October 2020 (SA version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

🌊 The Second Wave

“History doesn't repeat itself, but it does rhyme.” - Mark Twain

As we enter the final third of an eventful year (it won’t be boring!), a second wave of Covid infections is looming for Northern Hemisphere countries heading towards their winter, while Southern Hemisphere countries are still grappling with the economic and social consequence of a long lockdown.

While it was unlikely that this once-in-a-lifetime health event would disappear overnight, it feels like many had put the 6 months of chaos behind them and restarted the life they had led before. Hopes of an imminent vaccine will start being dashed by the thorough process that will need to be followed. This one’s not over as quickly as some of us may have hoped.

This new round of infections will throw many of us back into the uncertainty of what day-to-day life will look like for the immediate future, and will inevitably lead to a fresh round of media speculation about what this means for the economy and ultimately the investment markets.

Without making light of the health consequences of further infections, we appeal to you to maintain a long term perspective and to be encouraged by the historical returns of the market - returns that were only earned by the disciplined and patient investor.

In preparation for a possible onslaught of pessimism and calls for rash short-term decisions, we hope you are able to keep the following in mind as you navigate the next few months:

The stock markets are forward-looking, largely unconcerned about today’s headlines. Any news on your screen has already been factored into the market and the crowd of investors (not individuals) are looking beyond it to the future.

No one knows how this will play out or impact the economies of the world, so even if you did want to make changes based on short term events, you would be clutching at straws.

Longer term it may all be irrelevant . Humans have shown themselves to be remarkably resilient and ingenious. We’ve endured and survived many hardships.

Already we’ve seen advancements and changes in the way people see and live in the world. We know how to create the best of bad situations.

Understanding the above will help you to approach the next season with the right mindset, but there may still be a part of you that will feel the need to “do something”.

That’s perfectly reasonable. If that’s the case, we urge you to consider doing the things which you have control over, rather than trying to control that which you cannot.

Here are a few things you may want to consider:

Review your cash flows. Pre-Covid subscriptions may no longer be required, and a few luxuries may have crept into your spending during Covid. Which of these still makes sense?

Have any of your longer-term goals changed in light of this year’s events? Speak to us so that we can consider whether your financial master plan needs to be updated.

Keep paying yourself first. Many people (not my clients) temporarily stopped their investment contributions while their Covid-earnings were fluctuating. Now may be a good time to re-instate those contributions. Not only re-instate them but increase them. Financial success is counter-cultural.

Please remember that we are here to guide you through the ups and downs. This is why we exist.

