November 2021 (SA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

Sample Introduction

[edit and use as you wish]

It's that time of year again when Christmas plans start to take shape. Will we have a Turkey shortage or is this the latest crisis the mainstream media are touting? In previous years I have been known to have five or six Christmas dinners due to attending various events around Christmas time. I'm sure this year my Christmas dinner consumption will be kept to one dinner on the 25th.

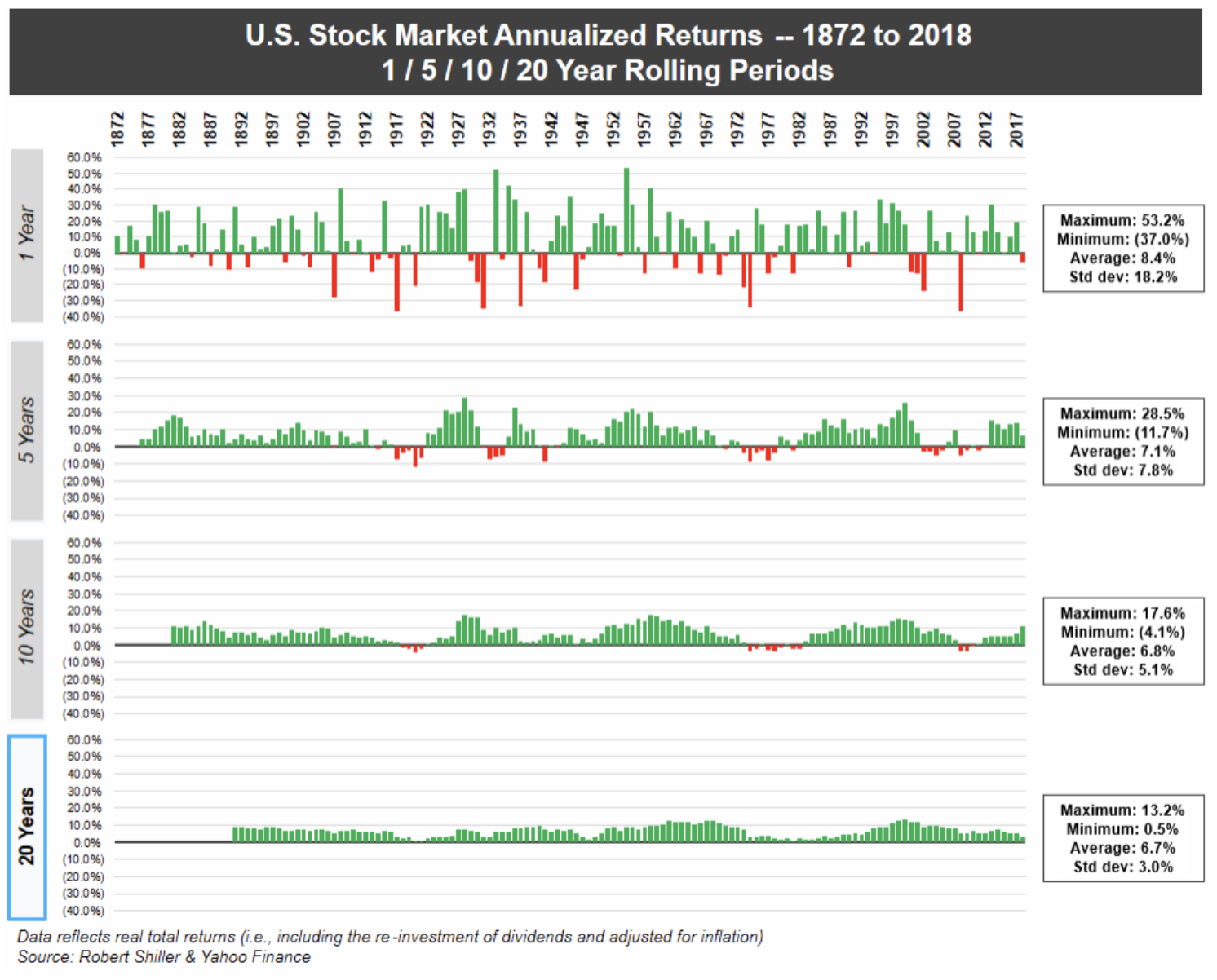

Those of you who've been clients of mine for some time will recall me saying that each year the general stock market (the great businesses we all use everyday) declines on average by about -14% a year. A correction, as these are called, has happened as frequently as your birthday. This year is an exception to the rule. It's been a very uneventful year really and the market has generally nudged up nice and smoothly, too smoothly it could be argued.

What can we take from this? No one really knows, but there may be dark weather on the horizon. Long term disciplined investors (all of my clients if they listen to me), however, pay little attention to the weather cycles. What we do pay attention to is the long term investing climate. With history being our guide (it's our only guide) there are no facts about the future. The investing climate rewards those who are patient and disciplined. All the stock market wants to do is enrich people and most people run from it or avoid it. Wealth, in and of itself, is arguably useless. However what wealth can do is provide freedom, security, and opportunity - the ultimate goal of financial planning.

How Many Good Summers Do You Have Left?

The change of seasons is a welcome reminder that we're not living in a never-ending now. Time marches on, and it waits for no one. Whether you find yourself on your way into, or out of, another Summer, it is a good time to reflect on the shortness of time.

At this time of the year we also ponder the year that's been and start thinking about our aspirations for what lies ahead. We’re roaring through the roaring twenties. While the days can feel long, the years are indeed short.

What is Wealth?

