December 2020 (AUS version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

The Foundations of Investment Success

As we wind down to the end of the year, many will be focusing on the strange year we've had, and trying to extract the lessons we've learnt.

Rather than do the same, we'd like to remind you of the foundations of lifetime investment success.

If you've been following the news, you may have seen them focus on short term investment trends. This will include the recent resurgence in the price of Bitcoin, and the recent new all-time highs in the American stock markets. Only a few months ago, gold was the flavour of the day. And, who could forget the surge in values of technology shares during the height of the lockdown. Recent news of a vaccine brought with it a recovery in travel and hospitality shares, and a drawdown in technology shares. For the investor who believes that lifetime success depends on timing the market and selecting the right shares, this was a difficult year. And, every year is like that.

One of the more troubling findings of investment research is that individual investors fail to earn anything close to the returns of their investments. How is this possible? In summary, most investors do the wrong thing, at the wrong time, for the wrong reasons.

But good investing, like many things in life, is counter-intuitive and counter-cultural. One of the core tenants of our approach is that true lifetime investment success is goal-focused and planning-driven. This is good news because it removes the burden of correctly guessing future interest rates, inflation, sector returns, and the many other variables that thousands of analysts spend their days obsessing over.

In a culture that will always be market-focused and performance-driven, this approach sees investors acting on a financial plan, rather than reacting to investment markets.

This approach is built on an evidence-based foundation of three inner principles and three investment practices. Master these, and lifetime investment success is available to you.

The three inner principles are:

Faith in the future

While it's easier and more trendy to be pessimistic, we believe that optimism is the only realism. Based on history, we confidently believe in the ability of a capitalistic society to prosper on the back of our collective ingenuity. And the asset class that best captures this ingenuity are equities (the global stock market, the great companies we all use every day).

Patience

Contrary to the financial illiterate, the mature investor refuses to react inappropriately to disappointing events. Rather, he/she continually acts on a plan.

Discipline

Similar to the principle of patience, discipline sees the investors continuing to do the right things, even if the fruit of these decisions can't be seen in the short-term.

Once these principles have been mastered, the financial literate follows the following three investment practices:

Asset allocation

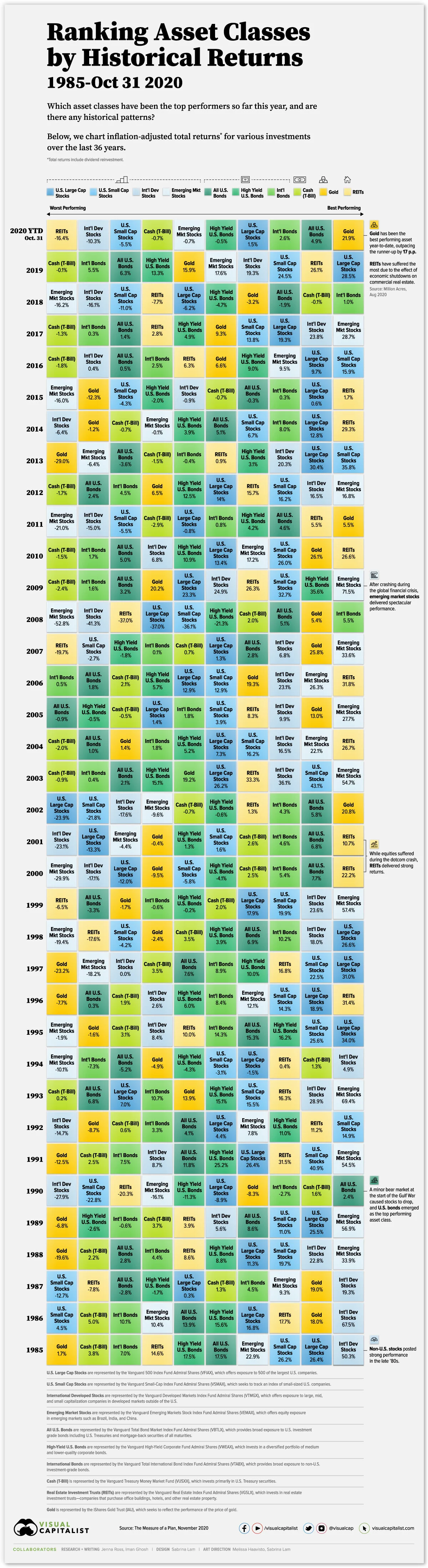

The one decision that has the biggest impact on the investors lifetime return is the mix of asset classes they invest in. While equities have outperformed for as long as we have accurate records, at a minimum the investor requires an asset mix likely to provide his/her required investment return in the long run.