🐉 The Real Enemy

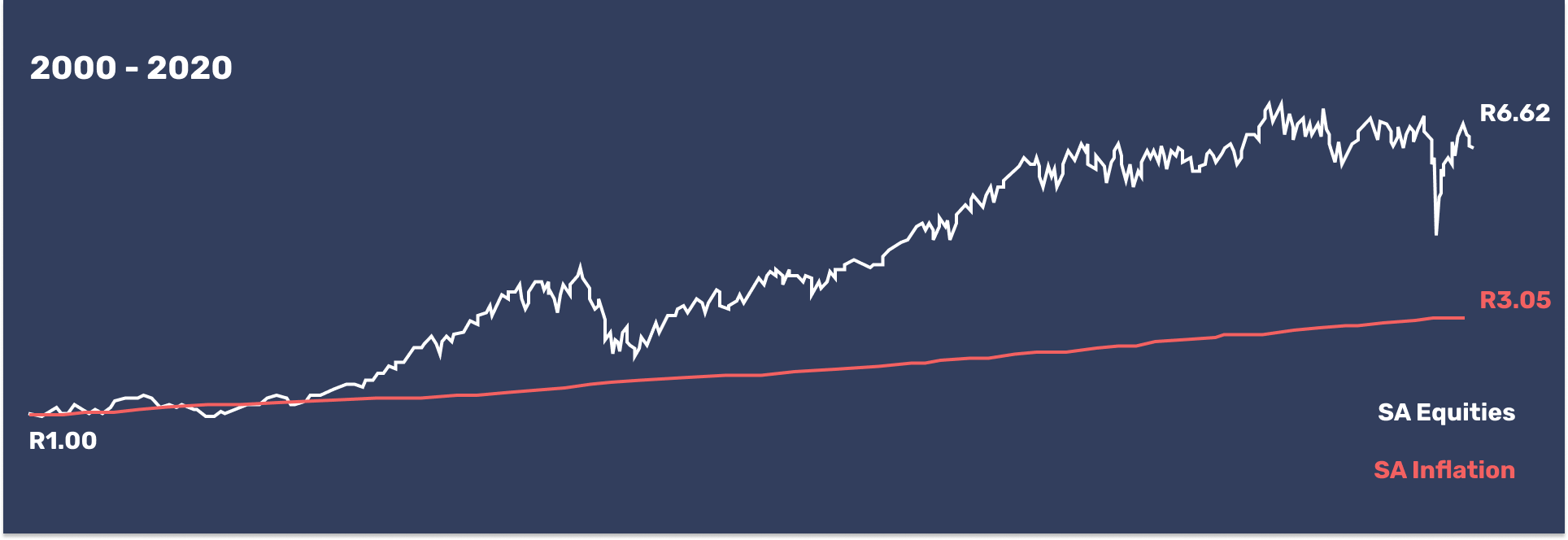

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 20 years, inflation in South Africa has resulted in an item costing R1 in 2000 now costing R3.05 in 2020. Your purchasing power has been decimated!

But R1 invested in the South African share market is worth R6.62 today, and that's ignoring 20 years of dividends! And this during a two-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

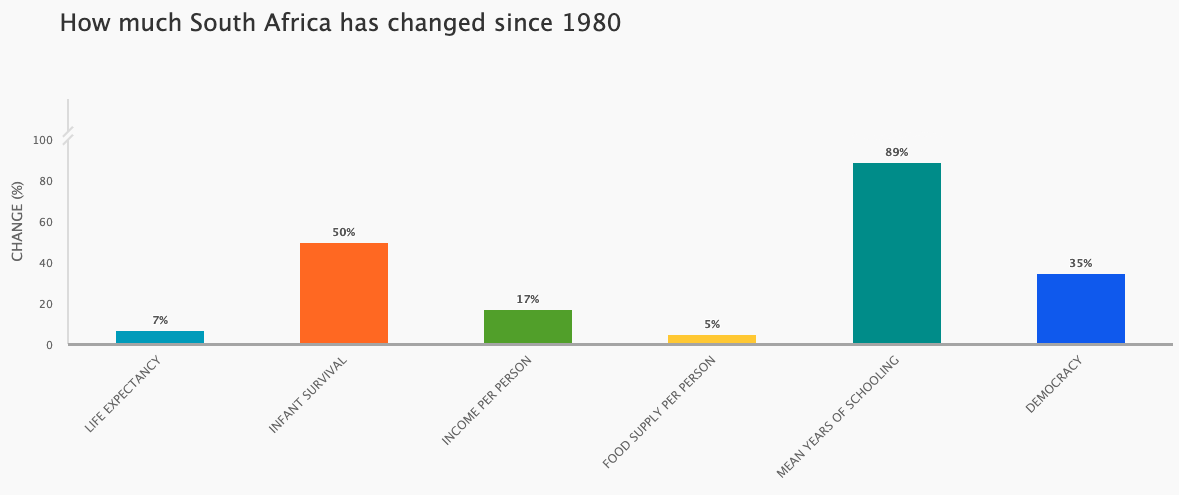

It’s not just about child mortality, life expectancy improved at all ages. Life is becoming longer for current and future generations.

Life In Numbers. A wonderful resource to explore how much the world has changed since you were born.

📰 Read

My No. 1 Money Lessons [10 minutes]. Lessons from those in the know.

My Regrets [5 minutes]. A few lessons on what not to do.

Save Like A Pessimist, Invest Like An Optimist [6 minutes]. Optimism and pessimism work together to keep everything in balance.

Sport, investing and the paradox of skill [8 minutes]. Conventional wisdom does not apply when it comes to investing.

How to Talk About Money [20 minutes]. Demystifying one of the last taboos.

These 7 Lessons Will Make You Better [9 minutes]. Lessons from the ancient world that apply to modern times.

We didn’t start the FIRE: The true history of financial independence [12 minutes]. A look at where the notion of financial independence originated.

🎧 Listen

Matt Ridley on How Innovation Works [71 minutes]. We give too much credit to inventors and not enough to innovators - those who refine and improve an invention to make it valuable to users.

Designing Your Work Life [81 minutes]. The events of the last few months have caused all of us to reconsider how we should design our work life to fit in with the rest of what we do.

🍿 Watch

Inside the mind of a master procrastinator

We're all drawn to easy and fun, but real work is often neither.

Understanding Market Volatility & Why We Need It

A proper understanding of market volatility will make you a successful lifetime investor.

🖼️ A Picture is Worth a 1000 Words

Visualizing the Range of EVs on Major Highway Routes

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative or colleague.

As always, we're here for you.

See you next month,