June 2020

Dear [FIRST NAME GOES HERE]

It's a brave new world out there.

We've turned the corner and billions of people are about to discover what the "new normal" looks like.

At Maven Adviser, we are excited to guide you through this and all future transitions as you walk the journey to your financial and life goals.

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

🌿 A Fresh Start

Life can be a whirlwind. Modern day life is not for the faint-hearted. It's busy, stressful, and sometimes lonely. We settle into our routines and chase the dream in front of us, not stopping often enough to put it into perspective.

And then came 2020. We've had nothing but time for 10 weeks. Some of us have experienced boredom for the first time in years.

Life is what we make of it, and how we react to events outside our control.

The great Lockdown of 2020 has given each of us the opportunity to stop, reflect, and gather our thoughts before the rollercoaster takes off again.

What will you do with your fresh start? What have you learnt about yourself during this time?

Financial planning is a process for bringing the future into the present by making smarter financial decisions. By being clearer about what's important to you, many of the other pieces fall into place.

We're here to help you achieve your cherished goals by crafting a personal lifetime financial plan for you and your family.

🆓 The Free Lunch Section

There's no such thing as a free lunch, as the saying goes. However, when it comes to investing there are many things which come close enough.

These things may require only a little bit of effort, but pay great dividends to those disciplined enough to do them.

One such habit is that of eliminating unnecessary and wasteful expenses. These could be habitual expenses that you may not enjoy anymore (the daily coffee, the newspaper you don't read) or they could be bigger items which tie you down (mortgage payment on the big house you didn't need).

A spring clean of your monthly statement will show you where you're spending money that's not bringing you joy. Pruning these extras is a discipline that will pay off long term.

Doing this brings a few benefits:

It helps us to simplify life, reducing the noise from our busy lives.

It helps us to clarify what's important by aligning our money decisions with our values, and

It creates space for us to spend more money on the things that truly bring us meaning.

Are you allocating your time and money in line with your intentions, what you find fulfilling, and what brings you joy?

🐉 The Real Enemy

The number one enemy of the real life investor is the financial dragon called inflation (the slow but steady increase of prices over time).

Over the last 30 years (about the length of an average two-person retirement), inflation in the UK has resulted in an item costing £1 in 1990 now costing £1.95 in 2020. Your purchasing power has almost halved!

But £1 invested in the FTSE All Share is worth £2.94 today, and that's ignoring 30 years of dividends! And this during a three decade period that included the dot-com bubble, the great financial crisis, and the current Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, they prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Matt Ridley: How Innovation Works [2 minutes]

Mental Models For a Pandemic [8 minutes]

📰 Read

We link to the following interesting content to help you separate the signal from the noise.

Life is Short [8 minutes]. Ask yourself whether you'll care about it in the future.

OK, People: It's Time to Think Big [6 minutes]. The current situatin is shaping how we intend to use our lives in the future, when we once again have a full set of choices before us.

Nobody Knows Nothing [6 minutes]. Everyone at some point has asked themselves: Am I good enough?

What Would You Do Differently? [5 minutes]. If you knew this was coming, what would you have done?

The Three Sides of Risk [13 minutes]. A moving story about the impact of low-probability, high-impact events.

The Technium: 68 Bits of Unsolicited Advice [8 minutes]. Reflections from a curious mind.

The Day You Decided to Take the Leap [9 minutes]. The idea of reaching one’s potential is deeply embedded in all of us.

🎧 Listen

Constraints [23 minutes]. An intriguing discussion on how constraints allow us to do more.

The Coach in Your Head [50 minutes]. The secret to effective coaching lies not in retraining the body, but the mind.

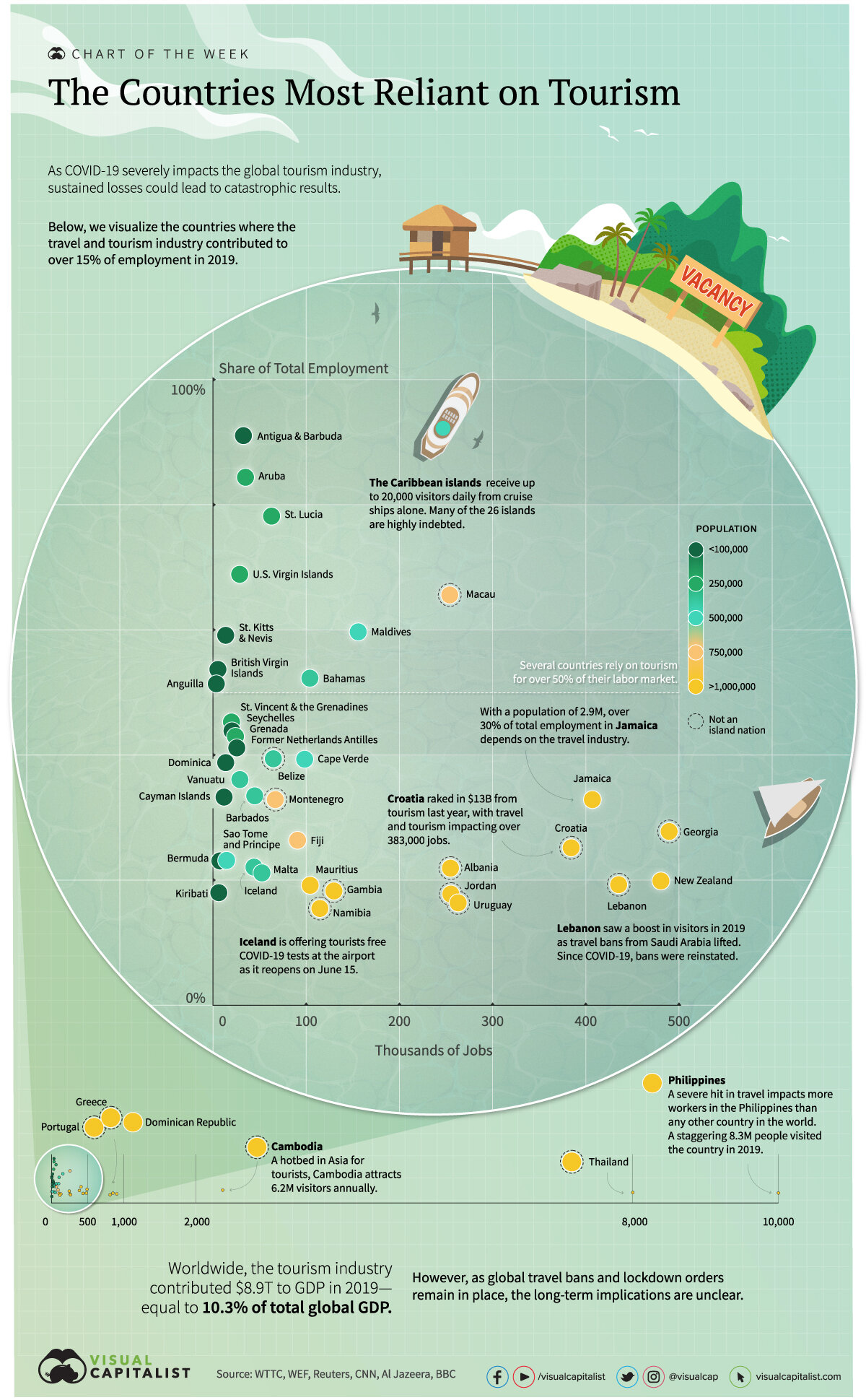

🖼️ A Picture is Worth a 1000 Words

Animation: The World’s Rapid Rise in Life Expectancy, in Just 13 Seconds

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative or colleague.

As always, we're here for you.

See you next month,