A simplistic definition of wealth is the amount of money you have access to. This unfortunately traps many people into spending their finite time to accumulate as much money as they can.

We know that money has value, and wasting it seems silly. But we all throw away something far more valuable every day: time. One of the few truly finite resources, the amount of time we get is uncertain, but we know it's limited.

Those who attain monetary wealth realise, sometimes too late, that real wealth is the ability to spend money to buy time. We find meaning in being able to spend time on our terms, doing things we love and that bring us joy.

One of the few benefits of the pandemic is that it forced most of us to spend time very differently from how we used to. It’s given us a valuable opportunity to recalibrate how we view the trade-off between time and money. Time is an abstract concept, difficult to get our heads around at times. One exercise that brings it to life is to consider how many specific events or seasons you may have left.

How many books will you realistically still be able to read? How many holidays do you have left to enjoy with your parents or children? How many good Summers do you have to look forward to, ones you are healthy enough to enjoy? We rarely reflect on how much quality time we have left, mostly caught up in the hustle and bustle of life.

Time Enough

Whilst the time we have is limited, there is enough of it to live a meaningful life if we use it wisely and are conscious of how much we have left.

The Roman philosopher Seneca wisely said:

"It is not that we have a short space of time, but that we waste much of it. Life is long enough, and it has been given in sufficiently generous measure to allow the accomplishment of the very greatest things if the whole of it is well invested."

A more holistic approach to your own financial planning may, therefore, involve resolving not only how you will invest your money, but also your time, energy, and talents.

Given that we find ourselves nearing the end of another calendar year, being intentional with our time is a challenge we can all rise to. It is our job to help you to make a connection between your money and the life you wish to live. It is a responsibility we take seriously and cherish.

As always, we are here to help you to make informed decisions about your money and enjoy the Summers you have left.

