October 2021 (USA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

Don't Neglect The Golden Goose

Financial planning can be thought of as the art and science of making financial trade-offs under conditions of extreme uncertainty.

The biggest uncertainty is not knowing how long we will live for, and how healthy we'll be while we're still around. Being a responsible adult with healthy habits can put the odds in your favour, but disaster still strikes from time to time.

While we invest to protect ourselves from living too long, we insure ourselves to protect against dying too soon.

The Goose and the Golden Eggs

Insurance is not a sexy subject! Indeed, it is often sold rather than bought, a grudge purchase as such. Many people do not have a good grasp of what, and how much, they are insured for or what the benefits mean for them.

Strangely, most people are happy to insure their cars, home, phone, business, and other valuables. These are the golden eggs. They're expensive, and so we insure them against disaster. We don't then live in hope that our home burns down, we pay the premiums hoping we'll never need the cover. In essence we hope all of the insurance premiums we pay are an utter waste of money.

But what about the Golden Goose? The items listed above all rely on our ability to earn money and yet we treat our own lives and talent as if disaster will never strike us. But without the Golden Goose, there can be no eggs. It's a generalisation, but we see more people hesitant to insure the Goose than we do taking risks with their Eggs.

This leaves a ‘protection gap’ that means entire family futures are at risk if a health disaster strikes.

Practical Steps

Partly to blame for the protection gap is an obsession by insurance providers to complicate their products. More choice usually leads to less action. Do they have an incentive to confuse you?

However, insurance needs to be set up before it's needed, so it's worth understanding the most important risks you can insure yourself against.

Life cover pays out on your death and is a great tool for those who will leave behind debts and loved ones who have been dependent on your income. As you go through different life stages this need will change.

Critical illness cover pays out a lump sum on diagnosis of a list of conditions covering the major categories of illness. For many people this is a more likely occurrence than death and is more expensive than life insurance.

Income protection is a crucial benefit for anyone with a income, and in most countries will pay out tax free while you are unable to work and earn.

Putting these in place should help you to sleep better knowing that your family is taken care of regardless of your future prospects.

Prepare for the Worst, Hope for the Best

It's important for every investor to understand that without your ability to earn, the golden eggs don't exist. Financial literates put in place a plan to protect the Golden Goose. They do so gladly.

While it's important to review your choice of cover regularly, don't overanalyse the numbers. As with most things, done is better than perfect.

Your mindset around this topic is important. While many see human insurance as a grudge purchase, we know people who happily pay the premiums knowing that it brings certainty and peace of mind to an otherwise uncertain situation. They hope it will be wasted money, knowing that this means they've had a healthy and long life with the people they care about.

🐉 The Real Enemy

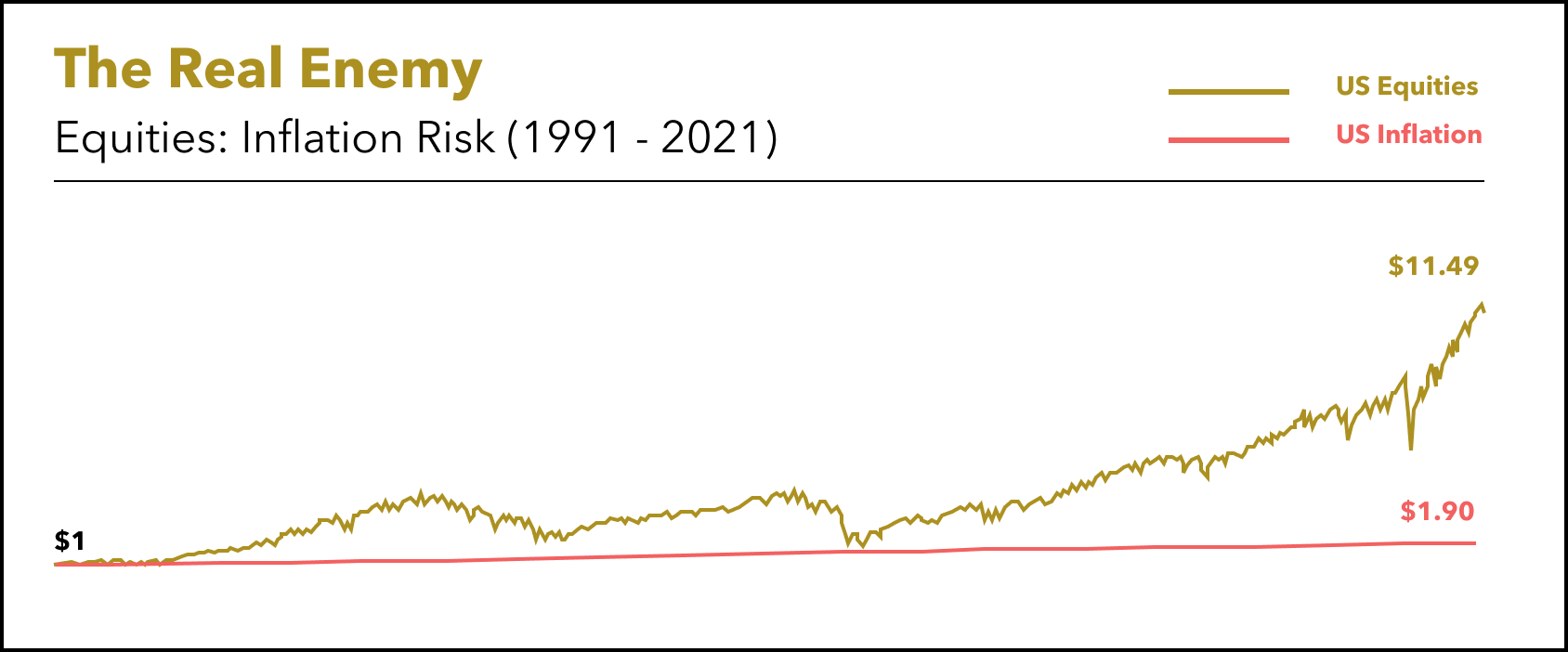

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in the USA has resulted in an item costing $1 in 1991 now costing $1.90 in 2021. Your purchasing power has almost halved!

