September 2020 (UK version)

Dear [FIRST NAME GOES HERE]

[company update]

Enjoy this month's instalment of our newsletter. As always, it is packed with links that you may find interesting.

✅ Doing What's Always Worked

The uninformed investor could be forgiven for thinking that they need to keep up with the ever-changing (and sometimes crazy?) world we live in.

It’s tempting to think that we need to keep up with all the latest market events. Even now one may read of the recent surge in the gold price and consider whether we are under-allocated to it in our portfolio. We are told that we need to be aware of the US election's impact on the markets and worry about the economy’s short-term health.

To help you during this time, we include below a restatement of our approach to the stewardship of your invested wealth. We believe these are principles to live by, and as such they do not change based on short-term events.

We believe that all long-term successful investing is goal-focused and planning-driven. All failed investing is market-focused and event-driven. Every successful investor acts continuously on a long-term plan. Every failed investor reacts to the sudden and terrifying immediate market shocks.

We are long-term, goal-focused equity (stock market) investors, acting on our financial plan with patience and discipline. A financial plan which we help you craft. Our key role is in helping you not to react in stressful times like this (Did someone say second wave?).

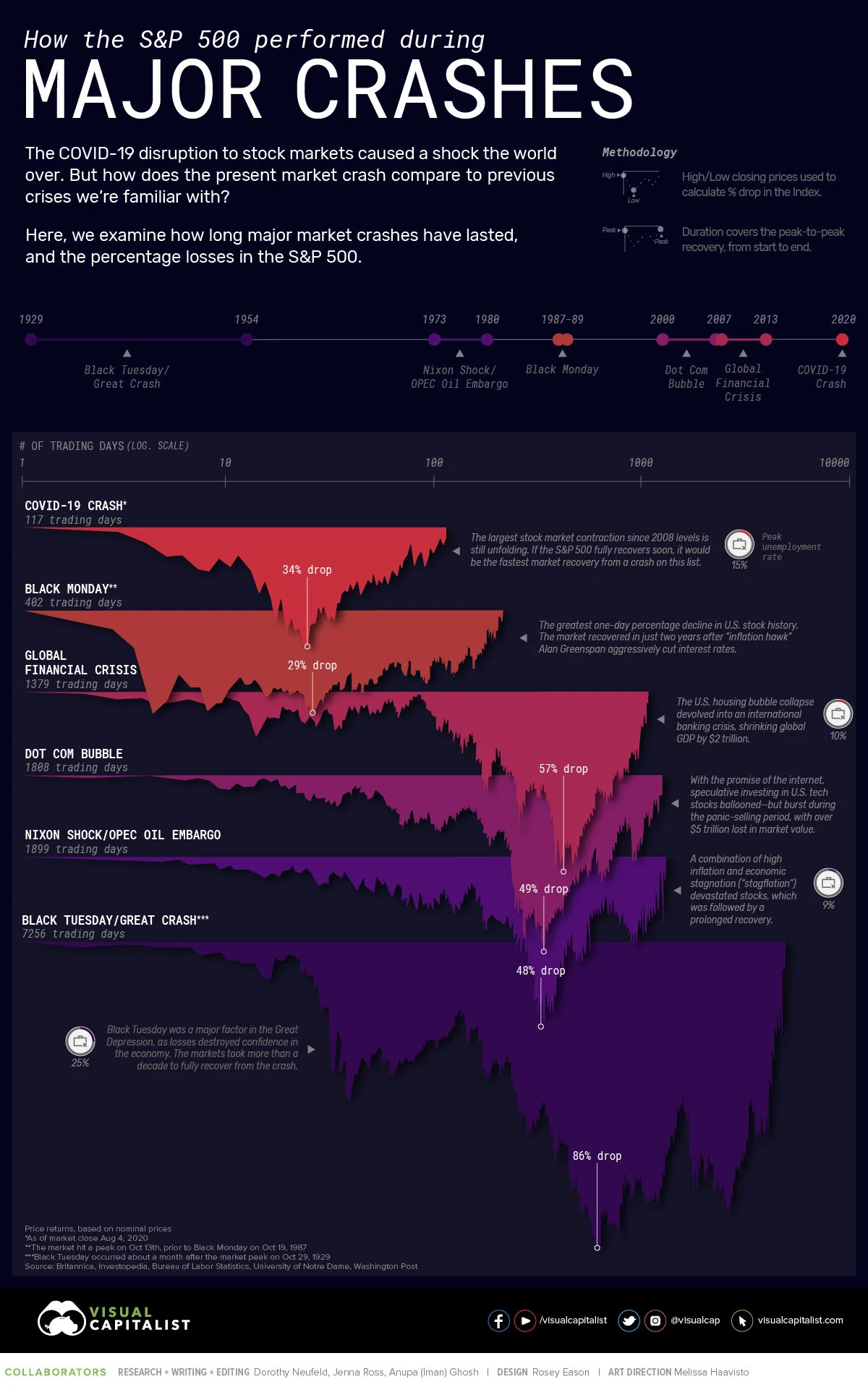

We continue to believe that the equity market (a collection of the greatest businesses on earth) can’t be consistently forecast, much less timed, and that the only certain way of capturing the market's superior long-term returns is to sit through their occasionally steep but historically temporary declines.

If you’re acting on your long-term financial plan to accumulate enough capital to fund a dignified and independent retirement—which essentially just means that you’re adding money to your portfolio whenever you can—chances are overwhelmingly good that you’re doing the right thing.