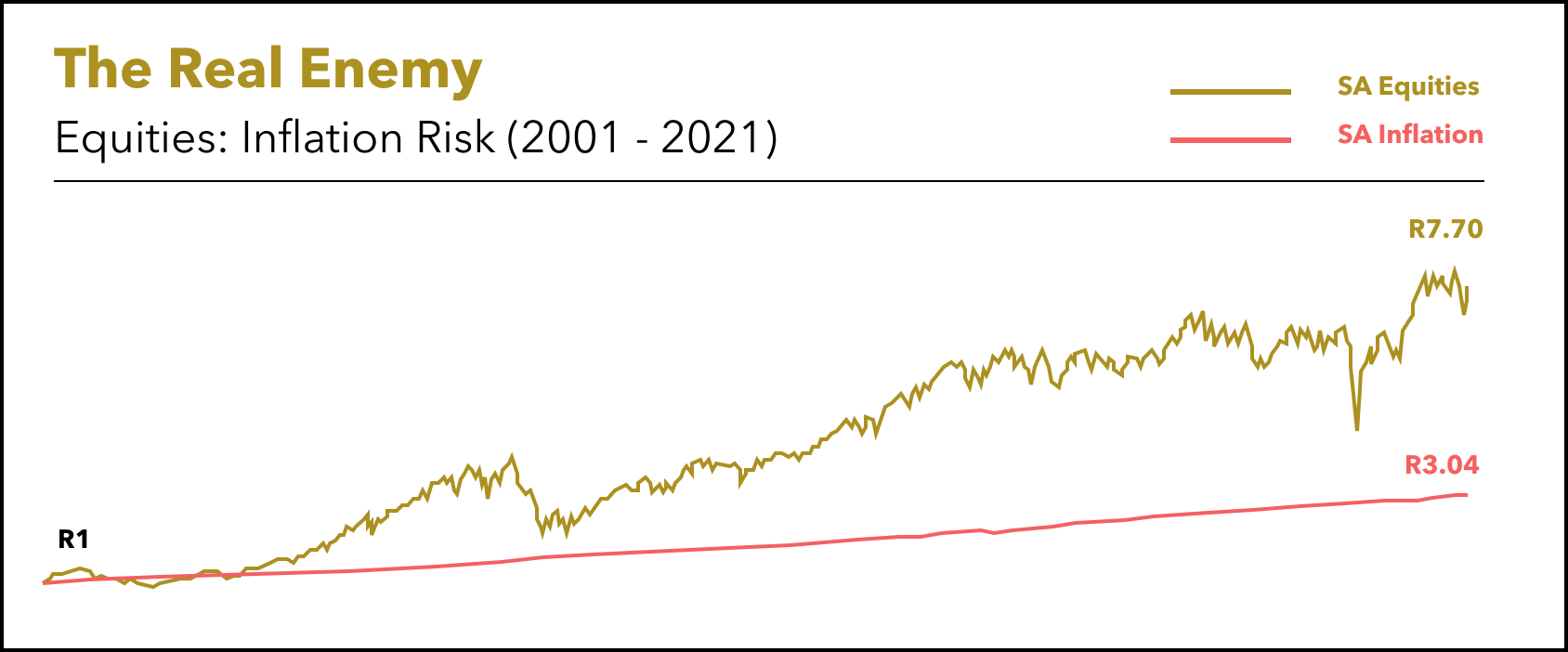

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 20 years, inflation in South Africa has resulted in an item costing R1 in 2001 now costing R3.04 in 2021. Your purchasing power has been decimated!

But R1 invested in the South African share market is worth R7.70 today, and that's ignoring 20 years of dividends! And this during a two-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Paul Ehrlich Ignores Abundance Again

The Reason We Are So Rich Is That There Are So Many of Us

Hydrogel Tablet Can Purify a Litre of River Water in an Hour

📰 Read

Nature Shows How This All Works [5 minutes]. Examples of mean reversion and exponential growth in the wild.

Be Challenged. Not Overwhelmed. [5 minutes]. Learn to navigate the ocean of your mind.

The Broken Clock [6 minutes]. People crave predictions.

4 Things That Will Never Change For Young Investors [6 minutes]. A few tenets of successful investing that won’t change in the years ahead.

Let the Market Worry For You [4 minutes]. If you worry too much about the downside, the upside won’t take care of itself.

What will you leave behind? [1 minute]. All growth comes with goodbyes.

🎧 Listen

Hidden Brain: The Halo Effect [53 minutes]. Is it possible to fairly evaluate our past actions when we know how things turned out?

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,