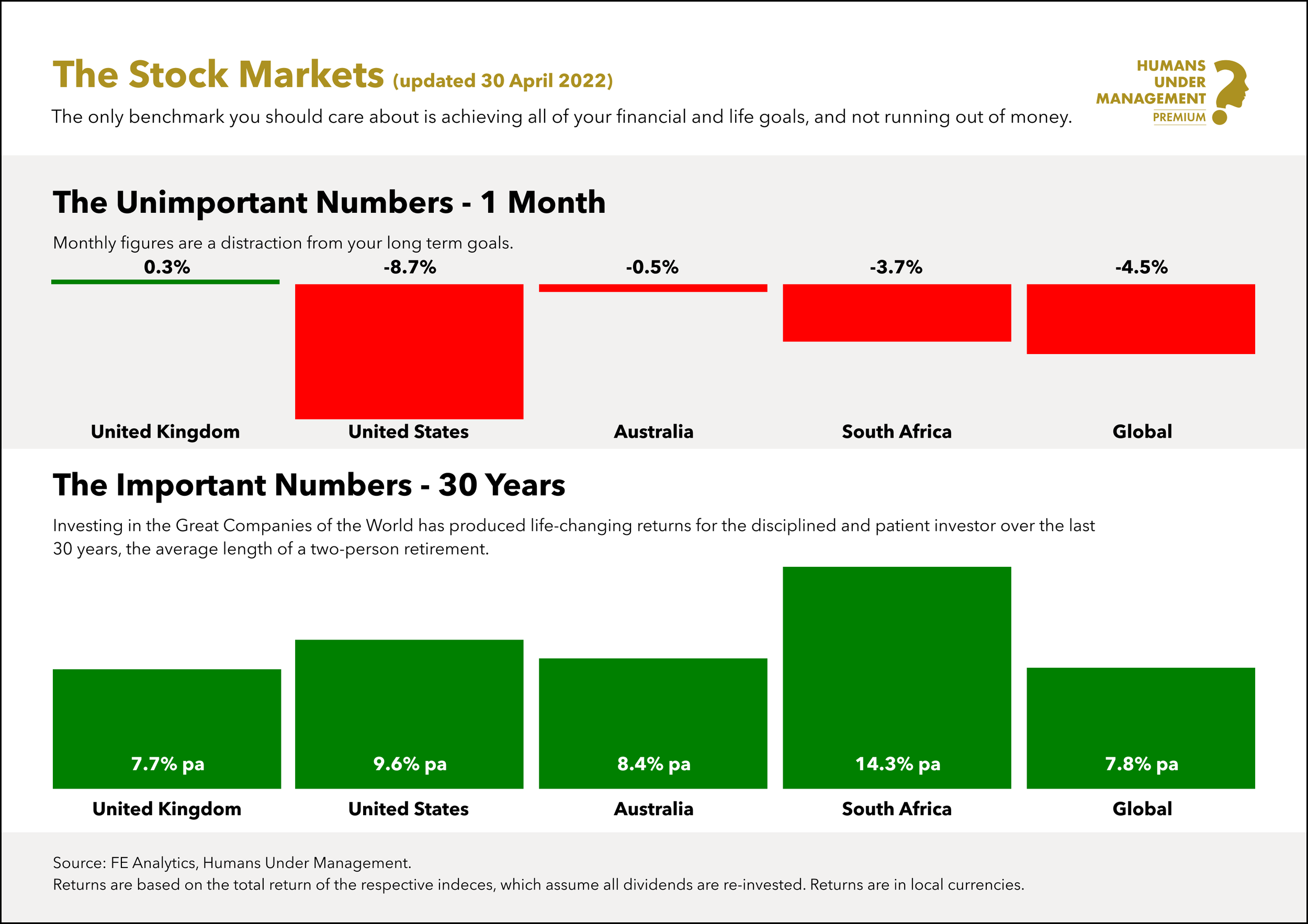

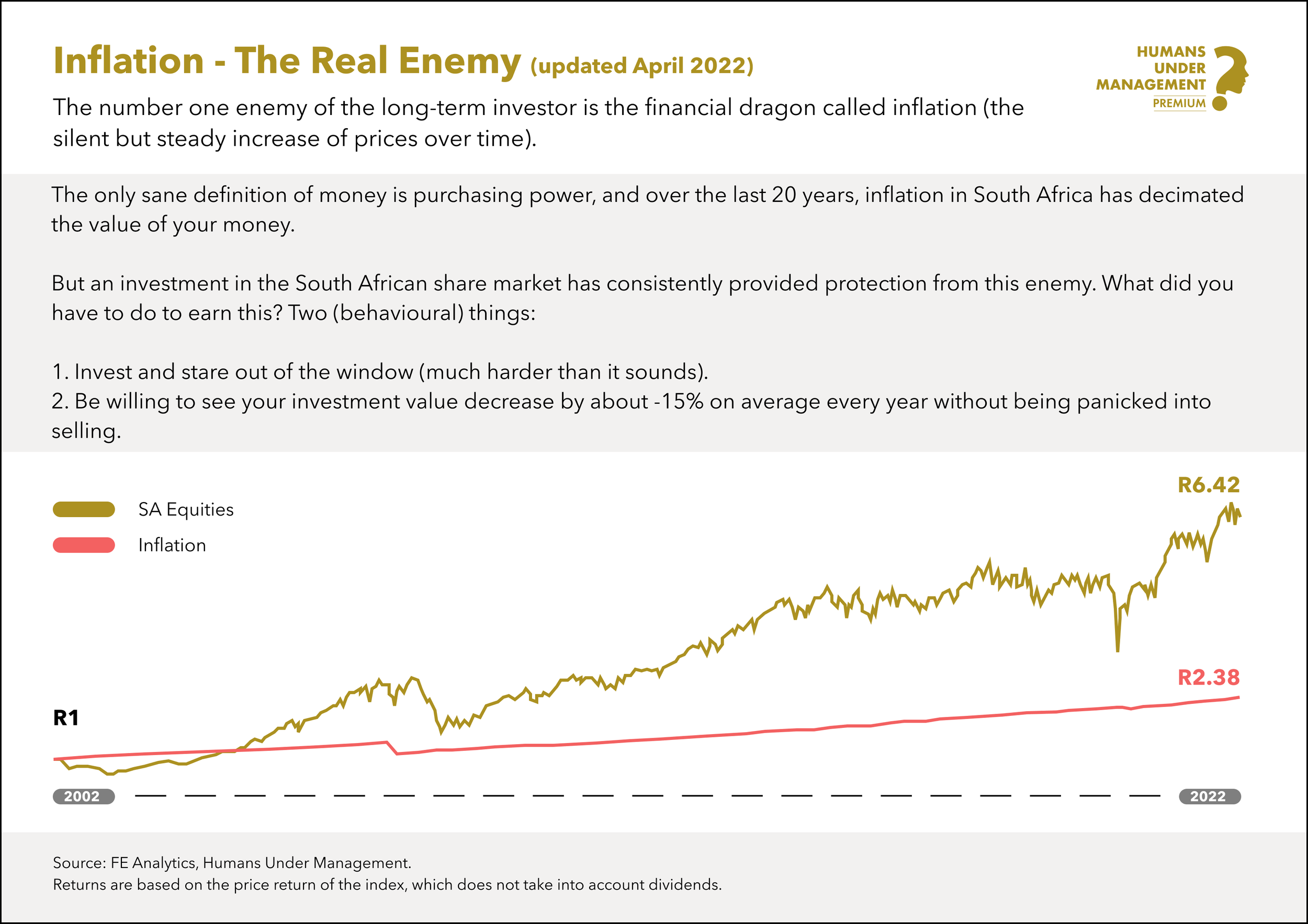

The Stock Markets

Congratulate Your Past Self

In theory, being a successful investor is easy. Spend less than you earn, invest the difference for three decades, and draw down what you need in retirement. The education, resources and tools needed to do this have never been more accessible. We’re practically drowning in information.

