January 2021 (Aus version)

Dear [FIRST NAME GOES HERE]

[personal and/or company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

Your Wealth Window - How Many Months Do You Have Left?

There are only two types of people, those who outlive their money and those who don't. Everyone wants to be in the latter group, but as you approach retirement it may be too late to do much about this. Once you stop earning an income you move into the spending stage of your life (retirement). In order to outlive your money you have various financial levers you can pull to get the odds on your side, but remember we're Financial Advisers and not Magicians!

The ideal time to create a retirement investment pot which will provide a retirement income you can't outlive is during the savings stage (whilst you're earning an income) of life. This stage is also known as the "wealth window", the period of life during which you can convert your human capital (income) into invested capital.

As you progress through life (and life is short, see the article Your Life In Weeks below) this "wealth window" is constantly getting shorter and shorter, one paycheck and one month at a time. Your ability to regularly put away money for the benefit of your future self is the driving force of an independent retirement.

One habit that all successful investors share is that of automating their monthly savings (ideally increasing the monthly amount by 10%+ at least annually). Think of this as your most important monthly expense, only you're paying in advance for a meaningful retirement. How much time is remaining in your wealth window? Savvy investors know this number to the month, if you're 10 years away from retirement you have 120 months left in your wealth window, if you're 14 years away you have 168 months to go.

How well are you converting your human capital into investment capital? The wisest investors know the % of their net income that they're putting away for the future. Helping you to make the most out of your wealth window is one of the reasons we do what we do.

Appreciating that investing today is the spending of your future self, the person you'll become. As always balancing the enjoying 'now' but planning for 'then'. If you wish to explore your wealth window in detail give us a call, we're here to help you.

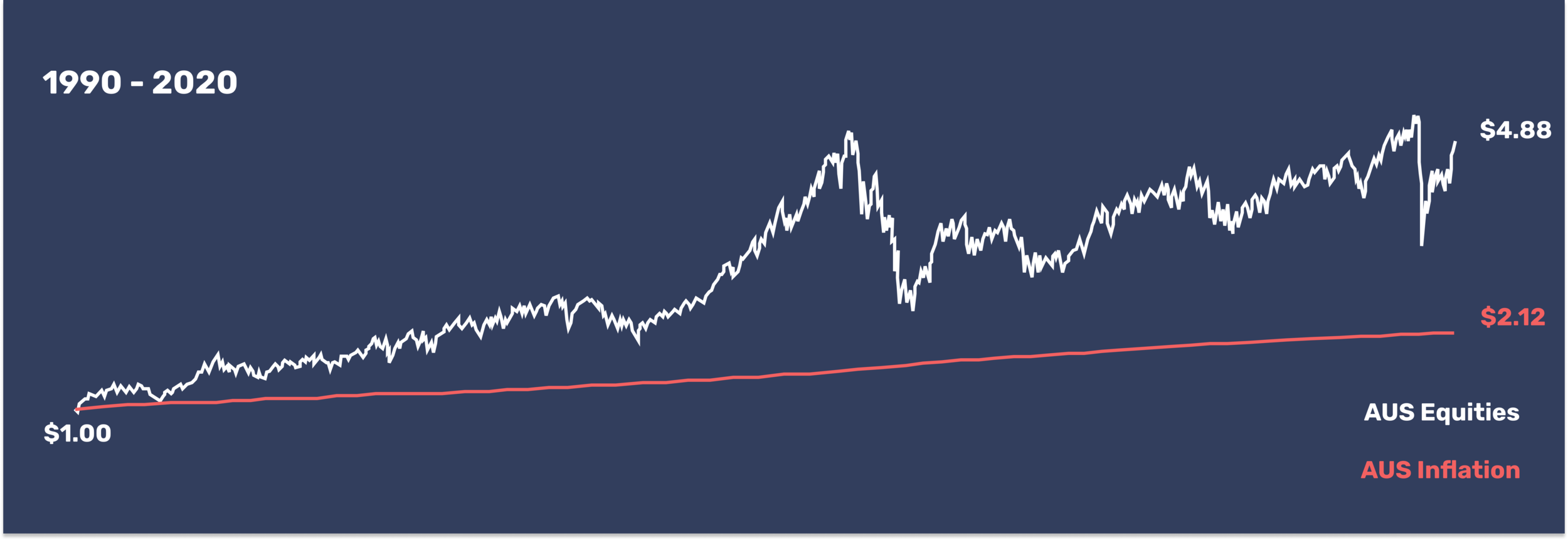

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in Australia has resulted in an item costing $1 in 1990 now costing $2.12 in 2020. Your purchasing power has more than halved!

But $1 invested in the Australian share market is worth $4.88 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Australian scientists map millions of galaxies with new telescope

📰 Read

Your Life in Weeks [5 minutes]. Life is short. Are you making the most of your weeks?

Hitting Pause on the Hedonic Treadmill [6 minutes]. What story are you telling yourself?

