July 2020 (SA version)

Dear [FIRST NAME GOES HERE]

[company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

🤔 Learning The Wrong Lessons

What a few months we've had!

I think we'd all rather look ahead than dwell on the last few months, but it's time to take stock. Lest we forget, as they say.

First the facts:

In a matter of 28 days the market "lost" approximate 34% of its value. The same businesses with the same managers became a third less attractive because of short-term uncertainty.

Since then, in a dramatic turnaround that is just over 100 days old, the same market has gained about 43%.

Was it possible to predict either the sudden downturn or the remarkable recovery? Of course not. Was it possible to predict BOTH? That's crazy talk.

As behavioural financial advisers we know that the future is essentially unknowable. That's why we craft plans that will stand up to the vagaries of the market. We know that it's not a matter of if the market will experience volatility (up and down), but a matter of when it will happen.

We've learnt this lesson by observing the history of the markets.

It is evident that not everyone has internalised this lesson. In fact, it is extremely worrying that many have learnt the opposite lesson.

It is human nature to want to be in control and to extrapolate the recent past into the future. While those who have studied the markets know that trying to time the market's inevitable ups and downs is a fool's errand, many have decided that it is both possible and a worthwhile pursuit.

We know that amongst us walk financial literates and financial illiterates. Let's look at what lessons these two different types of people may have taken away from the recent crisis.

The literate investor would have been reminded that markets can go down a lot, often without warning. They would have been reminded that the market does not follow the economy, often recovering long before economic data suggests that the future is looking brighter. They would have been reminded that it is always a good time to buy shares in the great companies of the world, and never a good time to sell unless the money is required. They would have learnt to focus on what they can control.

In contrast, the illiterate investor would look back on the market and convinced themselves that they saw it coming and should have done something about it. We could see the warning signs in China! They would have connected the dots between the market drop and any one of the regular articles warning about a coming crisis. They would convince themselves that the recent recovery isn't sustainable, and now might be a great time to sell and wait for the next market drop. After all, the economic data coming out isn't great, the future is extremely uncertain. If they avoided selling at the bottom, they would convince themselves they have the ability to predict the market, reading everything they could to stay "informed" so that they can predict the next crisis too.

We encourage you to take stock, examine your actions of the past few months, and consider what lessons you can carry with you on your investing journey. Which investor are you?