In practice, however, being a successful lifetime investor has never been more challenging. An abundance of investment options, breaking news delivered by phone notifications, and direct access to the competing views of “experts” mean that it’s no simple task navigating the journey from your first paycheck to your glorious financial independence day.

A few simple actions can reduce the noise you are exposed to, placing the odds in your favour. However, the greatest challenge you will face as an investor is one you cannot run away from; the emotional turmoil of living through a never-ending series of world and financial crises.

Is It Different This Time?

Benjamin Graham (the father of “value investing” and mentor to Warren Buffett) acknowledged the root of the problem over seventy years ago.

“The investor’s chief problem, and even his worst enemy, is likely to be himself”.

Whilst we’ve largely solved the mathematical element of the investing challenge, no one has yet solved the emotional part. We propose that no one will.

The behavioural challenge of acting rationally under uncertainty feels like it has been exacerbated by many of the developments we generally consider to be positive. The ease at which we can access information and near-zero transaction fees are benefits that have their downsides.

We know in theory that patience and discipline are required for investment success, but knowing something is not the same as experiencing it. In the middle of a global crisis (we’ve had many recently), being disciplined is easier said than done. But this is, and will always be, the defining characteristic of successful investors.

Whilst each crisis has its own name (Covid 19, Ukraine, Cost of living crisis) and its own unique characteristics, they all build-up to the point where it forces you to ask the golden question:

Is it different this time?

In this moment, your human side is screaming at you that this time is indeed different. How could it not be given how distressed you feel.

However, at that moment, your future self needs your present self to have the clarity of mind to acknowledge that while each crisis comes by a different name, they are essentially all the same.

Whilst we can’t prove anything about the future (after all, there are no facts about the future), we can look to the past and marvel at how resilient both humans and markets have been through every type of crisis. How is each crisis the same? The fact is that they are unlikely to matter in three decades. In fact, you won’t remember most of them in three years’ time.

You’ve Done This Before

You do not have to accept the above only in theory. You have your own unique history as an investor, and you have likely withstood many emotional challenges in the past.

If investing is more behavioural than intellectual, reflect on your past self’s good behaviour during difficult times. Investing is not one long cognitive challenge but rather a series of intermittent behavioural challenges.

It has been said that a successful investor's career is akin to a pilot’s career - long periods of utter boredom punctuated by a few moments of sheer terror.

When the next test comes (its name is as much a mystery to you as to me), take courage from your past self’s actions. There will be more to come. Stand firm. This time is never different.

Understanding the essence of the investing challenge, we see our role as standing guard between you and the few decisions which could derail your financial future. We call these the big mistakes. Please know that we are always available to you and understand that the emotional challenges described above are ones we all face.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Cancer survival rates are changing

Scotland’s forests are the largest they have been for 900 years

📰 Read

Choose Your Status Game Wisely [6 minutes]. The status game you choose in life ultimately determines what you optimise for.

The Most Important Question of Your Life [7 minutes]. If you're not sure what you want out of life, there is only one question you must ask yourself.

The Only Definition Of Wealth [3 minutes]. Just as important as monetary goals are health, time and optionality

The Good Old Days Are Happening Now [5 minutes]. Looking back with fondness is almost automatic, but you can consciously turn your fondness towards things happening now that you will one day miss.

The Quest to the Unlived Life [41 minutes]. We have our whole lives to play this game with Resistance.

Life Is Up To You: 8 Choices That Will Make Your Life Better [7 minutes]. These little choices add up.

🎧 Listen

The Case for Simplicity [53 minutes]. A great author's take on why less is more in investing.