But $1 invested in the US share market is worth $11.49 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Michelin's airless passenger car tires get their first public outing

📰 Read

Multi-Tasking and Our Greatest Fear [7 minutes]. Does it stem from the desire to overcome the finiteness of time?

This Little Decision Changed The Course of My Career [5 minutes]. Our biggest breakthroughs often come when we are working on them the least.

Money Is Time—Not the Other Way Around [4 minutes]. The reason many people want to earn more money is that they want to trade it for more time.

Trading Off [6 minutes]. 18 of life's key financial tradeoffs.

What Really Predicts Happiness? [5 minutes]. Close relationships, more than money or fame, are what keep people happy throughout their lives.

A Number From Today and A Story About Tomorrow [3 minutes]. It never seems like storytelling when you’re basing a forecast in data.

Want to Improve Your Career? Become an Uncertainty Killer [6 minutes]. If you can make other peoples’ lives more certain, they will sing your praises.

🎧 Listen

Boring is Beautiful [4 minutes]. Your investment strategy shouldn’t make your heart rate or blood pressure rise.

🖼️ A Picture is Worth a 1000 Words

The World’s Most Used Apps

Visualizing the Highest-Paid Athletes in 2021

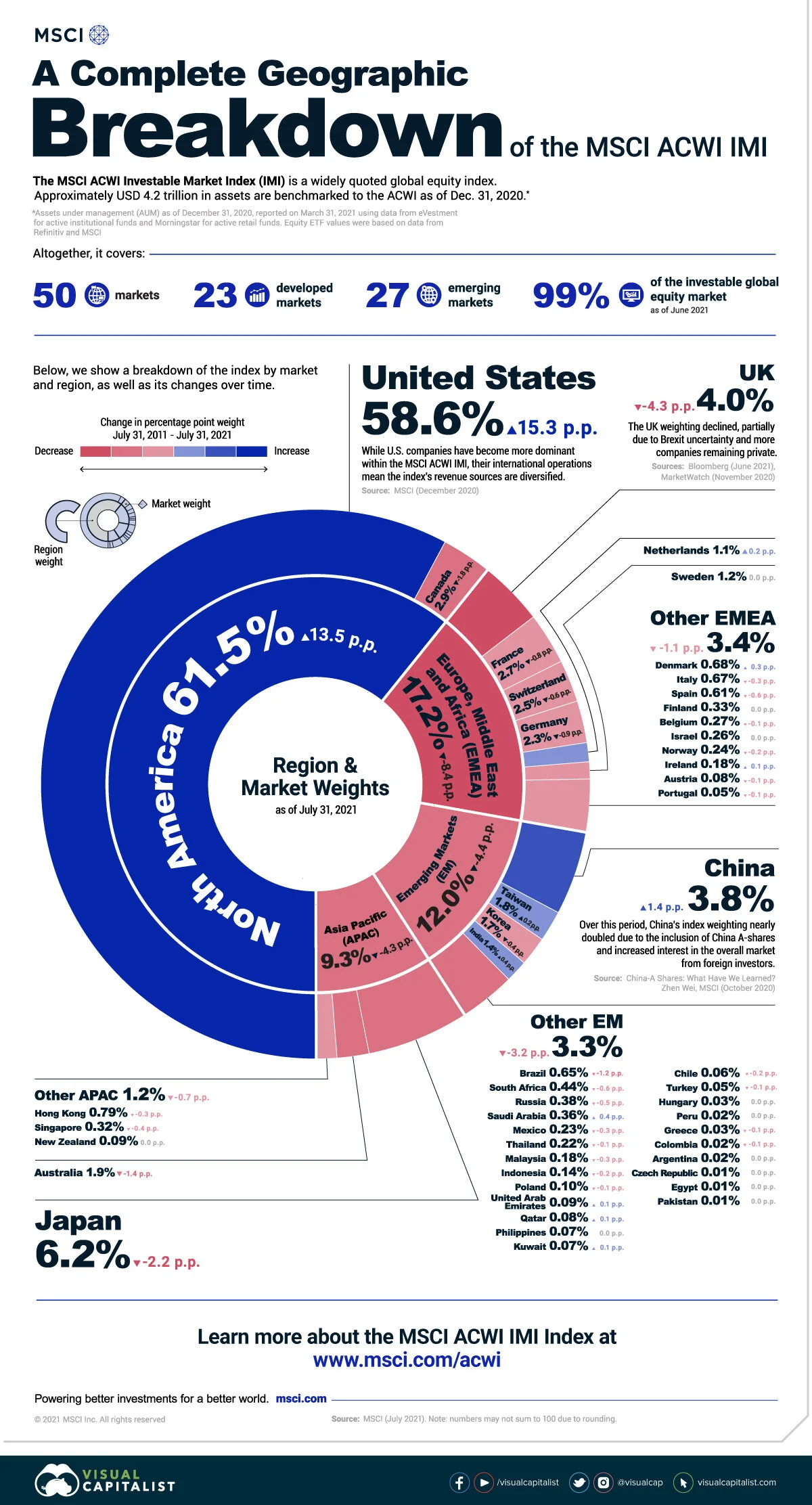

A Geographic Breakdown of the MSCI All Country World Index

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,