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

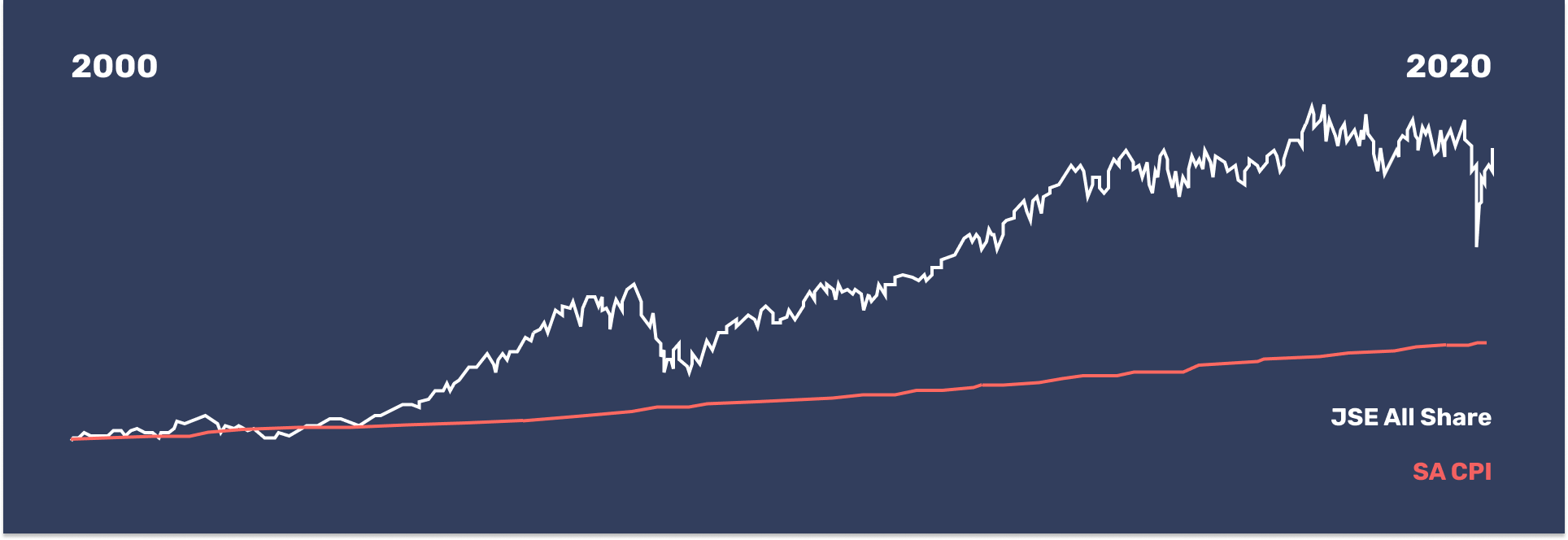

Over the last 20 years, inflation in South Africa has resulted in an item costing R1 in 2000 now costing R3.07 in 2020. Your purchasing power has been decimated!

But R1 invested in the JSE All Share index is worth R7.19 today, and that's ignoring 20 years of dividends! And this during a two-decade period that included the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

📰 Read

How Money Forever Changed Us [31 minutes]. A fascinating look into humanity’s greatest idea, its greatest paradox, and the story that forever changed human behavior

Happiness & the Gorilla [9 minutes]. A list of interesting visual models to help us understand what we really want from life.

Stop Preparing For The Last Disaster [5 minutes]. The same disasters tend not to happen twice in a row.

The Secret Sauce in the System [3 minutes]. Investors who fail to understand the cycle that uncertainty creates are doomed to repeat the mistakes of the past.

The Laws of Investing [19 minutes]. A collection of laws that describe a universal feature of how people respond to risk, reward, and scarcity.

Can You Think Your Way to Wealth? [7 minutes]. Which of these two mindsets do you have?

33 Things I Stole From People Smarter Than Me on the Way to 33 [11 minutes]. We stand on the shoulders of giants.

You Don't Need To Know The Future To Invest Successfully [3 minutes]. Does your plan require you to predict the future?

🎧 Listen

Dr. Brian Portnoy: Underwriting a Meaningful Life [59 minutes]. Author Brian Portnoy discusses his theory of funded contentment, which he hopes will get people to think about the different facets that go into a contented, joyful, and meaningful life.

Your Future Self [17 minutes]. Thought exercises about both the future and past self might be beneficial for the present.

🍿 Watch

Morgan Housel's presentation to kids about how money works and how we behave with it. A great watch for young and old.

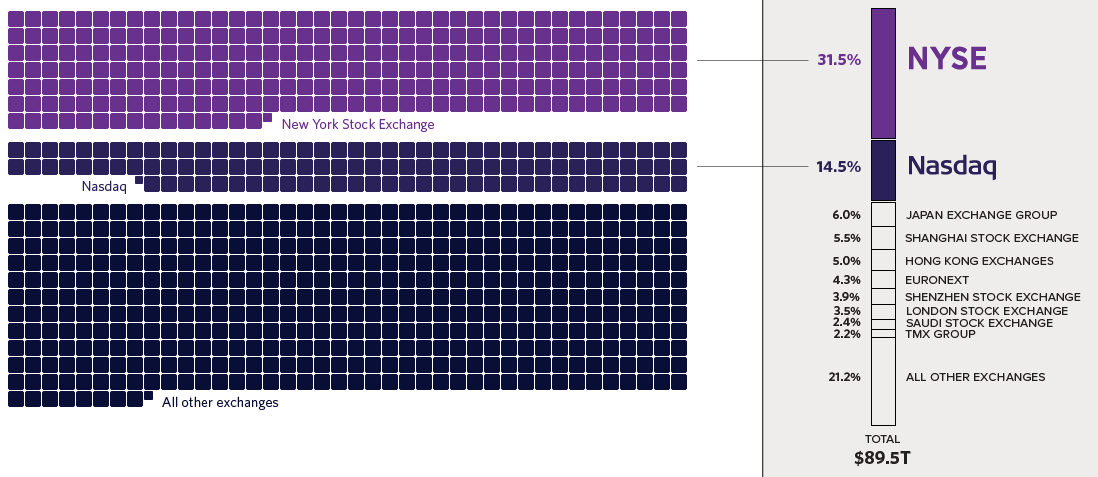

🖼️ A Picture is Worth a 1000 Words

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative or colleague.

As always, we're here for you.

See you next month,