Diversification

Once the mix of asset classes has been decided, the investor requires a sufficient mix of holdings within each asset class in order to reduce the negative impact of any one holding providing poor returns. Think of diversification as a group of 30 coloring pencils, grouped together they're almost impossible to snap, hold one on it's own and a small amount of pressure snaps it clean in half.

Rebalancing

Over any short periods, certain assets will outperform others. In order to keep the asset mix at its optimal level, a planned rebalancing of assets brings the portfolio closer to its aimed asset allocation. This will ensure that higher-priced and over-valued assets are sold to purchase lower-priced and under-valued assets. Effectively, buying low and selling high, the opposite of what most people do (which is buying high and selling low).

If followed by a financial literate, and guided by a behavioural financial adviser, investment success is all but guaranteed. While simple, it's not easy. Being your partner on this journey is why we exist.

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

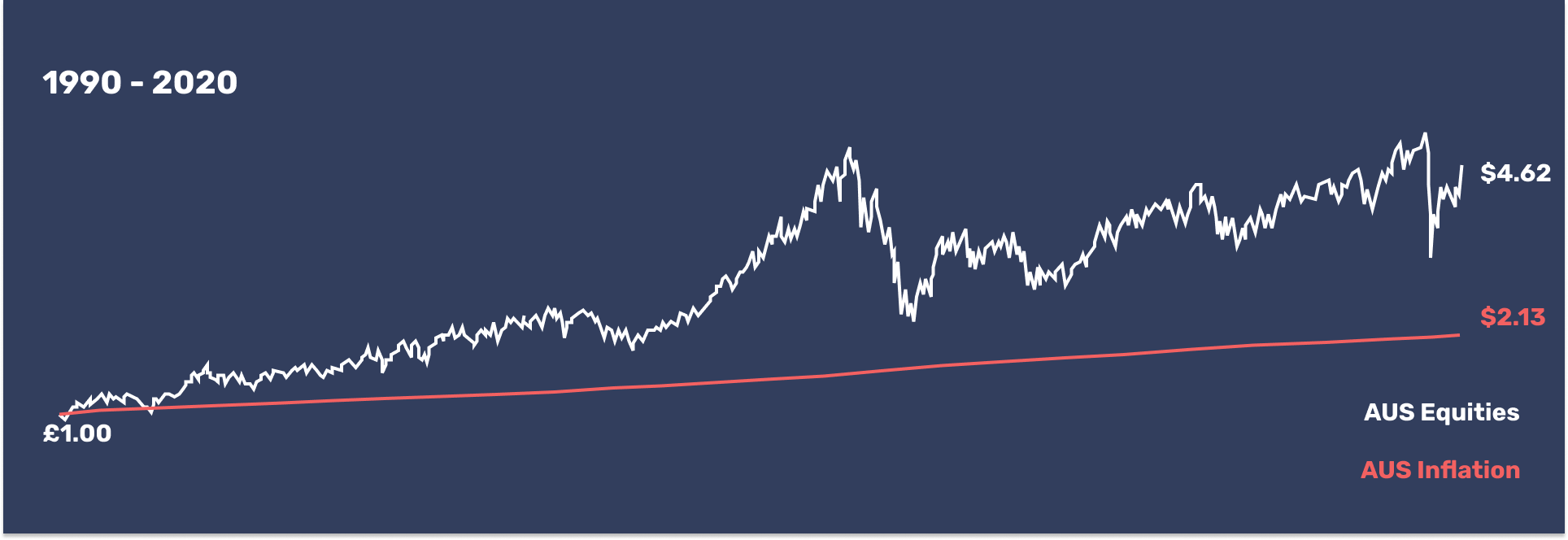

Over the last 30 years (about the length of an average two-person retirement), inflation in Australia has resulted in an item costing $1 in 1990 now costing $2.13 in 2020. Your purchasing power has more than halved!

But $1 invested in the Australian share market is worth $4.62 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Nothing Is More Responsible for the Good Old Days Than a Bad Memory

📰 Read

The Big Lessons From History [17 minutes]. The best article written on what we can learn from the Covid-19 pandemic.

Half a Life Ahead [4 minutes]. An interesting look at life and time.

Pursue Mastery, Not Status [6 minutes]. What game are you palying?

Why Do Stocks Beat Bonds? [2 minutes]. A good question with a simple answer.

Getting comfortable with your enough [5 minutes]. Everyone's "enough" is different.

Never Assume [3 minutes]. A great list to make you think.

🎧 Listen

The Ultimate Guide To INVESTING - Part One [41 minutes]

The basics of building wealth for the future.

How To Help Someone Gain A New Perspective [24 minutes]

The power of open-ended questions, in any relationship.

🖼️ A Picture is Worth a 1000 Words

Visualizing the Top Export in Every Country

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative, or colleague.

As always, we're here for you.

See you next month,