September 2021 (USA version)

Dear …

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

Introduction Idea:

It is said that being a successful long term investor is in some ways similar to being an Airline Pilot. Long periods of very little punctuated with short periods of pure terror. For investors, March 2020 was one such period of terror. You may recall I wrote an article a week during this time basically telling you to 'do nothing'. Well, this 'advice' to do nothing has turned out very well. I believe with all my heart that the fee you're paying me could be summed up as 'big mistake insurance'. Many DIY investors got hammered in March 2020 because they didn't have someone ready to stand between them and the big mistake.

As I write this introduction the S&P 500 (America's 500 greatest companies and the world's main stock market) has doubled in the last 354 trading days (approximately 18 months). This is a rare occasion, and it's where the bulk of my money and yours is invested.

What did you need to do over these 18 months to benefit from this soaring advance? The answer is simple: stay in your seat. This is far harder than it sounds. It's a great reminder that investing success is temperamental and not intellectual. Many smart geniuses reacted. We didn't, and we won't. Our investment policy is to be invested all of the time, predominantly in global equities (the great businesses of this world). In order to ride the permanent advance we occasionally have to stomach some gut-wrenching declines. We continually act on your financial plan, and we don't react to current events.

All successful investing is long-term in nature, failed investing is short-term in nature and in reaction to current events.

As always I hope you enjoy this month's newsletter, if you have any questions regarding anything please just hit reply, as always we're here to assist.

There’s Beauty In Simplicity

As we grow up and experience more of the world we learn that a topic typically gets more complicated as we dive deeper into it.

For example, supply and demand is a concept most of us can grasp quickly, but having a deep understanding of how these variables are affected by changes in interest rates, inflation and trade relations requires further study.

We also find that for those who push past a certain point in any discipline things seem to simplify again. The detail fades away, you unlearn some of the complexities that don't seem to matter, and you're able to distil the subject into the few key points that really matter.

True simplicity comes from a deep understanding and appreciation for the subject matter. When shared, this simplicity allows the rest of us to make sense of the world without becoming an expert in every field.

Every great teacher or writer has this quality. Richard Feynman's writing can make anyone appreciate the key lessons in physics, and he'll make you laugh. Who would have thought physics could be humorous?

Complexity For Its Own Sake

Unfortunately, we too often encounter complexity where simplicity is what we really need. In many cases it's used as a way to confuse, leaving the recipient with little understanding and keeping them reliant on the expert.

The financial industry is no different. Experts highlight the dismal level of financial literacy and argue for financial education to be part of the school curriculum, but very few contribute to the changes we need.

Most industry players are complicit by using complexity to spread fear and a reliance on an industry which is happy to sell a product without having the buyer understand what they are getting themselves into.

The media creates the crisis of the day (or fans the flames) while the financial machine stands ready with the solution which would have solved the previous crisis but little chance of being suitable for the current challenge.

If there's anything we've learnt from the history of the financial markets it's that there are a few key learnings which will always apply. Once you approach every new crisis with this knowledge, the world becomes much simpler.

Simple Is Better

Money, too, can be simple if you want it to be.

If it's complexity you want, then financial product providers will give it to you. There's a product for every financial fear you might have. But starting here is likely to lead you astray. You'll need to work out what these mean for you and the lifestyle you want to have. A new crisis might make you second-guess your tactic, taking you back to square one.

A true understanding of money allows you to build on your understanding of your own situation and the life you want to live.

A strategy can then be built on a simple understanding of the concepts of spending less than you earn, investing for your unknown future, providing for short term expenses, compound interest, and historical market returns combined with old-fashioned discipline and patience.

We have found that people find the above process easier when it's facilitated by a caring financial adviser who can educate, encourage, and hold them accountable.

Products may be required, but they'll be put in their rightful place.

The Choice Is Yours

We have a choice between simple and complex in many areas of life. Sadly, complexity is often perceived as clever and sophisticated. It's easy to look down on a simple strategy when a complex one will make you look smart. With financial matters, nothing could be further from the truth.

The real tragedy is that many don't know that simplicity with money is an option. They accept the complicity sold to them with the result often being overwhelm and a lack of understanding. In many cases this leads to disengagement, which itself compounds into long term consequences.

Our experience is that simple and done is almost better than complex and perfect. Clients taking action and engaging in their own financial affairs leads to a proper understanding of how their decisions will impact their long term future

How can your plan be simplified to remove the unnecessary?