Likewise, if you’re retired, and you’re continuously acting on a long-term plan of withdrawing far less than mainstream equities’ long-term historic compound return —again, the odds that you’re doing the right thing are very good.

Our focus is on history rather than headlines, and our mantra is from Churchill: “The farther back you can look, the farther forward you are likely to see.”

Think back to January 1 of this year. Have your most cherished lifetime financial goals changed since then? If not, we see no compelling reason to change your plan—and no reason at all to change your portfolio. Optimism remains to us the only long-term realism.

🐉 The Real Enemy

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

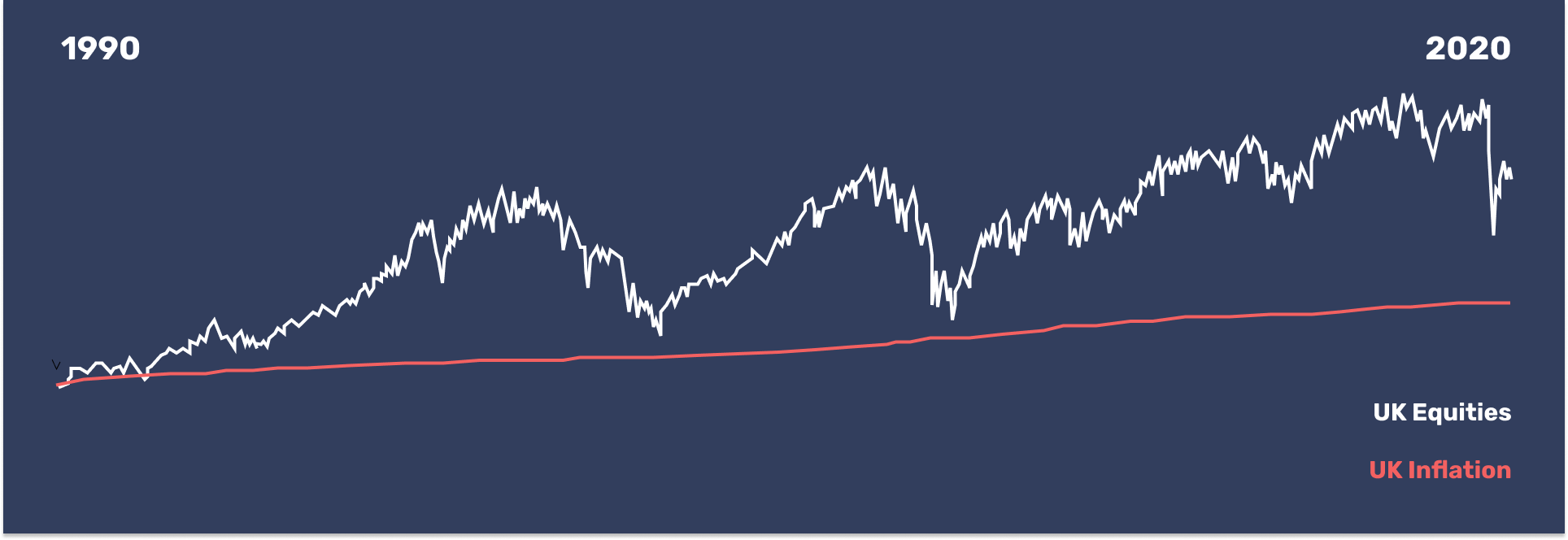

Over the last 30 years (about the length of an average two-person retirement), inflation in the UK has resulted in an item costing £1 in 1990 now costing £1.93 in 2020. Your purchasing power has almost halved!

But £1 invested in the UK market is worth £3.30 today, and that's ignoring 30 years of dividends! And this during a three-decade period that included the dot-com bubble, the great financial crisis, and the Covid-19 pandemic.

And what did you have to do to earn this? Two (behavioural) things:

1. Invest and stare out of the window (much harder than it sounds, as we've seen recently).

2. Be willing to see your investment value decrease by about -15% on average every year without being panicked into selling. Think of the yearly declines as hurricanes, unpleasant but they pass.

Guiding you through these periods of volatility is why we exist.

🛑 Ignore the media

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media prefer to focus on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

📰 Read

Investing Advice from 1937, Still Relevant Today [4 minutes]. Human nature doesn't change, wisdom lasts forever.

Expiring vs. Permanent Skills [4 minutes]. Which are you pursuing?

Personal Finance for Smart People: A Pocket Guide for Wealthier Life [3 minutes]. Wisdom that fits in your pocket.

Mere Superheroes [7 minutes]. Real heroes wear courage (not capes) and need nothing more.

Reading Financial News: The Top 10 Avoidable Distractions [8 minutes]. Avoid the noise.

What the Hero’s Journey Teaches About Happy Retirement [5 minutes]. Do you have a plan for the final part of your journey?

How Will You Measure Your Life? [18 minutes]. Only you can answer this question.

The Most Important Number in Personal Finance [8 minutes]. How good you are at converting your income into wealth?

🎧 Listen

Seven Golden Rules for Every Life-Stage [23 minutes]

Common themes from millennial finance to retirement planning.

Measure Your Actions, Not Your Outcomes [3 minutes]

Embrace taking action.

🍿 Watch

What is the tragedy of the commons?

A pattern of human behavior that explains some of history’s biggest problems.

An animated short film about the "invisible hand", and the supply of bread.

🖼️ A Picture is Worth a 1000 Words

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

Please forward to a friend, relative or colleague.

As always, we're here for you.

See you next month,