May 2020

Dear [FIRST NAME GOES HERE]

You're unlikely to ever experience an April as unique as the one we've just lived through.

We hope you and your loved ones are persevering during this challenging time.

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

🧠 Remember This Crisis

We may still be in the middle of what may prove to be a once-in-a-lifetime event for modern society.

Not only are we having to grapple with the health consequences, we're also forced to think about how this will affect daily life for the foreseeable future.

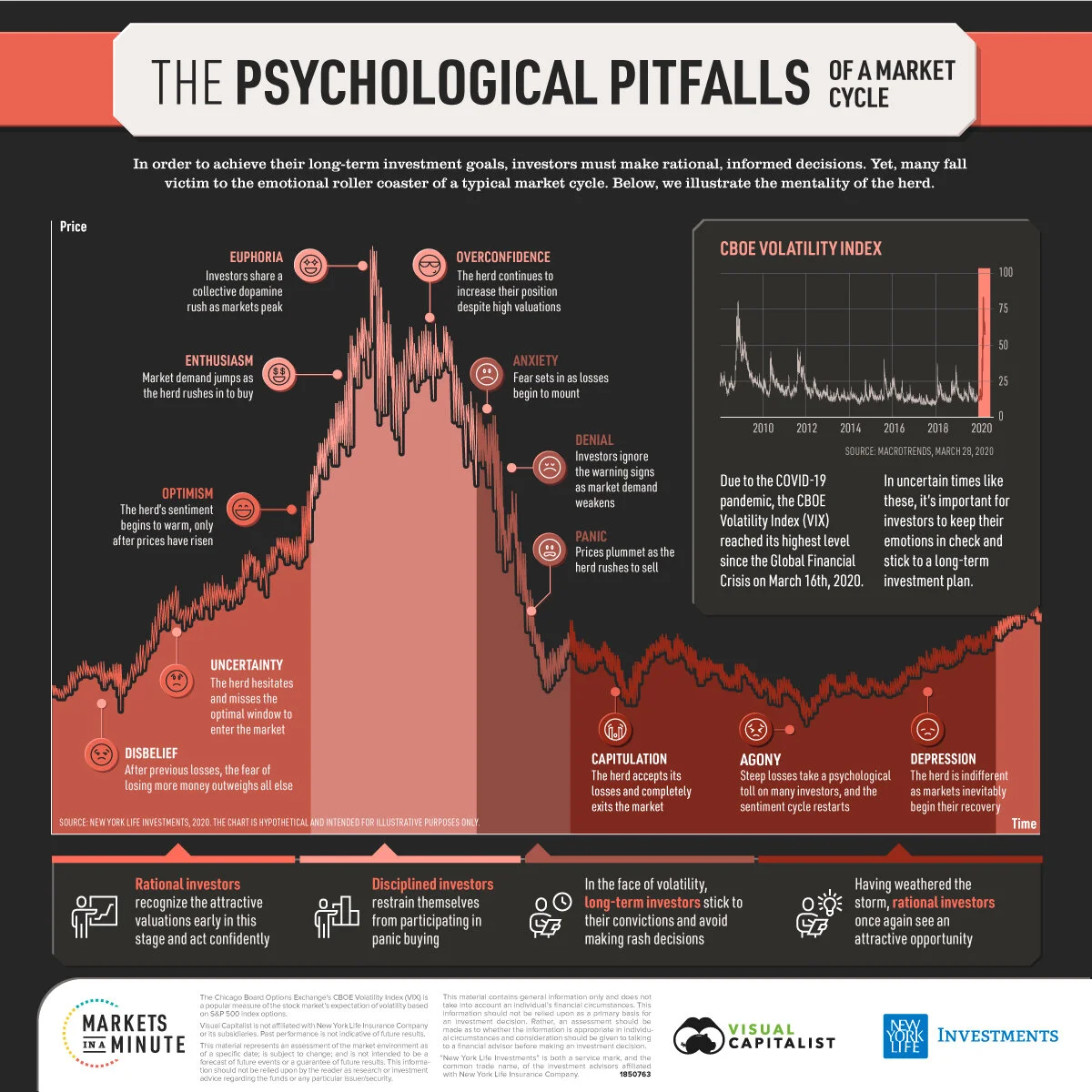

The stock market has also not gone unscathed, and because of that many have been on an emotional rollercoaster. Investing tests your emotions and not your intellect. It's highly likely that the messages you've been bombarded with by the media have run counter to wise investment discipline. If you are an investing literate or have the counsel of a behavioural financial adviser, you've likely come through this unscathed. Your portfolio is intact and your personal financial plan survives to fight another day.

We urge you not to move on and forget the emotions and temptations of the last two months. A time will come when you are challenged again, and in that moment the memories of your feelings and discipline will stand you in good stead.

Bottle this feeling. It will serve you well during the next crisis or panic.

🆓 The Free Lunch Section

There's no such thing as a free lunch, as the saying goes. However, when it comes to investing there are many things which come close enough.

These things may require only a little bit of effort, but pay great dividends to those disciplined enough to do them.

One such habit is that of not regularly checking your investment accounts. If you know that your current portfolio supports the goals and aspirations expressed in your lovingly-created financial plan, very little good can come from regularly checking in on your investment account.

You don't dig up a tree every 90 days to check on its progress, and neither should you be tempting your own patience by regularly checking your account statements.

The best part about developing this discipline? If you don't see the market crisis' effect on your investment account, did it even happen? Therein lies great investment wisdom.

🐉 The Real Enemy

The number one enemy of the real life investor is the financial dragon called inflation (the slow but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in the UK has resulted in an item costing £1 in 1990 now costing £1.97 in 2020. Your purchasing power has almost halved!

But £1 invested in the FTSE All Share is worth £2.95 today, and that's ignoring 30 years of dividends! And this during a three decade period that included the dot-com bubble, the great financial crisis, and the current Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, they prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Coronavirus Should Finally Smash the Barriers to Telemedicine

📰 Interesting Links

We link to the following interesting content to help you separate the signal from the noise.

Top Ten Behavioral Biases, Illustrated #5: Everybody Loves a Winner [5 minutes]. We are eager to identify with a group.

When Something Is Taken Away [3 minutes]. Only when something is taken away, do we truly realise its value.

Happiness Is Only A Vacation Destination [3 minutes]. We’re going to be O.K., despite our best efforts at predicting a bleak future.

What you pay a financial planner for [4 minutes]. A sound financial planner will play a number of pivotal roles for their clients, none of which are on the typical job description.

What’s Different This Time [4 minutes]. What was a tragic but expected part of life 100 years ago is now a tragic and inconceivable part of life in 2020.

The Next 20% Move [3 minutes]. We don’t know which direction the next 20% move will be, but we know where the next 100% move will be.

The prescription for living in a time of uncertainty [4 minutes]. Control what you can control.

Who Feels Rich Really? [6 minutes]. You can always point to someone else who is doing better.

Why We Doubt Ourselves [14 minutes]. It comes with the territory of any worthwhile endeavour.

🎧 Great Listens

Morgan Housel – The Psychology of Money [46 minutes]

What shapes the role of money in different societies, and how does investor psychology lead to self-inflicted problems?

🍿 Must Watch

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative or colleague.

As always, we're here for you.

See you next month,