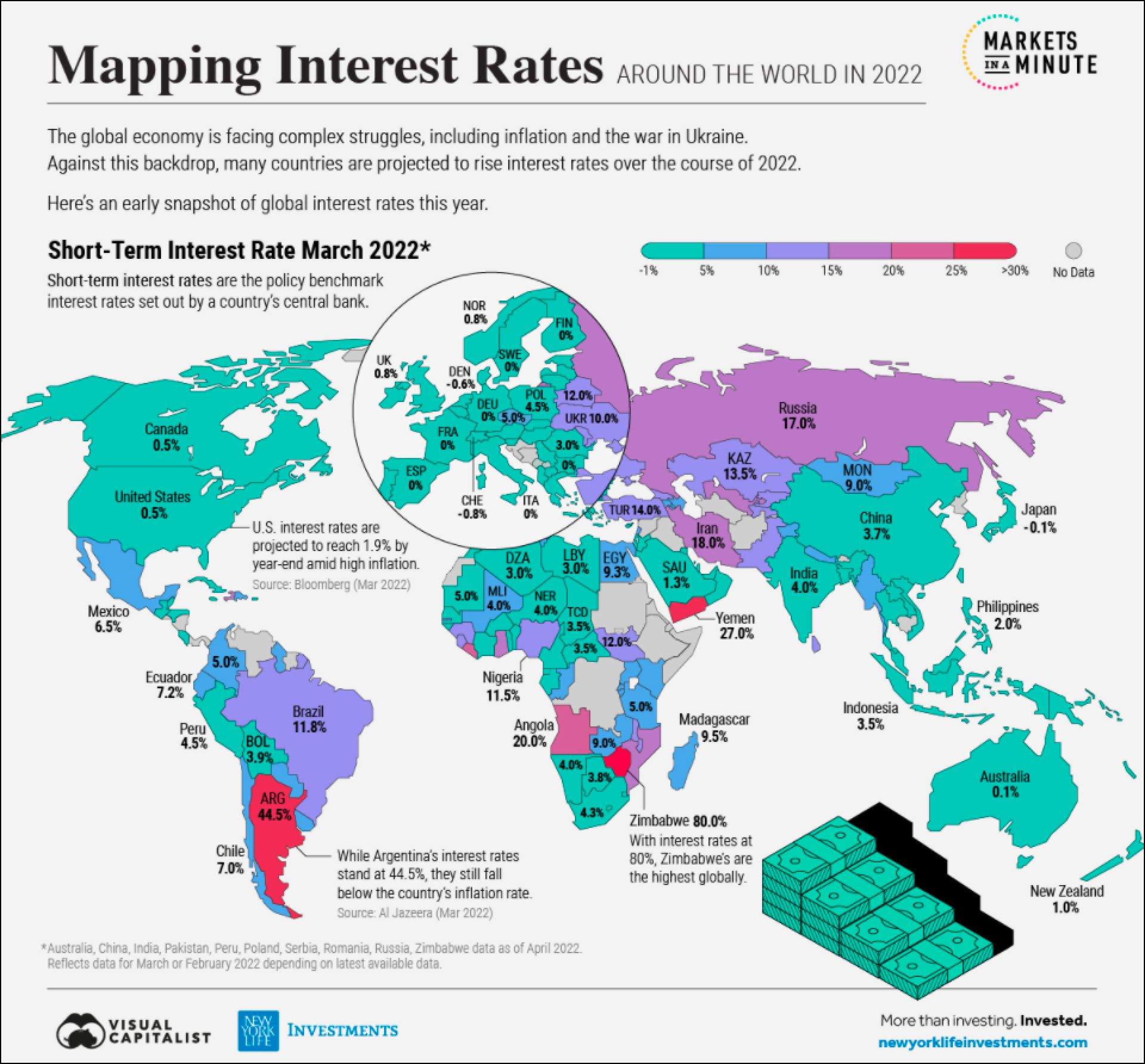

🖼️ A Picture is Worth a 1000 Words

Visualizing the Distribution of Household Wealth, By Country

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,