🐉 The Real Enemy

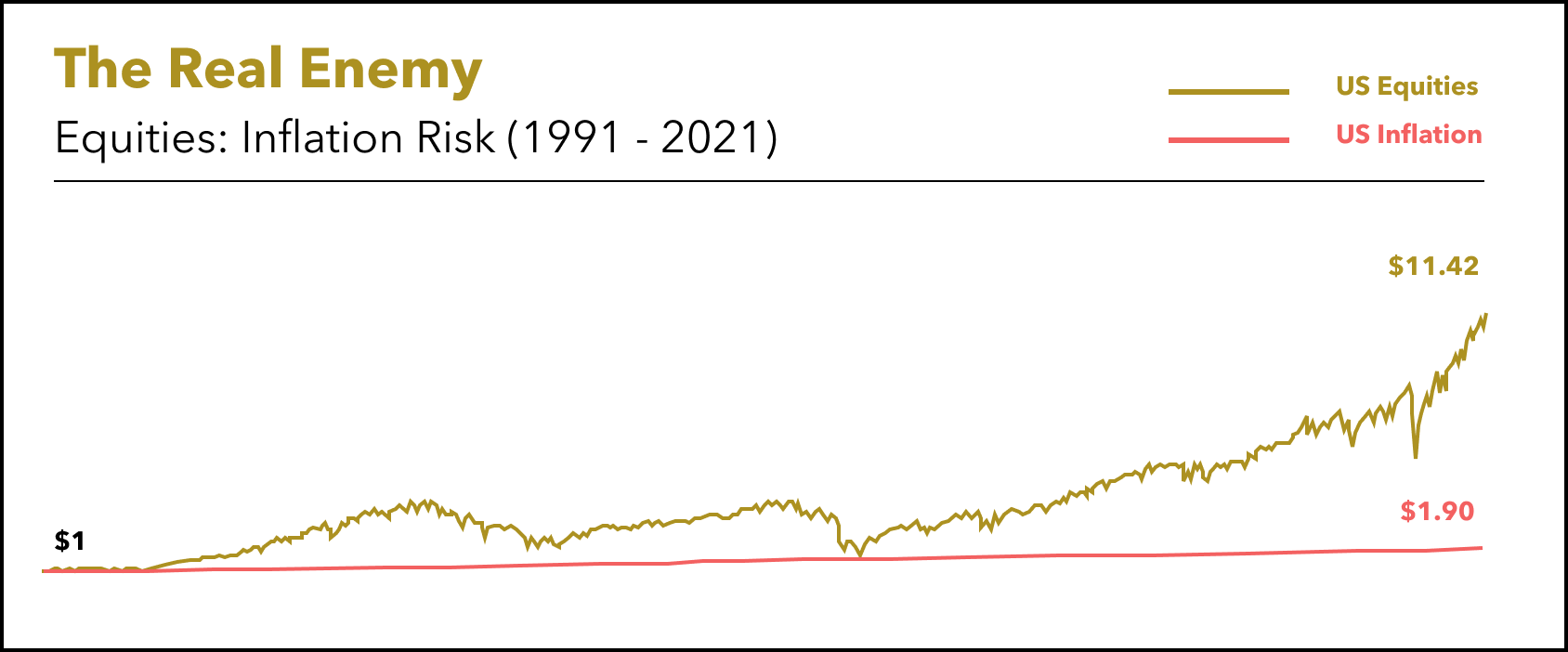

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in the USA has resulted in an item costing $1 in 1991 now costing $1.90 in 2021. Your purchasing power has almost halved!

But $1 invested in the US share market is worth $11.42 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Astronomers see galaxies in ultra-high definition

📰 Read

A Life of Meaning, Without Buying [3 minutes]. What we really want can’t be found outside of us.

The Cost of Friendship [5 minutes]. We should be concerned about accumulating friends as much as financial assets.

What it Means to be Rich [3 minutes]. A truly rich life goes beyond money.

Happiness Dividends: Making your Experiences Pay you Back [12 minutes]. What are memories worth?

The More Options You Have, The Happier You Are [5 minutes]. Sometimes what matters most is choice.

How to Buy Happiness (Responsibly) [5 minutes]. Not all spending is bad.

Hanging By A Thread [5 minutes]. Three stories from history.

🎧 Listen

How to Change your Financial Habits [57 minutes]. An interesting look at the science behind making healthy financial changes.

🍿 Watch

🖼️ A Picture is Worth a 1000 Words

Visualizing the Critical Metals in a Smartphone

Mercator Misconceptions: Clever Map Shows the True Size of Countries

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,