August 2020 (SA version)

Dear [FIRST NAME GOES HERE]

[company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

😷 Covid Reflections: The Futility of Predictions

As always, we find ourselves in times of great uncertainty. You may be tempted to look around for someone to make the future clearer. Anything to hold on to.

There is no shortage of people willing to share their predictions of what is to come. After all, the newspaper and 24-hour news stations want stories every day. Imagine that job!

Health and social events aside, let's revisit the ever-repeating cycle of financial markets. It's a good time because we've just been through a memorable one, and you'll experience a few more before you're done.

Investing professionals and investing commentators take it upon themselves to participate in the dark art of forecasting. However, humans have been terrible at forecasting since our time on the savanna. But this historical blip doesn’t stop us from having a go. Guessing the future and trying to time the markets seems like a credible vocation.

The investing centres of the world are stocked full of bright, intelligent and capable individuals. They are all trying to do one thing, outperform each other. Simply put, trying to get the best investment return over a rolling time block. Basic maths would tell you that 100 smart people all trying to outsmart each other is impossible. You’ll have a winner a loser and 98 people in between.

What they didn’t know

Predictions are always made by people who have made predictions before. And the last thing they want you to do is to analyse their past forecasts. They'd prefer you to focus on their new one.

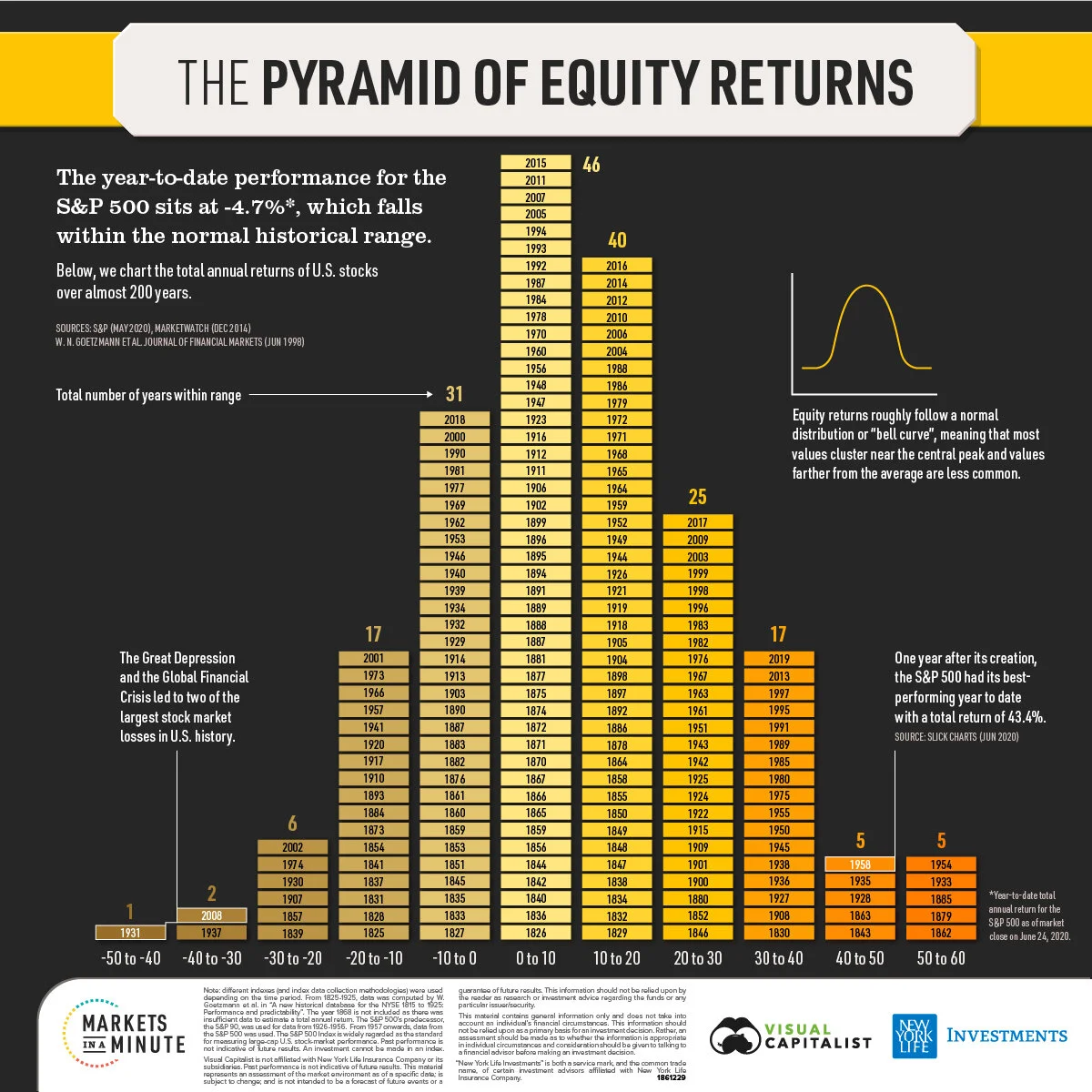

The US stock market has just completed its best quarter (March-June 2020) in 20 years. This was predicted by absolutely no one on planet earth. Not a whisper from the investing skyscrapers crammed with smart, high-IQ geniuses. No one knows what the market will do over the short to medium term, if anyone tells you they do, please run for the door.