Can You Think Your Way to Wealth? [6 minutes]. Do you have the desire to consistently improve?

5 Lessons From 3 Years of Early Retirement [9 minutes]. Reflections from someone on the far side.

Myths and misconceptions about financial independence and early retirement [12 minutes]. A useful primer on a trending topic.

Help Today's Self [4 minutes]. Don't spend all your time thinking about the future.

A Few Things I’m Pretty Sure About [4 minutes]. Which of these do you agree with?

🎧 Listen

Planet Money: Before The Shot In The Arm [25 minutes].

The logistics involved behind the scenes is mind-blowing.

5 Ways to Build Good Financial Habits [11 minutes].

A few good ideas to kickstart the new year.

🍿 Watch

The Christmas season is always a good time to reflect on the things we hold dear. These two adverts, both foreign, conveyed some of these feelings brilliantly.

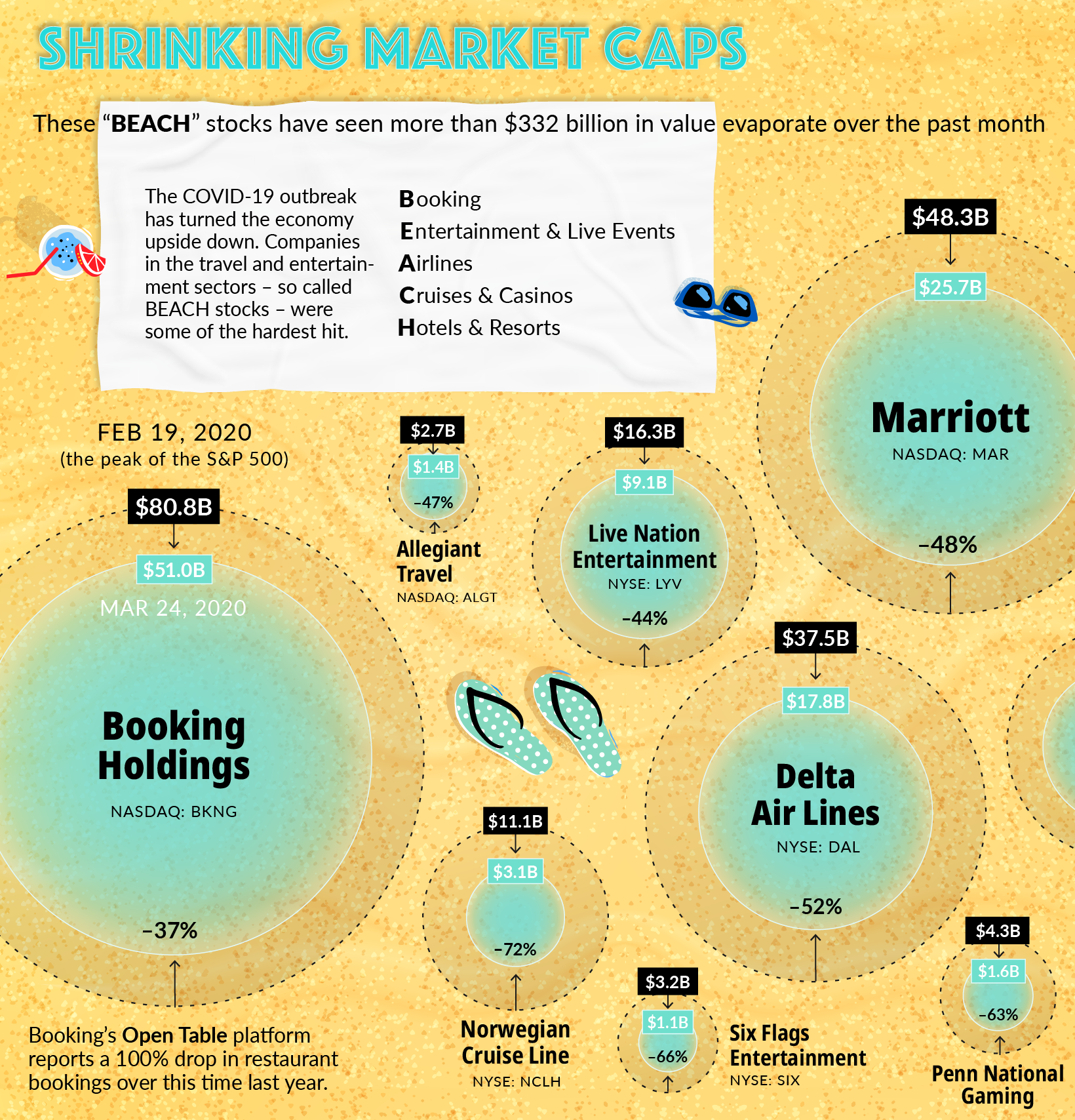

🖼️ A Picture is Worth a 1000 Words

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative or colleague.

As always, we're here for you.

See you next month,