What they now think they know

We now have the same individuals (fund managers, investment professionals, investment commentators, journalists, Financial Advisers) giving us their predictions for the second half of 2020 when they all spectacularly failed during the first half of the year. It's amazing how a person acts when their salary depends on it, they'll say anything to keep feeding the machine. I hope you can see the comedic side of the palaver. Find an investing professional who tells you the unvarnished truth, not the convenient lies.

What they’ll never say

"We have no idea where the stock market is heading over the next block of time."

Predicting the vagaries of the stock market over short blocks of time is the pursuit of the crazies. Successful investors are continually being anchored back to their financial plan which lists all of your transitions and cherished life goals. Your investment portfolio is the funding vehicle for your financial plan. If you leave your investing portfolio alone and never try to time the stock market you’ll be a successful investor. Weirdly, it’s one of those life oddities where the less you do (touch, tweak, change, study, research) the better you’ll perform. It’s likely that we’ll see some more declines before we continue the relentless advance, however, I could be completely wrong.

The market's movements are unknowable in the short term, but inevitable over a long block of time. Leave the stock market to work its magic. Don't blow up your own perfectly crafted fit-for-purpose investment portfolio.

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

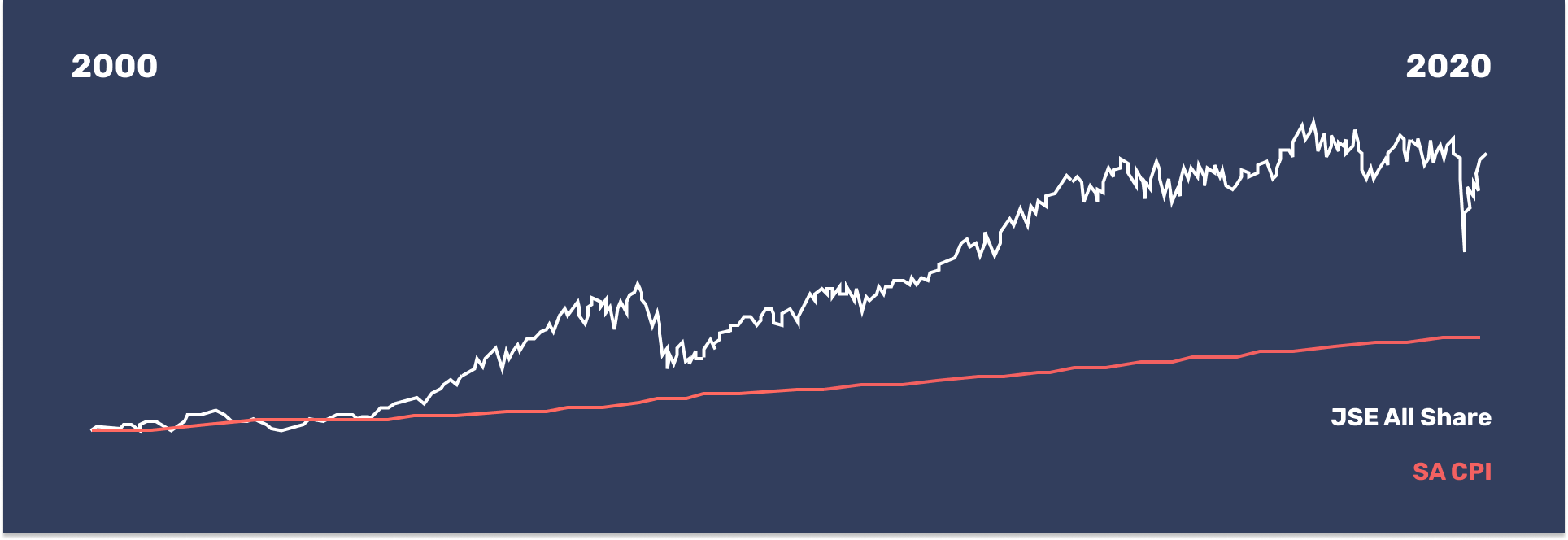

Over the last 20 years, inflation in South Africa has resulted in an item costing R1 in 2000 now costing R3.03 in 2020. Your purchasing power has been decimated!

But R1 invested in the JSE All Share index is worth R7.04 today, and that's ignoring 20 years of dividends! And this during a two-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Need some good news about covid-19? Here are six reasons for optimism.

UK's home finger-prick antibody test passes first clinical trial

📰 Read

Appearances vs Experiences: What Really Makes Us Happy [5 minutes]. Knowing some of the typical pitfalls in the search for happiness can help us improve quality of life.

Here We Are: 5 Stories That Got Us To Now [13 minutes]. To have any hope of making sense of what’s happening in 2020, we have to pay attention to a bunch of seemingly unrelated stories that began before anyone had heard of Covid-19.

7 Valuable Non-Financial Retirement Assets [4 minutes]. Not all assets are measured in numbers.

The Best Career Advice I've Ever Gotten [5 minutes]. Help yourself by helping others.

Let Yourself Be Unproductive. At Least for a Little While [6 minutes]. At times, not doing is the answer.

The Greatest Danger Investors Face [4 minutes]. Know when you are speculating.

The ladders of wealth creation: a step-by-step roadmap to building wealth [27 minutes]. Each step requires that you learn new skills to overcome new challenges.

🎧 Listen

Working Your Way to Happiness

How we view our work can contribute greatly to our daily levels of happiness - far more than money or status.

The famous actor digs into lessons learned, routines, favorite books, exercises, intuition, meditation, and much more.

🍿 Watch

🖼️ A Picture is Worth a 1000 Words

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative or colleague.

As always, we're here for you.

See you next month,